Fractional reserve banking occurs when a bank has reserves that are less than the amount deposited by its customers. In other words, the bank accepts customer deposits and holds reserves that are a fraction of what they deposited – it does not use that fraction to lend out.

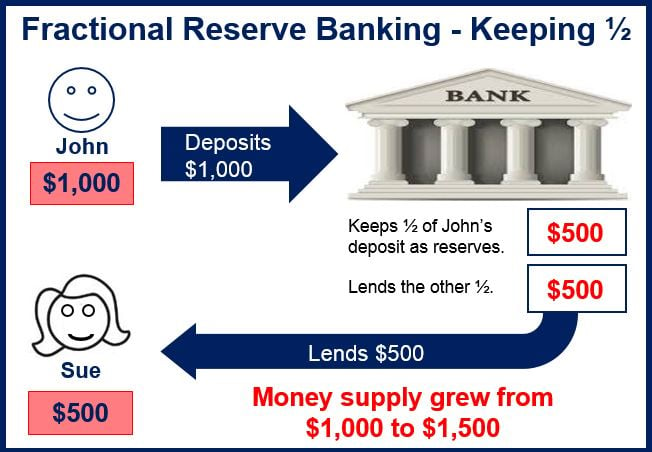

Fractional reserve banking is what makes the money supply grow. Say a bank must keep 50% of money that customers deposit, but can make loans with the other 50%. If I deposit $1,000, the bank will lend somebody else $500 – the original $1,000 has grown to $1,500.

As banks’ deposits are considered to be money, then fractional-reserve banking allows the money supply to be greater than the underlying reserves of base money created by the central bank.

The size of the fraction that banks keep in reserve from customers’ deposits influence money supply growth.

The size of the fraction that banks keep in reserve from customers’ deposits influence money supply growth.

If a bank runs (when there are a significant number of people who want to withdrawal their money at the same time) then governments typically offer deposit insurance and lend money to commercial banks.

In the majority of countries across the world a central bank is in charge of establishing reserve requirements, capital adequacy ratios (measure of a bank’s ability to absorb losses), and regulation of bank credit. This limits how much money can be created in the commercial banking system and ensures that banks are always solvent and have the funds for withdrawals.

When funds are deposited in a bank, they are no longer the property of the customer but become the property of the bank. The customer receives an asset in return (a deposit account), which is a liability of the bank on its books. Banks are allowed to create credit equal to a multiple amount of its reserves.

A common means of measuring the increase in the money supply is the “money multiplier”. It determines the maximum amount of money that an initial deposit can be enlarged (according to a specific reserve ratio).

According to Cambridge Dictionaries Online, fractional reserve banking is:

“The practice in which banks keep only a small amount of their customers’ money and lend the rest to other customers.”

Money multiplier formula:

Total Money Created = Initial Deposit x (1 / Reserve Requirement)

Reserve requirements are usually around 3% – 5%.

Example of fractional reserve banking

Assume someone has deposited $200,000 in the bank. The bank has to keep a certain fraction of that money reserved and can lend the rest to other customers. If the bank has a reserve requirement of 5%, then the bank has to keep $10,000 of the deposit reserved and can use the remaining $190,000 to lend to other customers.

If the bank lends out this $190,000 to another customer they can reserve $9,500 and use $175,000 to lend out.

This can go on and on and the bank can eventually use the initial $200,000 (deposited by the first person) to lend out over a million USD.

Using the money multiplier formula one can calculate how much money the fractional reserve banking system can create from the initial deposit of $200,000.

Money Created = $200,000 x (1/0.05)

= $4,000,000

Therefore a $200,000 deposit can essentially be used to create $4 million.