A graduated payment mortgage loan (GPM) is a mortgage that offers low initial monthly payments that increase over time to a specified level. This type of mortgage is usually attractive for young people – with low or moderate income – who expect their wages to eventually rise.

Recently qualified professionals, such as young doctors, may find this type of housing loan a good option, because they know that within a few years their income will increase significantly.

It is seen as an alternative to conventional adjustable rate mortgages. A GPM has a fixed note rate and payment schedule and is a type of negative amortization loan.

Over the long-term, the borrower will be paying out more in total, compared to conventional mortgages.

Over the long-term, the borrower will be paying out more in total, compared to conventional mortgages.

GPMs are offered in 15 year and 30 year amortization, and for a conforming and jumbo mortgage. GPM programs normally have five different plans that vary in length of time and rate of increase of nominal interest rate.

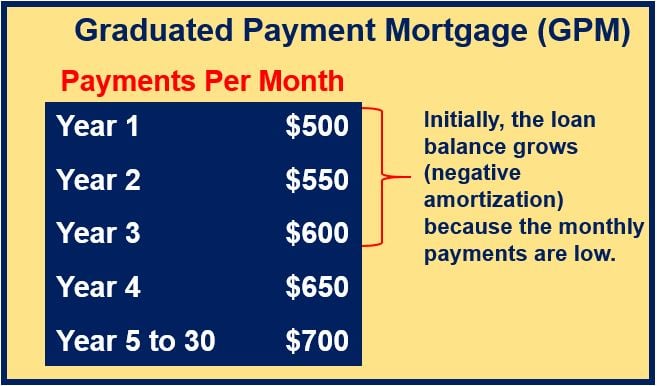

In a typical GPM, payments increase from around 7% to 12% from their initial base payment amount on an annual basis until they reach a set payment.

GPMs are currently only readily available in the US for mortgages insured by the Federal Housing Administration.

According to the U.S. Department of Housing and Urban Development:

“All FHA-approved lenders may make GPMs available to persons who intend to use the mortgage property as their primary residence and who expect to see their income rise appreciably in the future.”

There is a high level of risk associated with GPMs. It is often difficult to accurately predict whether the home buyer (who cannot afford to pay more than the initial price when the loan is issued) will actually have the earnings potential in the future to cover the payments.

Borrowers commonly overestimate how much they will be earning in future, and find themselves either struggling or simply unable to keep the payments going when they eventually rise.

Even if the GPM allows borrowers to save now by paying reduced monthly amounts, this type of mortgage is on the whole more expensive than conventional mortgages, especially when negative amortization (loan balance increases) is involved.

A graduated payment mortgage is different from a growing equity mortgage. With a growing equity mortgage there is no negative amortization of the loan.