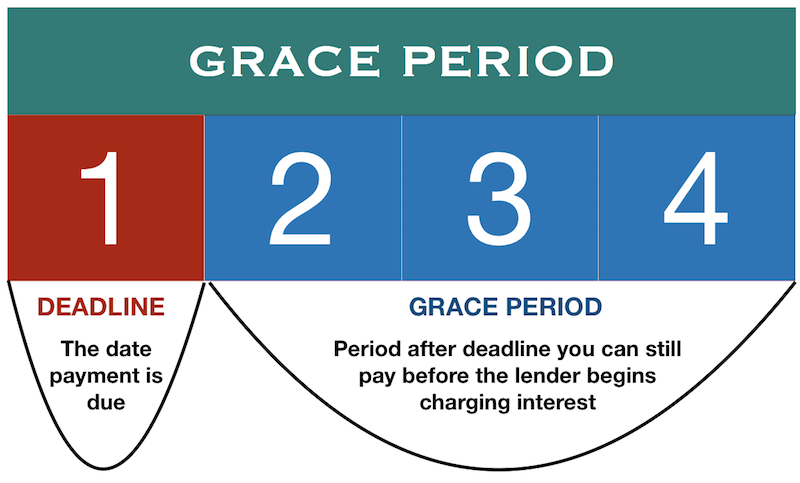

A grace period refers to the time permitted to meet an obligation after its deadline with little or no penalty.

Grace periods can range from minutes to several days (depending on the situation).

Many credit card companies give customers a grace period in which they can pay their credit card bill without having to pay interest. Utility companies often give customers a grace period to pay their bill before cutting the service.

One of the advantages of grace periods is that it allows people who typically meet deadlines on time to not face a penalty on the rare occasion that they are late.

A disadvantage is that some people may consider the grace period as the actual deadline to fulfill an obligation.

Examples of grace period

- Alex and a car dealership enter a contract. There is an understanding that Alex has a grace period of 10 days in which he can return the car without any fees. Alex returns the car 6 days later because the mileage isn’t as good as he expected. Because of the grace period, Alex does not face any penalties when he returns the car.

- John’s credit card bill arrives. His deadline to pay is on the 15th, but he won’t have the money to pay back until the 17th. John knows he has a 5 day grace period. He therefore makes plans to pay on the 17th with the understanding that the credit card company won’t charge interest.