What is fiscal stimulus? Definition and examples

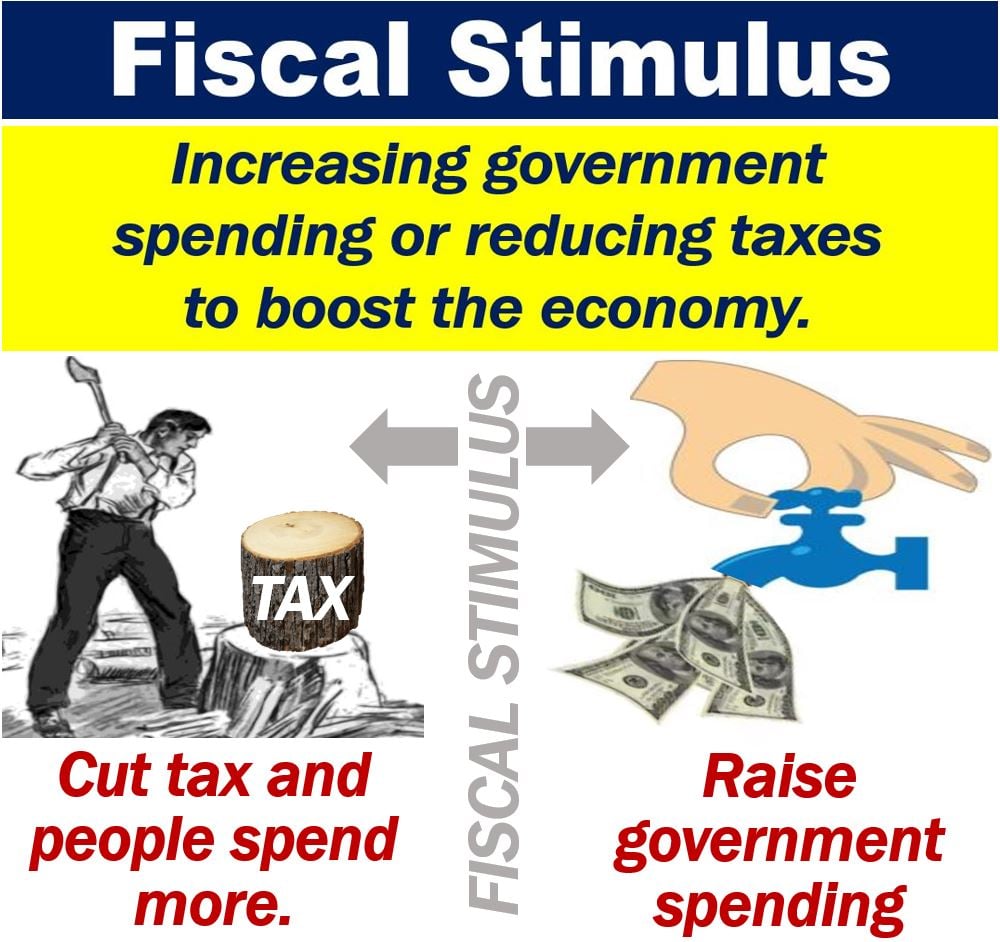

Fiscal Stimulus may refer to either greater public spending or tax cuts. In both cases, the government wants to boost economic growth. In the majority of cases, government bailout packages are also types of fiscal stimulus.

A bailout occurs when the government, i.e., the taxpayer, saves a company from dying. It saves the company by buying it, arranging a loan, or injecting money into it.

Fiscal stimulus efforts often include targeted subsidies to vital sectors that are considered the backbone of the economy, like manufacturing and technology.

The word ‘fiscal‘ refers to government finances, i.e., public expenditure or spending, taxation, and government debt.

Fiscal stimulus comes under the umbrella term ‘fiscal policy.’ Fiscal policy is the government’s policy regarding its spending, taxation, and levels of debt.

We call somebody who believes that fiscal stimuli are important for economic regulation a ‘fiscalist.’

According to forbes.com:

“Stimulus packages comprise a range of different government taxation and spending measures. When it enacts fiscal stimulus, the government hands over cash, via direct subsidies, loans or tax incentives, to individuals, companies and even entire industries impacted by an economic downturn.”

Boosting spending is favored by left-leaning parties and tax cuts by right-leaning ones. However, when there’s a serious financial crisis in the advanced economies, the fiscal stimulus each party uses is similar.

Fiscal stimulus – tax cuts

Conservative or right-leaning parties tend to opt for tax cuts to boost the economy.

If the government cuts taxes, disposable income subsequently grows. Therefore, consumers and businesses will spend more; this leads to greater aggregate demand.

An increase in aggregate demand leads to economic growth, or so the theory goes.

When the fiscal stimulus involves tax cuts, the government has two options:

- Reduce spending because lower taxes mean less government revenue.

- Borrow money, i.e., increase government debt.

Followers of Neo-Classical Economics believe that consumers are the ultimate drivers of an economy.

Therefore, Neo-Classical economists insist that the best way to get sustainable growth is through tax cuts.

Neo-Classical Economics, however, does not propose that the government should borrow its way out of trouble.

Fiscal stimulus – boost government spending

Rather than reduce taxes, governments also have the option of increasing public spending. Followers of Keynesian Theory believe that greater government spending can pull an economy out of a recession or depression.

John Maynard Keynes (1883-1946), a British economist, put forward this theory. Hence, its name.

Regarding Keynesian Theory, the IMF (International Monetary Fund) writes:

“The main plank of Keynes’s theory, which has come to bear his name, is the assertion that aggregate demand – measured as the sum of spending by households, businesses, and the government – is the most important driving force in an economy.”

Example sentences

“Here are examples showing how the term ‘fiscal stimulus’ can be used in context:

- The government’s package of fiscal stimulus is expected to inject $500 billion into the economy over the next fiscal year.

- During the recession, the central bank recommended a fiscal stimulus to counteract the downturn and stabilize the market.

- Critics argue that the fiscal stimulus will lead to inflation, but supporters claim it’s necessary to boost job creation.

- The fiscal stimulus targeted towards renewable energy projects is a step towards sustainable economic growth.

- Small businesses have benefited from the fiscal stimulus, which has provided them with essential tax breaks and subsidies.

- The administration’s fiscal stimulus plan includes significant investments in infrastructure to modernize roads, bridges, and public transport systems.

- Economists are debating whether the fiscal stimulus has had a positive effect on the country’s long-term economic health.

Video – What is Fiscal Stimulus?

In this visual guide presented by our affiliate channel, Marketing Business Network on YouTube, we explain what “Fiscal Stimulus” is using straightforward language and easy-to-understand examples.