Equity finance, also known as equity financing, is a way of raising funds for business – raising capital – by selling partial or complete ownership of the company’s equity for money. Sometimes the equity is traded for other assets.

Equity finance is most typically done by selling either common stock, preferred stock or both.

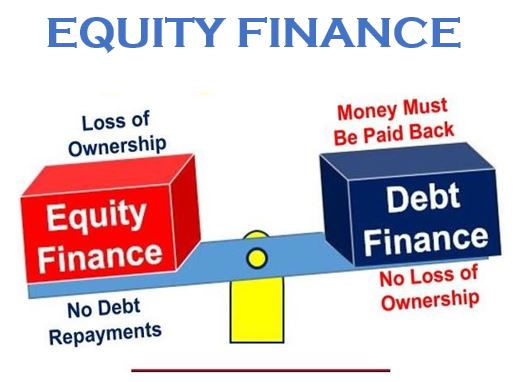

In order to expand, a business will typically need additional capital, which it may try to get in one of two ways: equity or debt.

Debt finance or debt financing involves borrowing money either by taking out a bank loan or issuing debt securities. Equity financing also has the aim of raising funds, but by selling the company’s stock and giving a percentage of the ownership of the entity to investors in exchange for cash.

There are two main ways of raising capital: 1. Equity finance, and 2: Debt Finance. Both methods have some advantages and disadvantages.

There are two main ways of raising capital: 1. Equity finance, and 2: Debt Finance. Both methods have some advantages and disadvantages.

The proportion of the firm that will be sold in an equity financing depends on how much has been invested in it and what the investment is worth when the equity is sold.

Example of equity finance

Imagine you are an entrepreneur who invested $500,000 in starting up your company – initially, you owned all the shares in the business.

As your business grows it requires additional capital. You may seek an angel investor or venture capitalist. If an investor offers to pay $250,000 to a share price of $1.00, and the original $500,000 invested is still worth that amount, then the company’s total capital will jump to $500,000 + $250,000 = $750,000.

When the investor has bought the shares, you do not own 100% of the business any more – you own 500,000 of the 750,000 shares, i.e. 66.66%. The investor owns 33.33%. You can use a dilution cap table to calculate how much equity you should give up to investors.

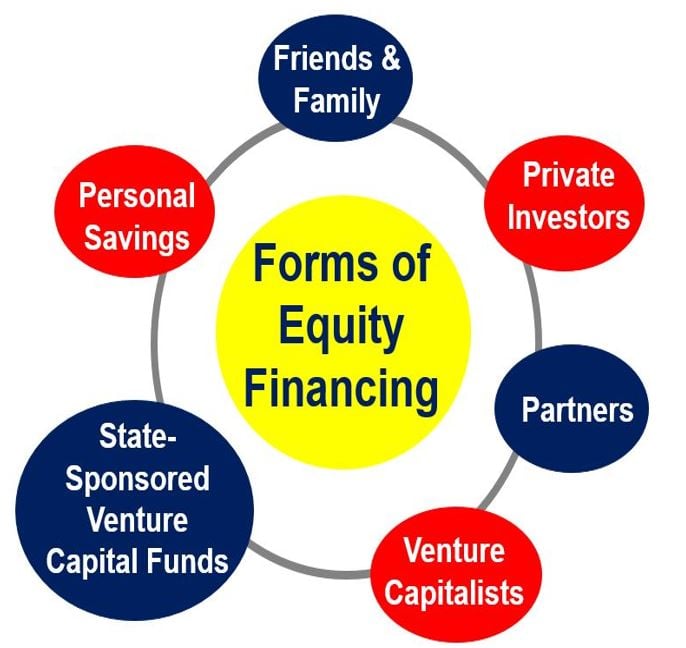

Money can come from several possible sources if you are considering equity financing.

Money can come from several possible sources if you are considering equity financing.

Advantages and disadvantages of equity finance

Sometimes equity finance is more appropriate than other forms of raising capital, however, it can place different demands on the owners and their business.

Advantages associated with equity finance:

- The money is committed to the business and its intended expansion projects.

- The arrangement is free of having to service bank loans or debt finance.

- Some venture capitalists and business angels can bring valuable skills, contacts and experience to the business.

- The investor or investors who channeled money into your business have a vested interest in its success – this is good for the company.

- Many investors are ready to release additional funds if they are needed in the future.

Disadvantages associated with equity finance:

- Raising equity finance is very time consuming and often costly. Focusing on it could be at the cost of other core business priorities.

- If you don’t like being micromanaged, equity finance might not be for you. The investors will want to know what is going on, some will become actively involved in the everyday running of the business. You will definitely have to provide regular reports on your targets and progress.

- You will have to lose some ownership of the business, and share it with others.

Video – Equity Financing and Debt Financing

In this Council for Education video, you can learn about the difference between equity financing and debt financing.