Hawala is an ancient system for moving money that predates western banking practices – the system is based on trust; there are no promissory notes. It is an informal way of moving or transferring money based on verbal assurance.

Today, the practice is more associated with the Middle East, North Africa and India, but in ancient times it was common in many parts of the world, including China during the second half of the Tang Dynasty (618-907), where it was known as Fei Quian, which meant ‘flying money’.

In Hawala, money is transferred without any actual movement. At its basic premise, Hawala is the undocumented transfer of money.

Hawala dealers, known as hawaladars, arrange the transfer of money based entirely on family connections, regional relationships, or simply trust.

Today, it is commonly referred to as ‘underground banking’, which many say is an unfair term, given that its services are mostly offered and carried out openly and legally. In some US states, Pakistan, India, and several other nations, Hawala is illegal.

The term comes from Arabic Hawala (حِوالة), which literally means ‘bill of exchange, assignment’.

The US Department of the Treasury makes the following comment regarding Hawala:

“The components of Hawala that distinguish it from other remittance systems are trust and the extensive use of connections such as family relationships or regional affiliations.”

“Unlike traditional banking or even the chop system, Hawala makes minimal (often no) use of any sort of negotiable instrument. Transfers of money take place based on communications between members of a network of hawaladars, or Hawala dealers.”

Such informal fund transfers help money flow into and between poor countries where formal western-style banking is too expensive, very heavily regulated, or simply not available.

Thanks to the Hawala system of transferring money, millions of people in developing nations receive money from relatives working abroad, which they use to buy food, clothes, medications, and pay other essential items.

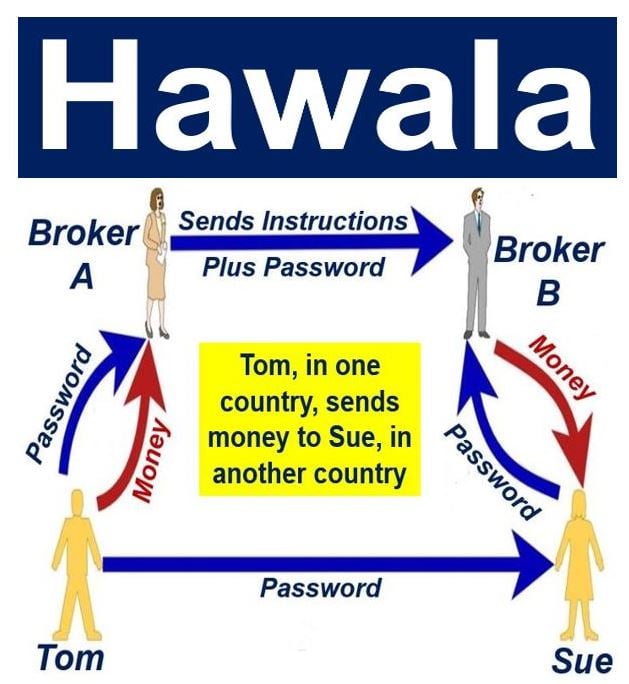

How does Hawala work?

Imagine a migrant worker from Jordan called Ibrahim who has a job in Dubai. He wants to send money to Jana (his wife) in Jordan. Here is how it would be done using Hawala:

- Ibrahim contacts a hawaladar (broker) in Dubai, and gives him some money and a password.

- The hawaladar in Dubai then contacts another broker in Jordan, and asks him to pay Jana the money.

- Jana had already been given the password by Ibrahim.

- Jana utters the password to the Jordanian hawaladar and collects the money.

- Now the Jordanian hawaladar is owed money by the hawaladar in Dubai, who decides to settle with him at a later date.

Hawaladars keep informal records of individual transactions, as well as a running tally of how much is owed by and to different brokers. Settlement of debts between hawaladars can take many forms, including cash, the exchange of goods, properties, services, or even the transfer of employees.

Advantages to using the Hawala system

– Secrecry: there are no records; no banks are involved. This means that for the sender and receiver the money is sent and received without the tax authorities finding out. This is the main reason some authorities and law-enforcement agencies say Hawala is illegal.

– Cheaper: hawaladars’ brokerage rates are considerably lower than those charged by banks or specialized companies such as MoneyGram or Western Union.

– Simple: the sender and receiver do not need to fill in complicated forms, stand in long queues, submit their IDs or other documents. All that is needed are two trustworthy hawaladars and a password.

– Untraceable: as there are no official records of the transaction, it is impossible to determine where the money came from. Unfortunately, this is a great advantage for criminals such as smugglers, drug dealers, people traffickers, and terrorists.

Law enforcement officers don’t like the system because it makes it much harder for them to monitor and/or prosecute criminals and money launderers.

Disadvantages to using the Hawala system

– Fraud: if fraudulent or unscrupulous hawaladars rip you off, there is nothing you can do. As there is no paper evidence of the transaction – it is impossible to take people to court.

– Foreign Exchange: if Hawala transaction volumes are large and the country’s currency is fragile, the effect can be detrimental for that currency.

– Banking System: a parallel system which thrives on anonymity and no records can seriously disrupt some banking systems in poor countries.

In an article published by the Global Development Research Center, Mohammed El-Qorchi, Senior Economist at the International Monetary Fund, wrote:

“It (Hawala) is less expensive, swifter, more reliable, more convenient, and less bureaucratic than the formal financial sector. Hawaladars charge fees or sometimes use the exchange rate spread to generate income. The fees charged by hawaladars on the transfer of funds are lower than those charged by banks and other remitting companies, thanks mainly to minimal overhead expenses and the absence of regulatory costs to the hawaladars, who often operate other small businesses.”

“To encourage foreign exchange transfers through their system, hawaladars sometimes exempt expatriates from paying fees. In contrast, they reportedly charge higher fees to those who use the system to avoid exchange, capital, or administrative controls. These higher fees often cover all the expenses of the hawaladars.

New competition for Hawala system

Western companies are learning from the Hawala system and beginning to adapt and compete. A London-based technology company, Transferwise, reduces the cost of international money transfers within the west by matching people who want to send money in each direction, and then transferring funds between their bank accounts domestically, thus avoiding the hefty bank charges for sending money across borders.

Other tech firms such as Facebook are getting in on the money-transfer act too.

Regarding this ancient and effective way of sending money abroad, The Economist says:

“Perhaps, despite the regulations, it is banking — not Hawala — which is the out-of-date system.”

Send Money India cites a number of studies that show that between $100 billion and $300 billion flow through the informal remittance systems annually across the world.

Interpol in India estimates that Hawala volumes represent approximately 40% of the country’s GDP (gross domestic product).

In many parts of the world, Hawala is illegal, so hawaladars work underground. In such cases the broker may be a taxi driver or somebody who owns a restaurant.

Attitudes to Hawala since 9/11

Following the September 11 terrorist attacks, the US government suspected that some hawaladars may have assisted terrorist organizations transfer money to finance their activities. Most investigations, however, found that the bulk of the funds were sent by official inter-bank transfer.

US authorities as well as those of Western Europe applied intense pressure to introduce anti-money laundering initiatives on a worldwide scale. As a result of this, several Hawala networks were shut down and a number of hawaladars were prosecuted for money laundering.

Despite these measures, the authorities are no closer to identifying and arresting a sizable number of drug smugglers or terrorists.

US officials stressed that the vast majority of people who used these informal networks were doing so for legitimate purposes.

Afghanistan’s Hawala system today is used for providing funds for the delivery of emergency relief and humanitarian and developmental aid for most of the domestic and international NGOs, development aid agencies, and donor organizations.

Video – What is Hawala? – Definition and Meaning

This Investors Trading Academy video explains what Hawala is, what its main components are, and why people use it.