Income Distribution looks at how much different socioeconomic groups in a country earn. In other words, income distribution refers to the equality or smoothness with which people’s incomes are distributed.

Income distribution tells us much more about a country’s economy and its wage patterns than average income does.

It can tell us, for example, how big the income gap is between university graduates and other people. In other words, it gives us insight into levels of inequality within a country.

Pay vs. wealth inequality

There are many types of inequality. For example, pay inequality refers to just people’s wages and salaries. Wealth inequality, on the other hand, includes all people’s assets, such as property, land, gold, investments, etc.

Countries with a relatively unequal distribution of income find it harder to grow economically in a sustainable way.

This difficulty arises because severe income inequality can lead to reduced consumer spending, decreased educational opportunities for lower-income groups, and increased social tensions

Income inequality includes wages and other incomes, such as dividends, investment income, sales of things, etc.

Furthermore, income from investments and property tends to accumulate more significantly among higher-income groups, further exacerbating overall economic disparities.

The difference between the top and bottom incomes in a company is the wage ratio. For example, if the CEO earns $10,000,000 per year and average worker’s pay is $50,000, the wage ratio is 200:1.

GDP per capita and PPP

If a country has a higher GDP per capita than another, it does not necessarily mean it is richer. The one with the higher figure may be much more expensive. Therefore, after factoring in purchasing power parity (PPP), it may, in fact, turn out to be poorer.

GDP per capita means GDP per head, i.e., per person. We calculate it by dividing GDP by the country’s total population. GDP stands for Gross Domestic Product.

Purchasing power parity looks at the relative value of a currency compared to others. In other words, what you can buy with one currency compared to other currencies.

Income distribution – extremes

Also, income distribution in the country with a higher GDP per capita may be more unequal.

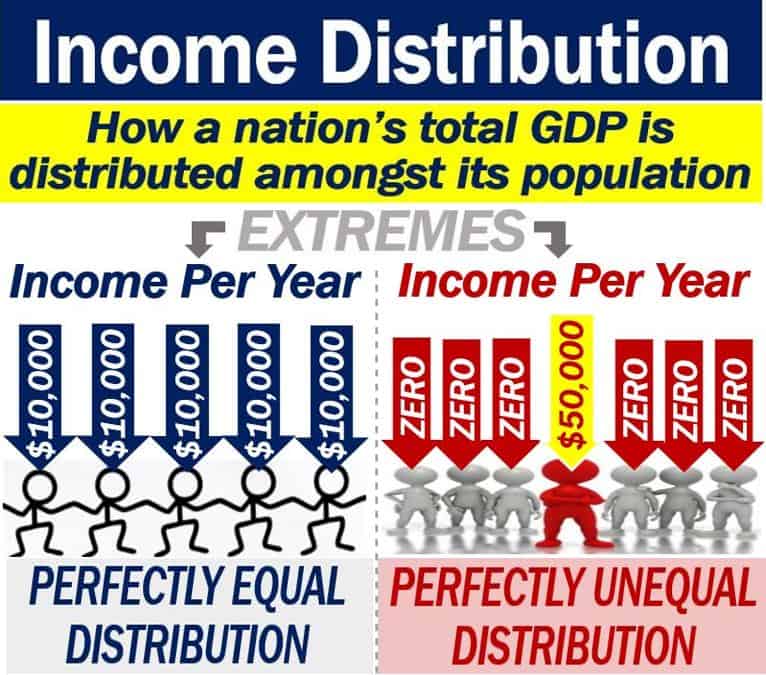

There are two extremes when talking about the distribution of incomes: perfectly equal and perfectly unequal distribution.

If everybody has exactly the same income, we say that distribution is perfectly equal.

If just one person earns, while nobody else in the country has any income at all, distribution is perfectly unequal.

A country with perfectly equal distribution does not exist. Neither is there a nation with a perfectly unequal distribution.

The advanced economies are closer to perfectly equal distribution than the emerging or developing economies.

An emerging economy, such as China or Mexico, is a country that may soon become an advanced economy. We also call them emerging markets.

An advanced economy, such as the USA, UK, Germany, or Japan, is a ‘developed’ country.

Developing countries, such as Chad, Haiti, or Somalia, are the ‘poorest’ countries.

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Income Distribution’ means using simple and easy-to-understand language and examples.