What is the Goods and Services Tax (GST)?

The Goods and Services Tax (GST) is a comprehensive tax that is levied on the value added at every stage of the manufacturing or distribution process. It is multi-stage and destination-based. Put more simply, it’s a tax on the consumption of goods and services that replaces several different indirect taxes that were in place before. In some countries, it is called VAT (Value Added Tax). In India and Singapore, it is known as Goods and Services Tax or GST.

According to the Inland Revenue Authority of Singapore:

“Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods(collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT.”

Characteristics

The following are some of the characteristics of GST:

-

- Multistage

GST is applied at various stages, from the purchase of raw ingredients to the product’s sale.

-

- Destination-based

The tax is collected where the goods are consumed, not where they were produced. In other words, the authorities levy the tax based on where the goods and services are going, not where they came from.

-

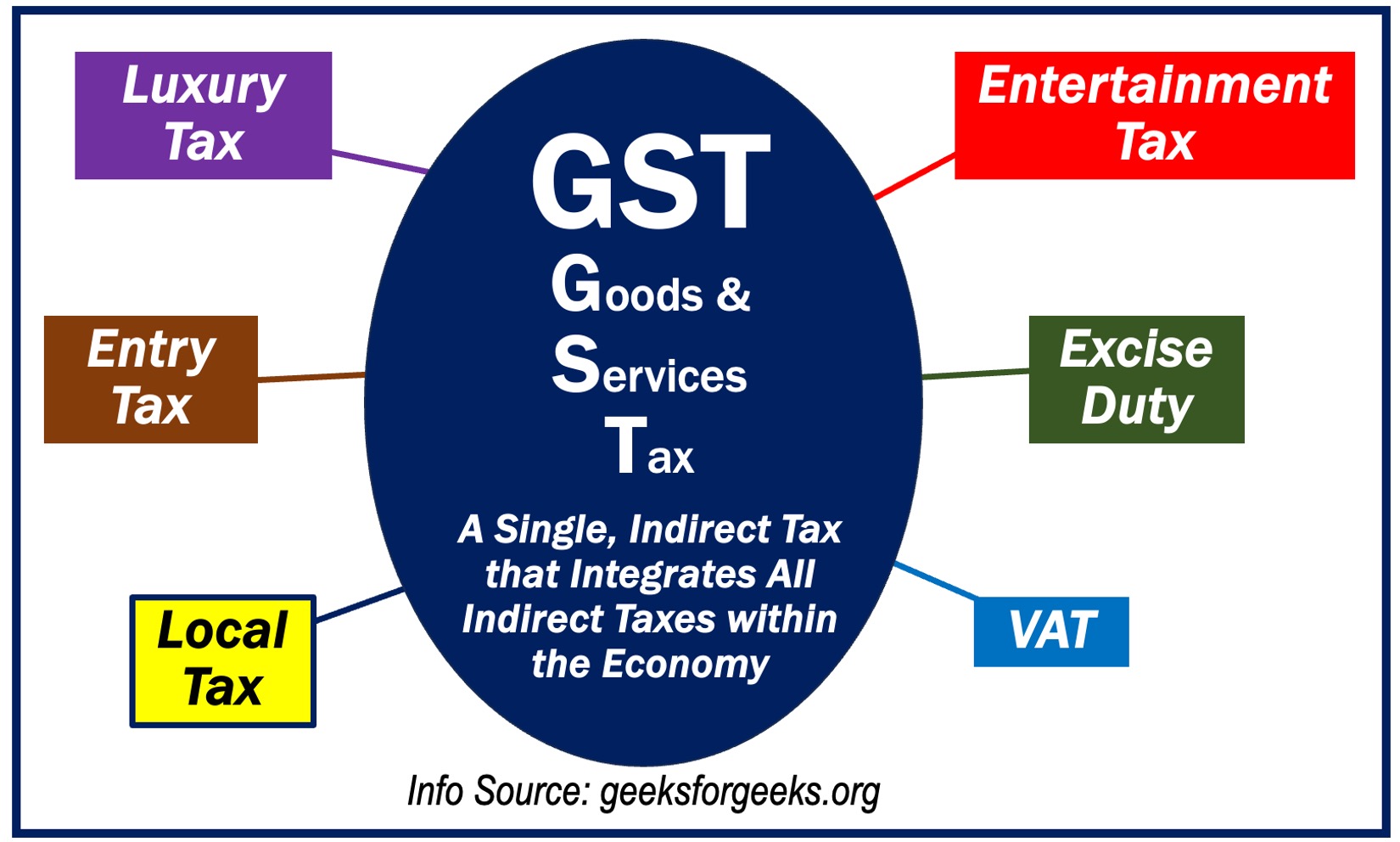

- Single umbrella

GST brings many different indirect taxes, like sales tax, service tax, and excise duty, under one conjoined system.

Benefits of Goods and Services Tax

GST offers various benefits, including:

-

- Simplified tax structure

By incorporating several taxes into a single system, GST simplifies the tax structure, simplifying compliance.

-

- Avoids ‘Tax on Tax’

GST removes the cascading effect of tax, where goods are taxed multiple times at various stages.

-

- Price reduction

A more efficient tax process can lead to a reduction in production and distribution costs, which may help lower prices for consumers.

-

- Boost to the economy

GST has the potential to stimulate economic growth and enhance the overall business environment by unifying the market and minimizing state barriers.

Challenges and concerns

As well as benefits, there are also concerns and challenges, such as:

-

- Implementation hurdles

Transitioning into a new tax system can be difficult and complex, since it requires changes in software, training, and administration.

-

- Rate slabs

Many countries with the GST system have multiple rate slabs for different goods and services, leading to classification issues. ‘Rate slabs’ are predefined tax brackets specifying different tax rates.

-

- Short-term economic disruption

Initially, the shift to GST can cause short-term disruption in the economy as businesses adjust to the new system.

Global perspective

A lot of countries all around the world have implemented a form of GST or Value Added TAX (VAT). The rate slabs or exempted commodities, might change depending on the requirements and goals of the nation’s economy. However, the general ideas stay the same.

Which countries have GST?

According to quaderno.io, the following countries have GST:

-

- Australia

- Canada

- India

- Malaysia

- Maldives

- New Zealand

- Papua New Guinea

- Singapore

Written by Nicolas Perez Diaz, October 27, 2023.