Horizontal integration, also known as lateral integration, is an acquisition of or merger with a company that operates in the same phase of the supply chain.

For example, if Company A, a mining business, merges with company B, another mining operation, this is a horizontal integration – they are both in the commodities/raw materials stage of the supply chain.

Horizontal integration does not necessarily have to occur through a merger or acquisition. It can be achieved by internal expansion.

The company may set up new mines, manufacturing plants, distribution centers, or retail outlets on its own. The trend these days, however, is to achieve this by buying or fusing with other companies.

In this image, you can see examples of horizontal integration (companies C and D), and Forward or Backward Integration (A and B). Companies A and B are examples of vertical integration. Forward and backward, in this context, can also be called ‘upstream’ and ‘downstream’.

In this image, you can see examples of horizontal integration (companies C and D), and Forward or Backward Integration (A and B). Companies A and B are examples of vertical integration. Forward and backward, in this context, can also be called ‘upstream’ and ‘downstream’.

Horizontal integration vs. vertical integration

Horizontal integration contrasts with vertical integration, when the two companies operate in the same business but in different stages of the supply chain. The supply chain consists of: 1. Raw Materials (commodities). 2. Manufacturing. 3. Distribution. 4. Retail.

If an iron mining company merges with a steel manufacturing corporation, this is vertical integration – a commodities (raw materials) business is merging with a manufacturer; both operating in different phases of the supply chain.

If the goods or services offered by the merging companies are the same or very similar, it is known as a ‘merger of competitors’.

The process can lead to a monopoly if a firm captures most of the market for a particular product or service.

Examples of horizontal integration

In 2012, German carmaker Volkswagen AG completed its acquisition of German luxury automaker Porsche SE. As of April 2012, Volkswagen owned 49.9% of Porsche’s shares. In July of the same year, Volkswagen agreed to buy the remaining 50.1% for a total of $5.6 billion.

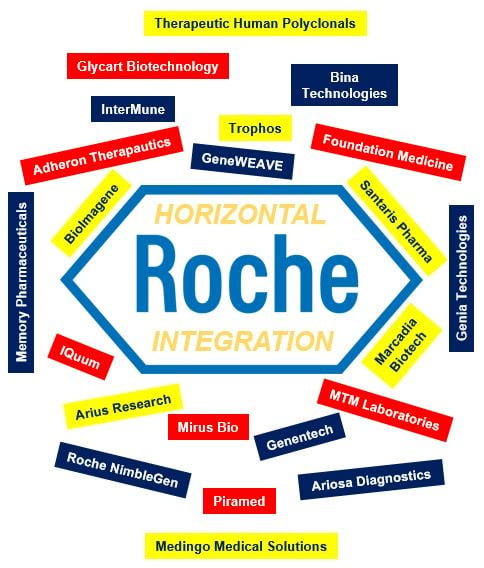

This image contains the names of all the companies that Swiss pharmaceutical giant has acquired since 2005. They are all related to the healthcare sector. Many of the purchases would be classed as horizontal integration. (Data Source: crunchbase.com)

This image contains the names of all the companies that Swiss pharmaceutical giant has acquired since 2005. They are all related to the healthcare sector. Many of the purchases would be classed as horizontal integration. (Data Source: crunchbase.com)

In 2009, US food giant Kraft Foods launched a hostile bid for British chocolate maker Cadbury. It was the final acquisition needed by Kraft to allow it to be restructured and split into two companies. The acquisition of Cadbury’s provided scale for its snacks business, especially in emerging markets.

In 1998, German carmaker Daimler-Benz AG merged with Chrysler Corporation, the smallest of the three US automakers – Daimler bought 92% of Chrysler to form DaimlerChrysler AG. It was called the ‘Merger of Equals’, but has gone down in business history as a disaster. Investors launched lawsuits over whether the whole deal really was the ‘merger of equals’ that the directors had claimed. In 2007, Daimler agreed to sell the Chrysler unit to Cerberus Capital Management for $6 billion.

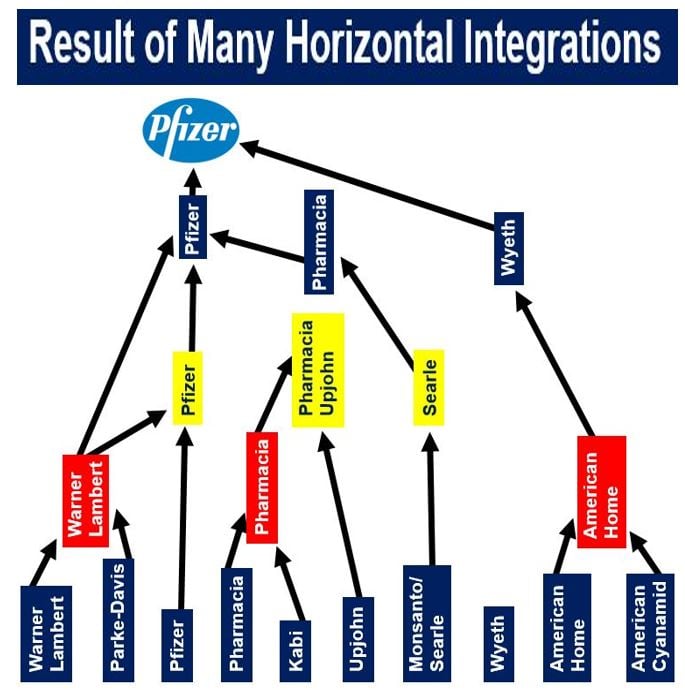

Other examples of horizontal integration include HP’s acquisition of Compaq (computers), Pfizer & Wyeth (pharma), Sandoz & Ciba-Geigy (pharma), Roche & Genentech (pharma), and AT&T & T-Mobile (telecoms).

Advantages of horizontal merger

– Competition: there is less of it. A lateral integration reduces that number of competitors that there are in the marketplace. If a market has five major competitors, and two of them merge, there are now only four rivals. The integrated company can focus more on improving its product or service and less on finding out what the competition is doing and taking necessary measures.

– Economies of Scale: as the size of the company increases, the cost per unit of production declines, partly because there is the elimination of duplication of machinery and personnel. The merged company can negotiate the purchase materials at lower unit prices from suppliers because it will be buying in greater quantities.

– Brand Image: the merged company’s brand is present in or exposed to a greater proportion of the marketplace.

– More Streamlined: the absence of multiple structural layers allows for more streamlined communication and reporting processes, making the merged entity more nimble and better able to adapt to change.

– Diversification: the horizontally-integrated entity can diversify its goods or services, and sell them to a larger market.

Pharmaceutical giant Pfizer Inc., based in New York City, is the result of several horizontal integration type acquisitions. The company was founded in 1849 by Charles Pfizer and Charles F. Erhart. Today it employs more than 78,000 people, and has total assets of $169.3 billion. In the pharmaceutical industry, the largest ten companies globally are the result of hundreds of mergers and acquisitions. (Data source: pm360online.com)

Pharmaceutical giant Pfizer Inc., based in New York City, is the result of several horizontal integration type acquisitions. The company was founded in 1849 by Charles Pfizer and Charles F. Erhart. Today it employs more than 78,000 people, and has total assets of $169.3 billion. In the pharmaceutical industry, the largest ten companies globally are the result of hundreds of mergers and acquisitions. (Data source: pm360online.com)

Disadvantages of horizontal integration

– Culture Change: companies trying to convert from a vertical to horizontal structure may face challenges, as managers and other personnel need to adjust to a less authoritarian system with peer-like relationships.

– Monopoly Pricing: if the new entity now controls most of that particular stage in the supply chain, it can charge whatever it wants. This disadvantage is for consumers, rather than the company itself.

There is also a risk that regulators will intervene and either ban or constrain the horizontal integration.

– Expected Synergies: may never materialize. This can undermine the overall value of the firm.

Video – Vertical and Horizontal Integration – Definition and Meaning

In this video, Paj Holden talks about the different kinds of integration there are in the world of business.