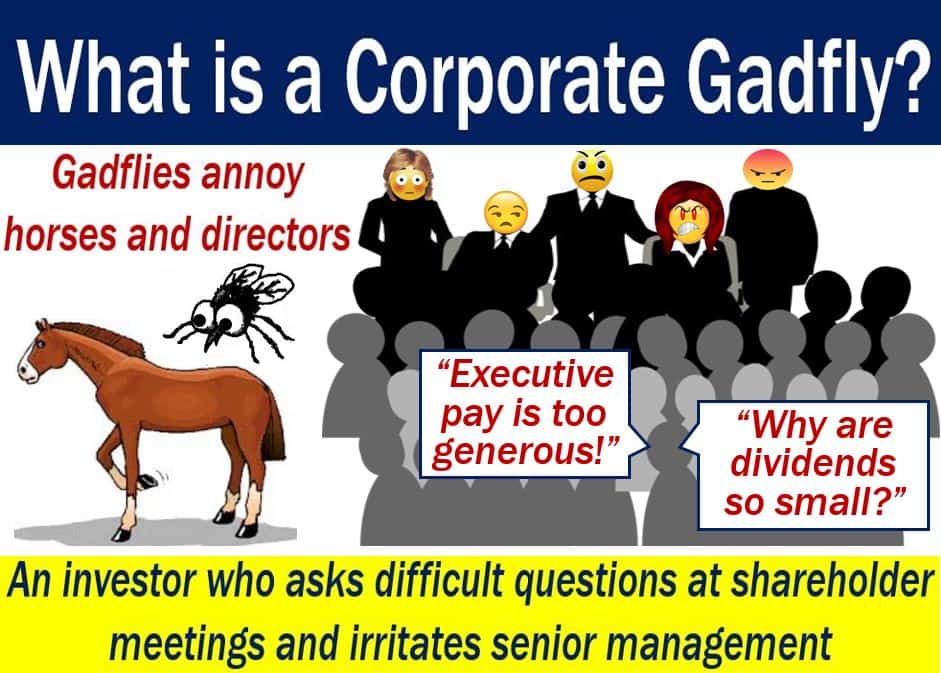

A Gadfly, apart from being a fly that annoys livestock, is also an activist investor who attends shareholder meetings and causes problems. Specifically, problems for senior management. We often refer to this person as a Corporate Gadfly. They are activist investors who passionately advocate for change during shareholder meetings. A gadfly is usually distinctive for aggressively grilling senior management during the meetings.

Additionally, the influence of gadflies extends beyond mere questioning; they often use social media and public platforms to raise awareness and garner support for their causes, effectively amplifying their impact on corporate decisions.

In non-business contexts, gadflies are people who criticize or annoy others to provoke them into action. This article focuses on the meaning of the term in a business context.

Just like the small insect that drives horses crazy, the gadfly aims to annoy senior management until it does something about shareholder concerns.

Gadflies ‘stir the pot’

Gadflies commonly rattle management regarding inconvenient locations for annual meetings or executive compensation. In other words, when shareholders resent how much the company pays senior management, gadflies are sure to bring it up.

In other words, they like to stir the pot. ‘To stir the pot’ means to cause unrest or controversy by provoking or bringing up issues that are potentially divisive or contentious.

For the other shareholders, gadflies are useful and often welcome.

Financial-Dictionary.TheFreeDictionary.com has the following definition for gadfly:

“A slightly derogatory term for a shareholder who attends annual meetings of shareholders and asks the executives difficult questions.”

“The gadfly may question executive pay, ask why a dividend was not larger when it could have been, and may also generally point out issues about which other shareholders may not be aware.”

Gadfly and the activist shareholder

Gadflies are activist shareholders. In other words, they advocate for changes in how managers govern. They do this by offering proposals for votes at shareholder meetings.

Meeting organizers must place proposals that shareholders offer on the agenda. At the next meeting, the shareholders vote on those proposals.

However, typical gadflies offer proposals that the directors prefer to avoid. Therefore, they tend to trigger confrontations.

Gadflies’ proposals force the directors either to urge stockholders to vote against them or work on a compromise.

Gadfly proposals may focus on the size of dividends, corporate political lobbying, proxy access, or voting rules. They also put forward proposals regarding executive compensation, social responsibility, and environmental concerns.

Many activist investors are different from gadflies. For example, activist investors like William Ackman and Carl Icahn tend to purchase major stakes in companies. They do this because they want to influence senior management directly.

According to Investopedia.com:

“Gadflies are stockholders who have held a minimum of $2,000 in a company’s equity for at least one year.”

In the United States, any shareholder who holds over $2,000 in stock can put forward a shareholder proposal. Shareholders who own 1% or more of a company can also put forward proposals. Therefore, a gadfly can be a very small stockholder.

Video – What is a Gadfly?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Gadfly’ is using simple and easy-to-understand language and examples.