In finance, efficient diversification refers to the organizing principle of portfolio theory, which attempts to maximize portfolio expected return for a given level of portfolio risk. In other words, having enough diversification in an investment portfolio to earn money, while still keeping risks within reasonable bounds.

Diversification is a strategy most investors and companies adopt to spread risk.

Efficient diversification is a way for a risk-averse investor to achieve the highest expected return for any level of portfolio risk.

A good portfolio has to be well diversified to give the investor both protections and opportunities to earn money.

A portfolio with the highest likely return is not always the one with the least uncertainty of return. A reliable, or effective portfolio, is one that has a varying degree of likely return and uncertainty.

A portfolio with the highest likely return is not always the one with the least uncertainty of return. A reliable, or effective portfolio, is one that has a varying degree of likely return and uncertainty.

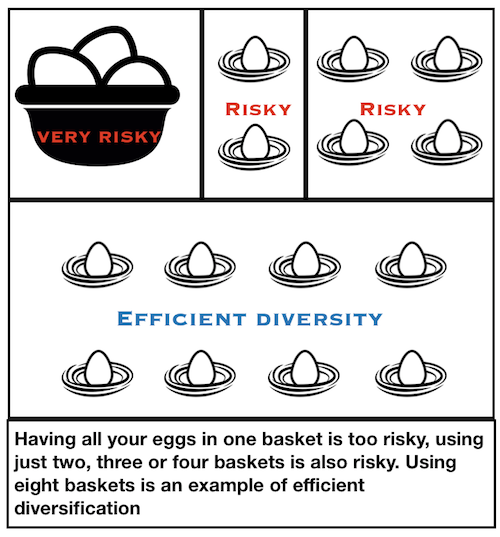

Efficient diversification simply comes down to having a portfolio of securities that contains a variety of different companies or options so that the investment portfolio is well-rounded.

Through diversification an investor can be sure that all the capital is not focused on one or two stock options.

A big part of the process of picking stocks or securities to efficiently diversify a portfolio is done through fundamental research and demanding strong margins of safety in your price.

However, this does not mean that an investor should choose 200 companies to invest in. In fact, one can achieve efficient diversification with just 5 to 12 companies. Experts say that when an individual investor spreads his or her portfolio to more than 20 companies, staying on top of things is simply not possible.

However, trimming them down to just one or two companies will not insulate the investor from damaging, unexpected future events that can wipe out the investments.

The main reason for diversification in investing is to reduce the amount of risk and maximize gains.

Nasdaq defines efficient diversification as:

“The organizing principle of portfolio theory, which maintains that any risk-averse investor will search for the highest expected return for any particular level of portfolio risk.”

Video – Portfolio Diversification