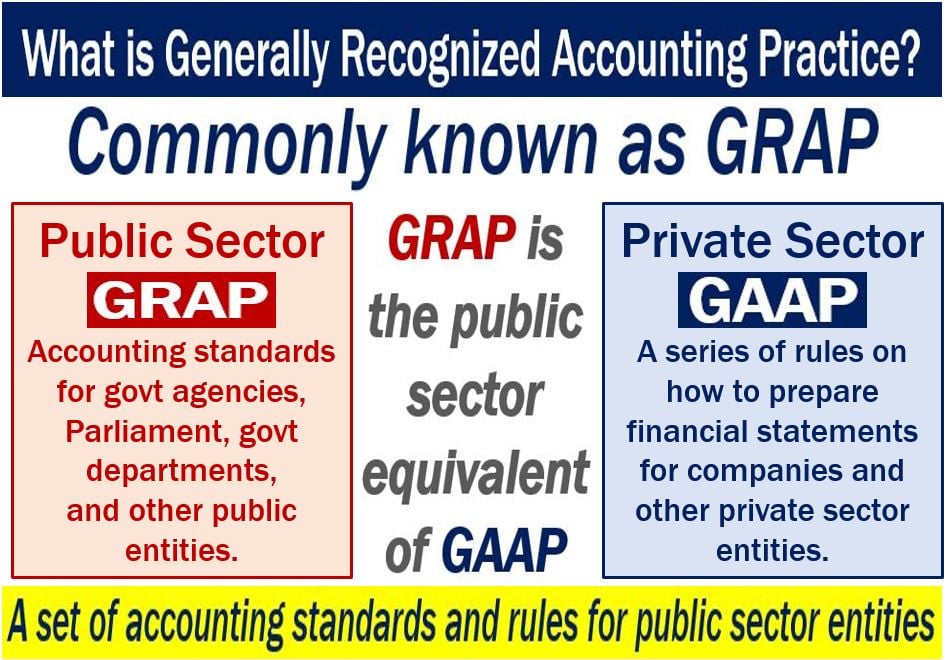

Generally Recognized Accounting Practice or GRAP is a set of fundamental concepts that serve as accounting process guidelines. However, unlike GAAP, they apply to the public sector. GAAP stands for Generally Accepted Accounting Principles. The term ‘GRAP’ is common in South Africa. The United States, United Kingdom, and most other countries have public sector accounting standards that are consistent with IPSAS. IPSAS stands for International Public Sector Accounting Standards.

GAAP consists of the standard rules and guidelines for accounting in the private sector.

Although we use GAAP and GRAP in different sectors of the economy, their function is the same.

GRAP’s guidelines exist so that public sector agencies can record their financial activities reliably and consistently. The rules and guidelines also help agencies report and record their financial activities accurately.

The Law Dictionary says the following regarding Generally Recognized Accounting Practice:

“Very similar to the private sector accounting standards known as (refer to) Generally Accepted Accounting Practice (GAAP) these are public sector accounting standards.”

GRAP also stands for the GRB2-Related Adapted Protein. It is a protein that the GRAP gene encodes in humans. The protein interacts with Linker of activated T cells.

This article focuses on the term’s meaning in accounting.

Generally Recognized Accounting Practice and PFMA

PFMA stands for South Africa’s Public Finance Management Act. Generally Recognized Accounting Practice are accounting standards that the ASB issued. ASB stands for the Accounting Standards Board. ASB issued the standards in terms of section 89 of the PFMA.

These standards apply to Parliament, provincial legislatures, municipalities, and constitutional institutions. they also apply to government departments and other public entities.

According to BusinessPundit.com, GRAP ensures that accountants follow the same processes as in GAAP in many areas. For example, when dealing with areas that can easily lead to confusion and ambiguity, such as management of errors and estimation.

BusinessPundit.com writes, regarding Generally Recognized Accounting Practice:

“This ensures transparency in the handling of funds by public entities. It is therefore important that all covered public entities strictly observe and comply with the GRAP.”