An Economic Recovery occurs when a recession ends, and the economy starts to grow again. During a recession there are job losses, industrial production falls, and consumer spending declines. We call the phase that reverses these trends an economic recovery.

During a recovery, unemployment falls, consumer spending rises, and economic output expands, leading to increased business investments, higher stock market valuations, improved housing market conditions, and greater government revenues from taxes.

An economic recovery may not necessarily occur only when the economic shrinkage stops – there must be growth. So, if the economic shrinkage stopped in March, followed by two flat months (no growth, no shrinkage), and then started to grow again in June, the economic recovery began in June, not March.

The IG Group has the following definition of the term “economic recovery”:

“An economic recovery is when an economy is bouncing back from a recession and starting to expand again. Economies move in phases and, once they have contracted and fallen into a recession, they eventually enter a stage of recovery before starting the cycle again.”

Indicators of an economic recovery

To be able to know when recovery has started, we need to monitor some indicators. Key among these are:

- GDP Growth

Measures the increase in the value of all goods and services produced by an economy, indicating overall economic expansion. - Employment Rates

Reflects the percentage of the labor force that is employed, showing how many people are gaining jobs as the economy recovers. - Consumer Spending

The total amount of money spent by households in an economy, indicating consumer confidence and economic health. - Business Investments

Spending by businesses on capital goods, a sign that companies are confident in future economic growth. - Housing Market Activity

Involves sales of new and existing homes, indicating consumer confidence and financial health of households. - Stock Market Performance

The overall trend in stock market indices, reflecting investor confidence and economic prospects. - Manufacturing Output

The volume of goods produced by manufacturers, showing industrial strength and demand. - Trade Balance

The difference between a country’s imports and exports, indicating economic competitiveness and global demand for its products.

Types of economic recoveries

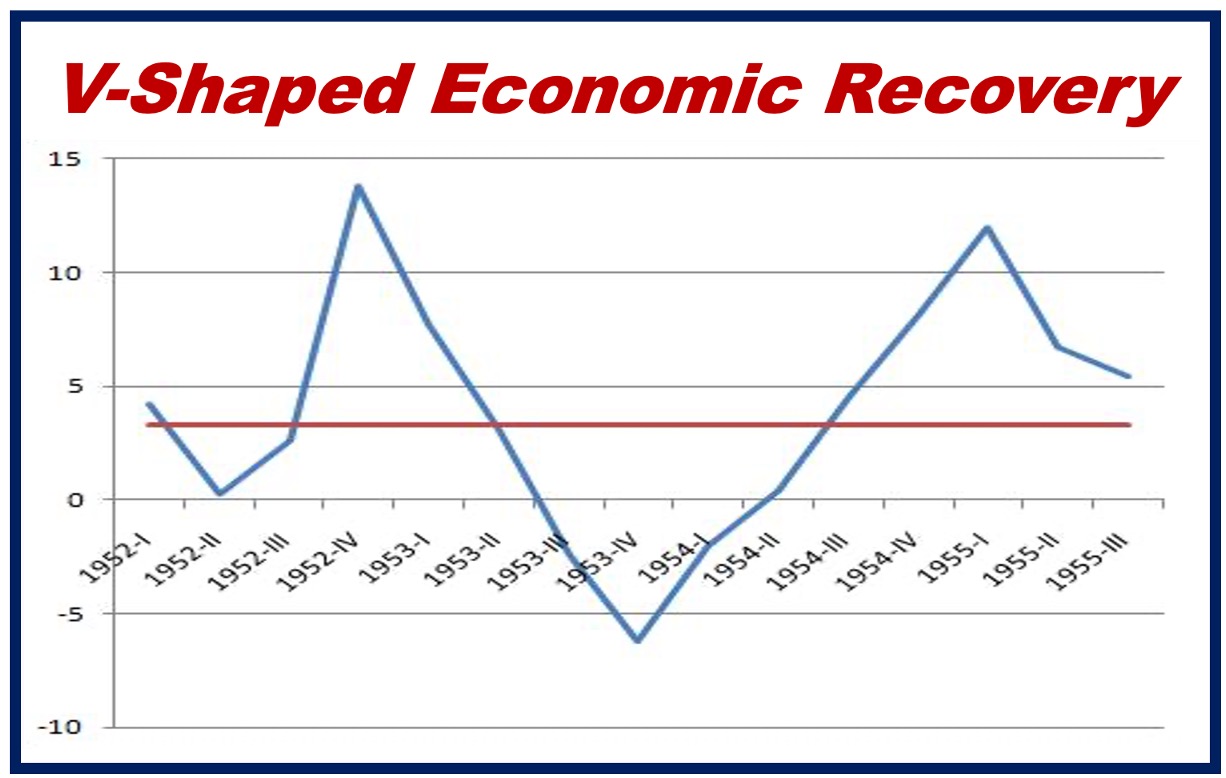

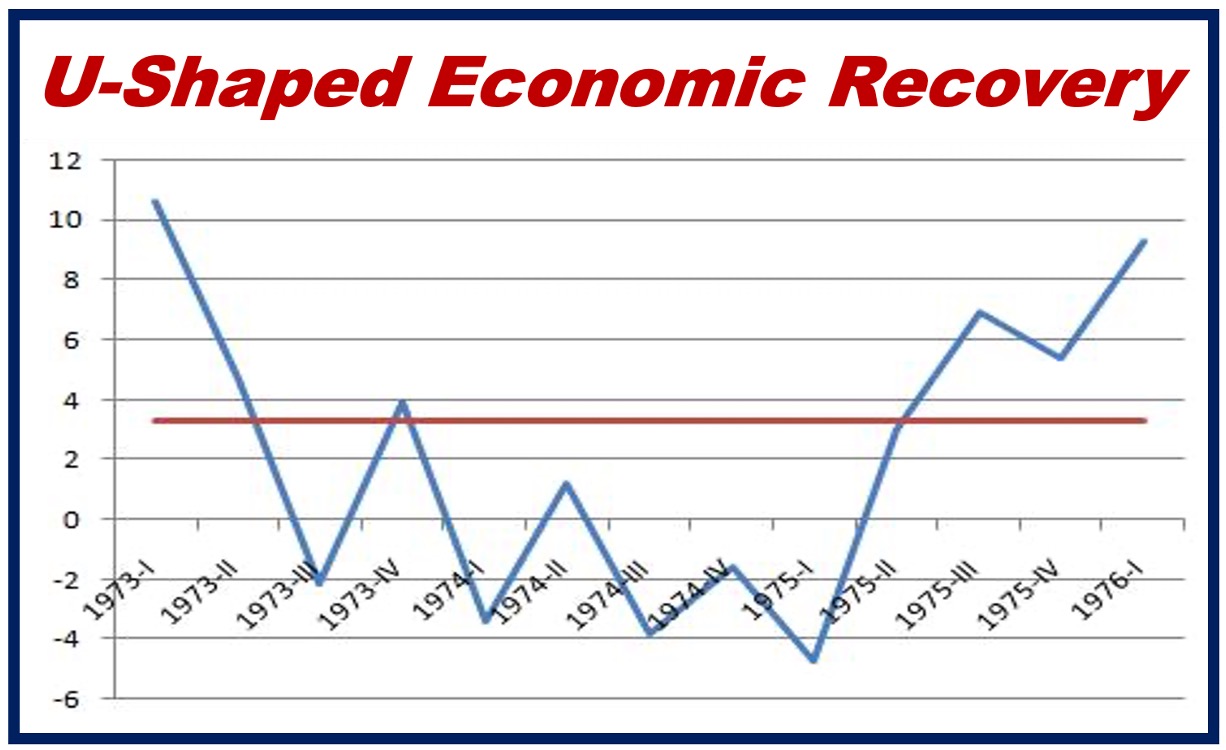

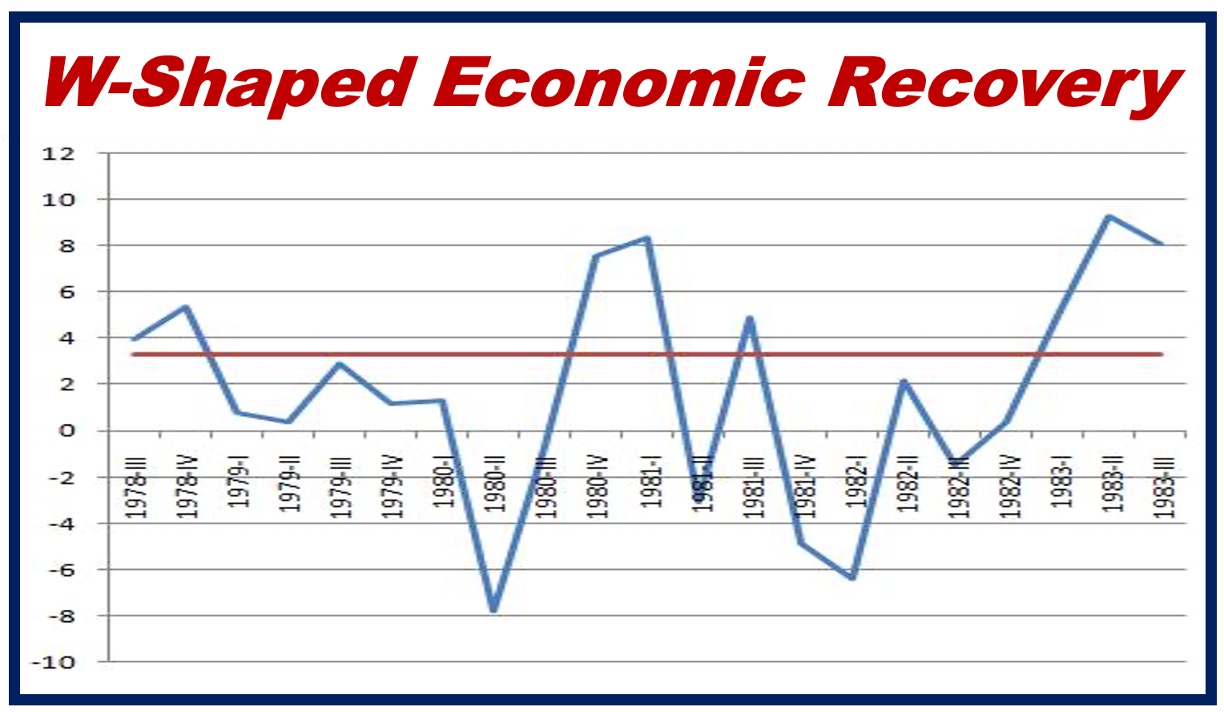

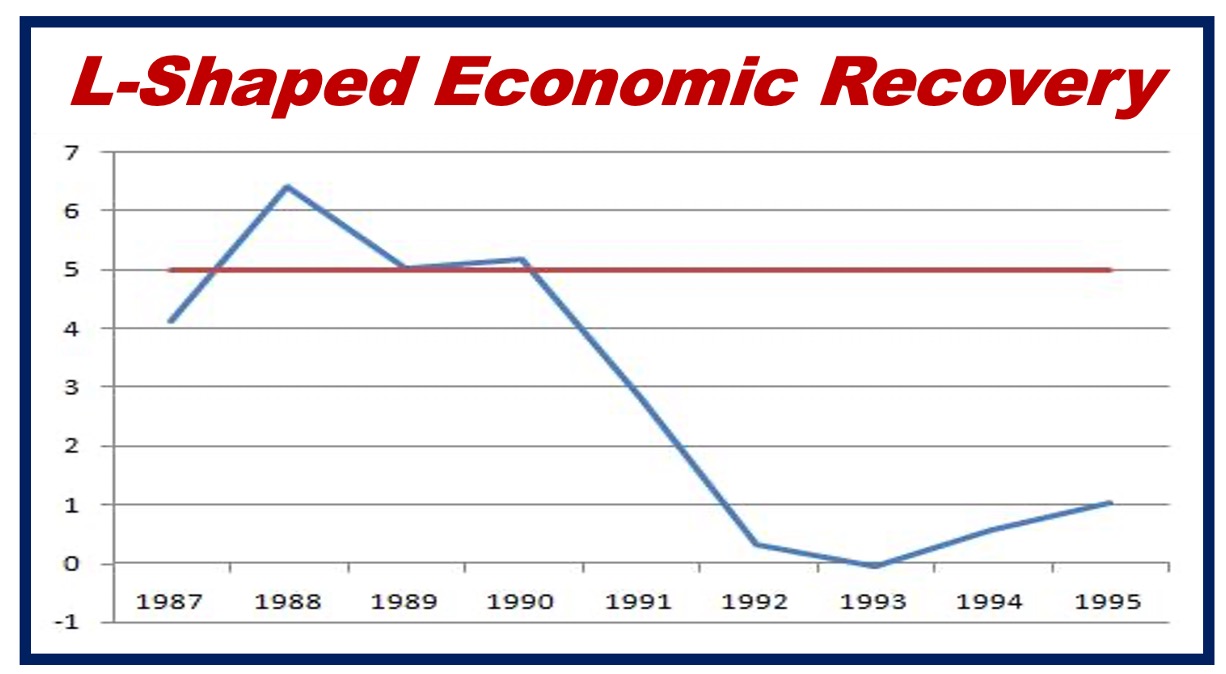

Economies can recover in different ways. Economists describe them by the shape of the recovery’s graph, which may look like one of four letters in the alphabet:

- V-shaped: A rapid decline followed by a swift, strong recovery.

- U-shaped: A prolonged downturn followed by a gradual recovery.

- W-shaped: A quick recovery followed by another downturn, then another recovery.

- L-shaped: A sharp decline with no immediate recovery, leading to a long period of stagnation.

Duration and length

How long and robust an economic recovery is depends on many factors.

Examples include global economic conditions, government policy, consumer confidence, and technological advancements.

Fiscal policies such as tax cuts or boosting public spending can lead to an economic recovery. John Maynard Keynes (1883-1946), a British economist, advocated for increased government expenditure during downturns to stimulate demand and prompt recovery. His ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments.

Monetary policies, such as adjusting interest rates also play a crucial role in getting the economy to grow again.