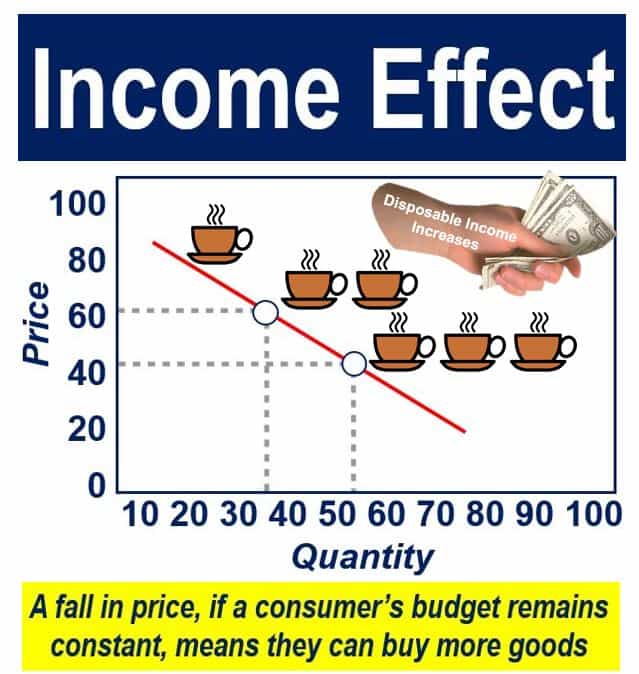

The Income Effect refers to the change in the demand for a product or service caused by a change in consumers’ disposable income. Disposable income is the portion of somebody’s income that is available for spending on non-essentials or savings.

The term may also refer to the effect on real income when there is a change in the price of a good or service – which also affects the amount of disposable income – the effect can be positive or negative.

The income effect may also refer to the effect of a change in taxes on people’s consumption behavior in reaction to this effect.

This effect can extend to broader economic indicators, as shifts in disposable income often precede changes in savings rates and investment behaviors.

In all cases, the income effect drives demand – either upward or downward. An increase/decrease in disposable income or a rise/fall in the price of a product either boost or subdue demand for that or other goods or services.

Example of income effect

For example, if a household spends one quarter of its income on rice, a 40% decline in rice prices will increase the household’s disposable income, which they can spend in purchasing either more rice or something else.

Spending more on something else is known as the substitution effect.

According to BusinessDictionary.com, the income effect is:

“A change in the demand of a good or service, induced by a change in the consumers’ discretionary income.”

“Any increase or decrease in price correspondingly decreases or increases consumers’ discretionary income which, in turn, causes a lower or higher demand for the same or some other good or service.”

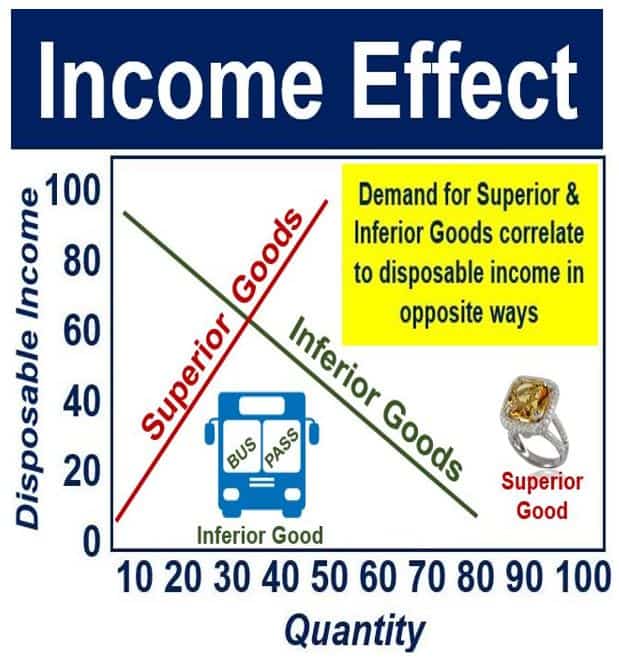

Income effect on luxury and inferior goods

The income effect also influences demand for luxury goods. Examples of luxury goods – also called superior goods, upmarket goods, or Veblen goods – are fancy cars, yachts, expensive watches, jewelry, posh restaurants, designer clothes and footwear, and expensive vacations.

Any increase in disposable income, caused either by higher wages, lower taxes or a fall in the price of a particular good, will increase the aggregate demand for luxury goods.

If the price of gasoline at filling stations declined by a dramatic 90%, demand for luxury goods would rise because people would have more spare cash.

If disposable income declines, whatever the reason, demand for luxury goods also falls.

While luxury goods have a positive correlation between demand and income, it is the opposite as far as inferior goods are concerned.

Examples of inferior goods are bus-passes, supermarket brand products, McDonald’s coffee (versus Starbucks coffee), cheap cars, payday lending, frozen dinners, fast food restaurants, and other cheap foods.

If the price of a good rises, wages decline, or taxes increase, i.e. a person’s disposable income falls, the demand for bus-passes rises. However, if the opposite happens – people have more disposable income – demand for bus passes drops.

The exception is a Giffen good. A Giffen good is an inferior product that does not obey the ‘law of demand’. When the price of a Giffen good goes up, so does demand for it.

The income effect can significantly influence national economic trends, as widespread changes in disposable income can lead to shifts in consumer spending patterns and overall economic activity.

2 Educational Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what ‘Income Effect’ and ‘Income’ are using simple, straightforward, and easy-to-understand language and examples.

-

What is the Income Effect?

-

What is Income?