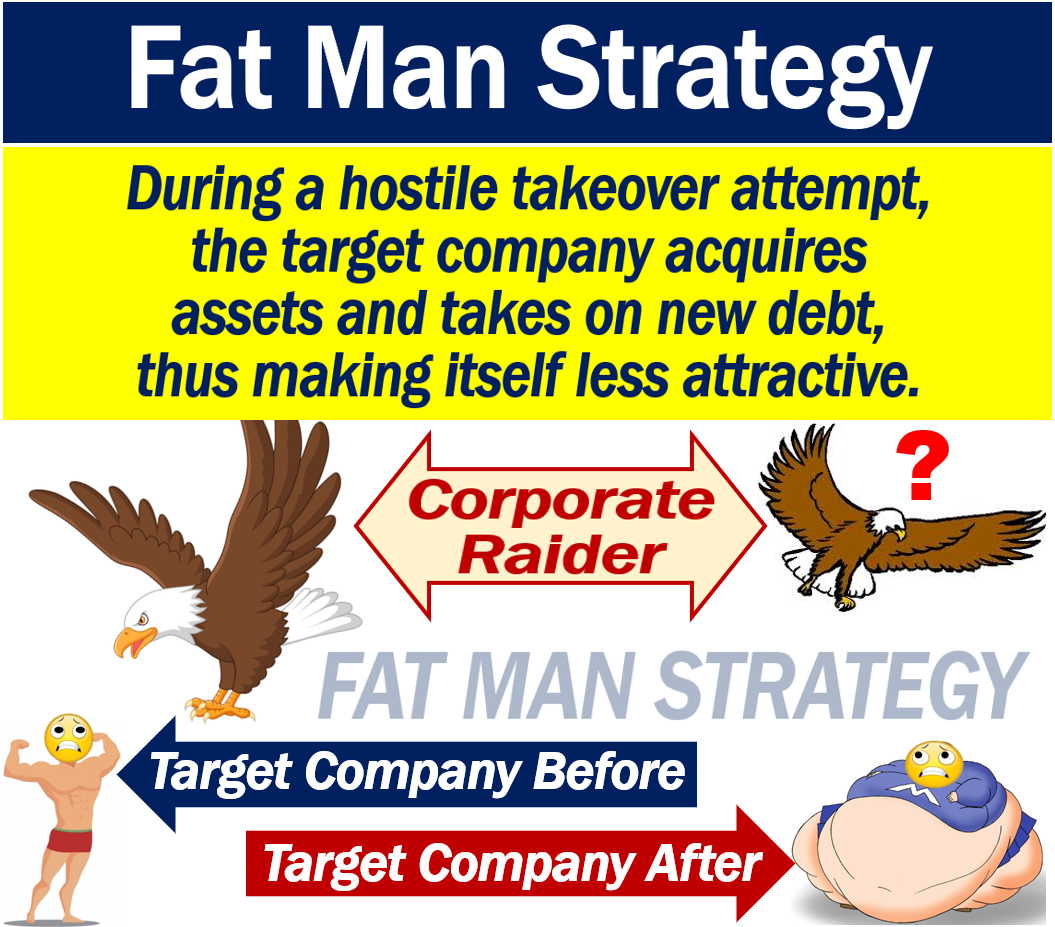

A Fat Man Strategy is a technique that a company uses when it is the target of a hostile takeover. The target company, in a fat man strategy, acquires the assets of another company. It might even acquire a whole company. It deliberately chooses assets or a company that the predatory company does not like. By doing this, the target company becomes unattractive.

Utilizing this approach, the target company often selects acquisitions that not only dissuade the predator due to their size or complexity but also because they may come with regulatory challenges that are unappealing to the potential acquirer.

A hostile takeover is a takeover in which the ‘prey’ does not want the takeover to occur. It is the opposite of a friendly takeover.

During a takeover attempt, the predatory company, i.e., the one wanting to acquire, is the ‘bidder‘ or ‘corporate raider.’

We call the ‘prey’ the ‘target company.’ In a hostile takeover attempt, the target company tries to resist.

The target company may also take on additional debt to make itself unattractive.

Finance @ TAPMI has the following definition of the term:

“A takeover defense tactic that involves the acquisition of a business or assets by a target company.”

“The strategy is based on the premise that the bulked-up company – the “fat man” – would have reduced appeal to a hostile bidder, especially if the acquisition increases the acquirer’s debt load or decreases available cash.”

Fat man strategy – kamikaze defense

The fat man strategy forms part of what we call a kamikaze defense. When a kamikaze defense strategy is underway, the target company either takes on new assets or debts or gets rid of assets.

In other words, the target company deliberately makes itself either fat and bloated or thin and skinny.

Fat man strategies are only those in which the target company acquires new assets or takes on new debt. Put simply; with a fat man strategy, the company wants to make itself ‘fat and bloated.’

Below are three kamikaze defense strategies to resist a hostile takeover attempt.

-

Sale of the crown jewels strategy

A corporate raider usually wants to acquire another company because it has assets or products that it desires. The most prized or coveted assets of a company are its ‘crown jewels.’

If the target company sells off its crown jewels, it may succeed in putting off the corporate raider.

However, this strategy may be an extreme option. If it sells off its crown jewels, the target company could be destroying itself.

-

The fat man strategy

The target company buys other businesses or assets that make it appear ‘fat and bloated,’ i.e., less attractive.

The target company may also take on additional debt. Another option is to acquire another company that has lots of debts.

By diversifying its business operations through these acquisitions, the target company may also gain new competencies and markets that further complicate the raider’s integration plans.

-

Scorched earth policy

A scorched earth policy in business is similar to what some military strategists do when their troops are retreating.

Retreating troops destroy all crops and infrastructure. Subsequently, the invaders will find it hard to survive.

The target company sells off assets and takes on big debts. By doing this, the corporate raider sees that there will be virtually nothing useful there after the acquisition.

A fat man strategy or other kamikaze defense strategies are last resort options. They are very high risk strategies, because the company risks doing itself irreparable damage.

The strategy could even lead to the company’s death.

Unlike WWII Japanese kamikaze pilots, the target company’s aim is not to commit suicide.

Educational Video – What is a Fat Man Strategy?

This video, from Marketing Business Network, our sister channel on YouTube, explains what ‘A Fat Man Strategy’ is using easy-to-understand language and examples.