The Federal National Mortgage Association, known also as FNMA and more commonly as Fannie Mae, was founded during the Great Depression in the United States in 1938 as part of President Franklin Delano Roosevelt’s New Deal. It is a GSE (government-sponsored enterprise), which has been a publicly traded company since 1968.

Roosevelt wanted to establish an entity that would provide local banks with federal money to finance home loans in an attempt to expand home ownership across the nation, as well as the availability of affordable housing.

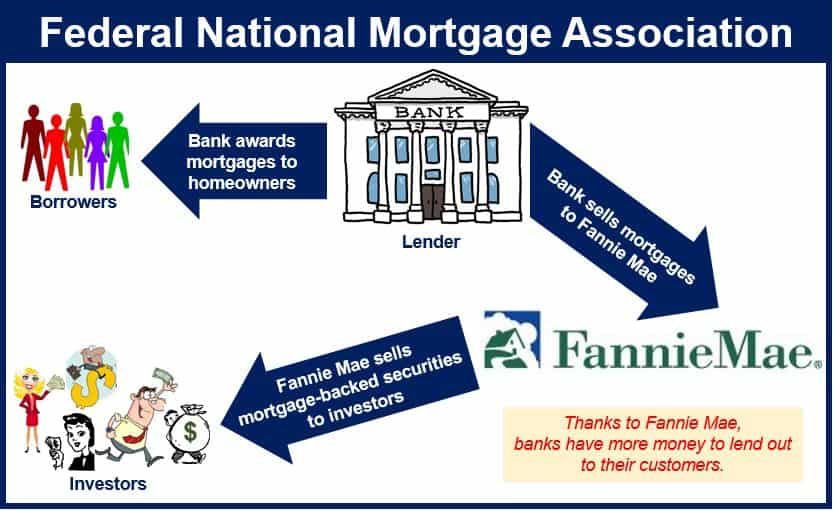

Fannie Mae’s purpose is to enlarge the secondary mortgage market by securitizing mortgages in the form of MBS (mortgage-back securities), thus allowing lenders to reinvest their funds into providing more mortgages for their customers, and effectively expanding the number of lenders in the mortgage market.

Fannie Mae was set up to get more Americans to own their homes.

Fannie Mae was set up to get more Americans to own their homes.

As a major source of residential mortgage credit in America’s secondary market, Fannie Mae claims it is supporting the current economic recovery and helping build a housing system which is sustainable.

According to Fannie Mae:

“We exist to provide reliable, large-scale access to affordable mortgage credit in all communities across the country at all times so people can buy, refinance, or rent homes.”

“We are working to establish and implement industry standards‚ develop better tools to price and manage credit risk‚ build new infrastructure to ensure a liquid and efficient market‚ and facilitate the collection and reporting of data for accurate financial reporting and improved risk management.”

During the first thirty years of its life, Fannie Mae held a monopoly over the secondary mortgage market in the United States.

The Housing and Home Finance Agency acquired Fannie Mae from the Federal Loan Agency in 1950 as a constituent unit. In 1954 it became a ‘mixed-ownership corporation’, with the federal government holding preferred stock while private investors bought common stock.

In 1968, Fannie Mae became a privately-held corporation. In the same year it was split into two: 1. The Current Fannie Mae, and 2. Ginnie Mae (the Government National Mortgage Association).

Ginnie Mae, which is still a government-owned organization, supports FHA-insured mortgages as well as mortgages insured by the Farmers Home Administration and the Veterans Administration.

The federal government authorized Fannie Mae to buy conventional mortgages in 1970. In that same year it went public on the New York and Pacific Exchanges. Freddie Mac was created to compete with Fannie Mae, the aim being to facilitate a more efficient and robust secondary mortgage market.

Fannie Mae issued its first mortgage passthrough in 1981, calling it a mortgage-backed security (MBS).

Fannie Mae guarantees mortgage payments

Today, Fannie Mae buys and guarantees mortgages that adhere to its funding criteria, and then sells them on to investors, such as insurance companies, foreign governments and pension funds as mortgage-backed securities.

It also holds a vast portfolio of its own, as well as MBS belonging to other institutions (retained portfolio). To fund this portfolio, it issues debt (agency debt).

Together with its little brother (Freddie Mac), the two entities purchase or guarantee from 40% to 60% of all mortgages granted to borrowers in the US.