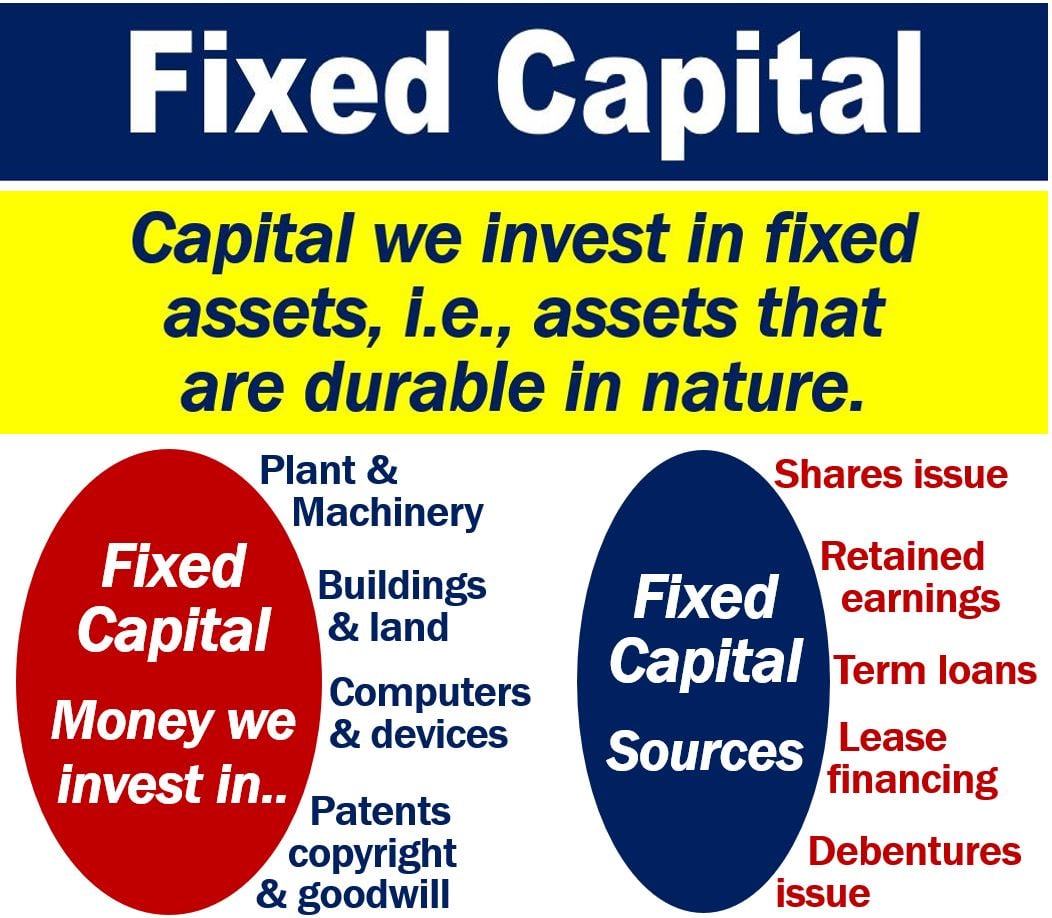

Fixed Capital is capital or money that we invest in fixed assets. In other words, money that we invest in assets of a durable nature. These are assets that we repeatedly use over a long period. We can also use the term ‘fixed investment‘ with the same meaning.

Fixed assets are tangible assets that we cannot convert into cash easily. Property is an example of a fixed asset, and so are plant and equipment. Hence the term, PP&E (property, plant, and equipment).

We do not resell fixed assets as part of our everyday business operations. We use fixed assets in the production of our company’s income or for administrative purposes.

Some people use the terms fixed assets/capital interchangeably. However, technically, when we use the term ‘capital,’ we refer to the money we invest in fixed assets.

Fixed capital for businesses

The term includes all the capital investments and assets that we need to start up a business. It also includes all the capital investments and assets we need to conduct business at any stage.

We invest the money in assets that we cannot consume or destroy during the production of a product. We cannot consume or destroy them in the delivery of a service either. Hence, they are ‘fixed assets.’ However, they have a reusable value.

Fixed assets include tangible items we need for business operations. It does not include items we use in the production of something.

For example, equipment and facilities form part of fixed assets. Wood, however, in a furniture factory, is not. We use wood in the production of furniture, i.e., it is a component of an item of furniture.

The term contrasts with circulating capital. Circulating capital includes, for example, raw materials.

Therefore, in furniture a factory, we refer to the building and machinery as fixed assets and the wood as circulating capital.

Fixed capital – David Ricardo

British political economist David Ricardo (1772-1823), first theoretically analyzed fixed capital in depth.

The term subsequently became a concept in accounting and economics.

Fixed capital is the part of the total capital outlay that we invest in fixed assets. In other words, the portion of total capital outlay that we invest in equipment, plant, buildings, land, and vehicles.

Maintenance and depreciation are significant factors to consider in fixed capital, as these assets require regular investment to retain their value and functionality over time.

Furthermore, fixed capital investments often entail a higher degree of financial planning and risk management due to their substantial upfront costs and long-term commitment.