What is fiscal? Definition and examples

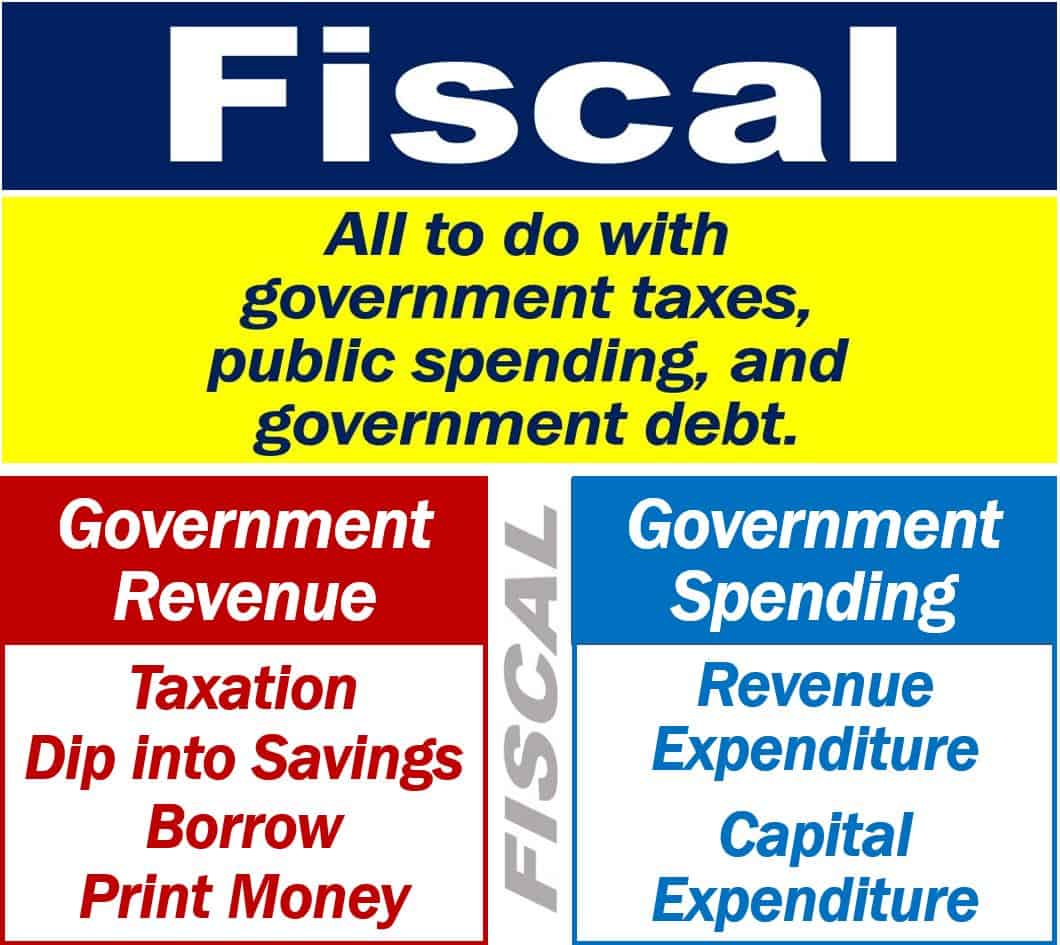

Fiscal relates to government revenue and spending, i.e., tax revenue and government expenditure. It also relates to government borrowing, i.e., public debt. In the United States, the term also means ‘financial year.’

In Scotland, the procurator fiscal is a public official who puts people on trial, i.e., the public prosecutor.

This article focuses on the word when it relates to government revenue, expenditure, and debt.

The Collins dictionary has the following definition of the term:

“Fiscal is used to describe something that relates to government money or public money, especially taxes. Example sentence: ‘…last year, when the government tightened fiscal policy.'”

Fiscal policy

Fiscal policy refers to using government expenditure and taxation to impact the national economy.

All national governments hope that their policy encourages strong and sustainable growth.

Sustainable growth is a growth rate that a country can continue achieving over the long term. In other words, growth that does not subsequently result in serious economic problems.

When a government alters levels of taxation and public spending, the following variables in the economy are affected:

- Aggregate demand and levels of economic activity.

- Savings and investment.

- The distribution of income.

The government can fund expenditure through taxation, borrowing money, and dipping into savings. It can also sell assets or print money.

Two government measures – boosting public spending or reducing taxation – come under the umbrella term ‘fiscal stimulus.’

People who believe that fiscal policies are vital in economic regulation are ‘fiscalists.’

Fiscal measures, such as tax incentives for businesses and credits for low-income families, are designed to address income inequality and stimulate economic participation from all sectors of society.

Fiscal vs. monetary policy

We frequently see these two terms in the financial press. Their meanings are quite different.

-

Monetary policy

Monetary policy is the focus of the central bank. Regulating the cost of borrowing, i.e., interest rates, for example, is part of monetary policy.

Monetary policy’s main aim is to control inflation and stabilize the country’s currency.

Fiscal policy

Fiscal policy refers to public spending, i.e., government expenditure, and its impact on macroeconomic conditions.

Macroeconomics is a branch of economics that looks at general or large-scale economic factors.

GDP (gross domestic product) and unemployment, for example, are macroeconomic factors.

Etymology of fiscal

Etymology is the study of where words come from, i.e., their origins, and how their meanings have evolved.

The term first emerged in the English language in the 1560s. According to etymonline.com, at the time it meant ‘pertaining to public revenue.’

The English term came from the Middle French word Fiscal, which came from Late Latin Fiscalis. The Late Latin word meant ‘belonging to the state treasury.’

The Latin word Fiscus meant ‘state treasury, money bag, purse, basket made of twigs (in which one kept one’s money).’

Fiscal – vocabulary and concepts

There are many derivatives of the English root word “fiscal,” as well as compound words. Let’s have a look at some these terms, their meanings, and examples of how we can use them in a sentence:

-

Fiscal (Adjective)

Related to government revenue, especially taxes.

Example: “The fiscal policies of the government were revised to combat inflation.”

-

Fiscally (Adverb)

In a way that relates to financial matters.

Example: “The government needs to act fiscally responsible to reduce the national debt.”

-

Fiscalist (Noun)

An economist who emphasizes the role of fiscal policy in government.

Example: “As a fiscalist, she believes in adjusting tax rates to manage economic cycles.”

-

Fiscalism (Noun)

The economic theory that endorses the use of fiscal policy to manage the economy.

Example: “Fiscalism has gained traction among policymakers during the economic downturn.”

-

Fiscality (Noun)

Definition: The state or condition of being subject to taxation.

Example: “The fiscality of the new regulations could impact small business owners the most.”

-

Fiscalize (Verb)

To deal with financial matters or bring into relation with finances.

Example: “The government decided to fiscalize the new public health initiatives to ensure adequate funding.”

- Nonfiscal (Adjective)

Not related to government revenue, taxation, or public spending.

Example: “They discussed nonfiscal benefits of the legislation, such as improved public health.”

-

Fiscal Year (Compound Noun)

A year as reckoned for taxing or accounting purposes.

Example: “The company’s fiscal year runs from July 1 to June 30.”

Video – What is Fiscal?

This educational video presentation, from our YouTube partner channel – Marketing Business Network, explains what the word ‘Fiscal’ means using simple and easy-to-understand language and examples.