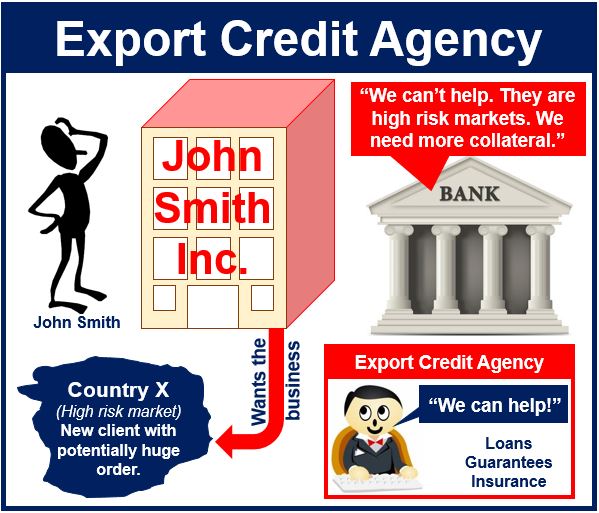

An export credit agency (ECA) is a quasi-governmental or private entity that acts as an intermediary between exporters and national governments to issue export financing, i.e. it provides trade financing to domestic businesses that are selling their goods and services abroad.

The financing may include loans, guarantees, and credit insurance to businesses in order to encourage exports in the ECA’s domestic economy.

The agencies may also offer cover or credit on their own account. Their services do not differ from normal banking activities. Some ECAs are private, government-sponsored, or a blend of the two.

Unlike commercial banks that try to make a profit, ECAs only seek to cover their operating and financing costs.

Export credit agencies say they help promote exports and job creation.

Export credit agencies say they help promote exports and job creation.

ECA’s come in many shapes and sizes. Some just specialize in short-term credit business, while others focus entirely on medium- and long-term business.

Most ECAs provide insurance and other financial services for the medium-term (2-5 years) and long-term (5-10 years and longer) – transactions that are generally linked to large projects.

The export credit agency helps eliminate uncertainty

An export credit agency’s main aim is to eliminate the risk and uncertainty of being paid that exporters face when selling their goods and services abroad. For a premium, the risk shifts from the exporter to the agency.

ECAs also offer coverage for the political and commercial risks of investments in ‘high risk’ foreign markets.

According to ECA Watch, an International NGO campaign on export credit agencies:

“ECAs are now the world’s biggest class of public finance institutions operating internationally. Collectively they exceed the size of the entire World Bank Group and fund more private-sector projects in the developing world than any other class of finance institution. Most industrialized nations have at least one ECA.”

Three main functions of ECAs

In a document – ‘The Role And Importance of Export Credit Agencies’ – written by Raquel Mazal Krauss of the Institute of Brazilian Business & Public Management Issues, part of George Washington University, ECAs provide three basic functions:

1. They help exporting companies meet officially supported foreign credit competition.

2. They provide financing to overseas buyers when private lenders will not or cannot finance those export sales, even when the risks are removed.

3. They assume risks beyond those generally assumed by private lenders. This is probably their most important function.

ECAs do not compete with private banks. In fact, they help their domestic lenders compete more effectively internationally. In most countries, business people can access ECAs through their country’s banking institutions.

ETAs have been around for over a century

Federal of Switzerland, set up in 1906 and still operating today, was the world’s first export credit insurance agency.

The first government export credit insurance program was established in the UK in 1919. According to the UK government at the time, its mission was “to aid unemployment and to re-establish export trade disrupted by the conditions of war.” This mission statement was soon adopted by several other countries.

The British government established a trade finance program, which in addition to export credit insurance, offered up to six-year financing of exports at 1% above the Bank of England minimum rate.

It was not long before other countries saw the benefits of the British and Swiss programs and started setting up their own guarantee and insurance schemes. By 1929, Austria, Germany, Finland, the Netherlands, Denmark, Belgium, Italy, France and Spain had their own ETAs.

Video – The importance of ECAs

In this CNBC Africa video, experts talk about the importance of ECAs in oiling the wheels of international trade and investment. International trade refers to the importing and exporting of goods and services.