Increased hazard is a situation that increases the risk that something unpleasant will happen to a person or property. The insured’s circumstances have changed. In other words, there is now a greater risk of an insurance claim. If I insure myself or an organization, I am or the organization is ‘the insured.’

The term may mean that either the risk of something unpleasant is greater, or there is now a new risk.

A hazard is a danger or an unpleasant or undesirable event. ‘Hazard’ has a similar meaning to ‘risk.’ However, hazard is all about the event or danger, while risk is about probability. With the term ‘increased hazard,’ however, the word ‘hazard’ may refer to the probability or a danger/event.

There are technological, anthropogenic, and natural hazards. Anthropogenic means that it originated from human activity.

Dam failures, chemical spills, nuclear radiation, for example, are technological hazards.

Earthquakes, volcanic eruptions, avalanches, floods, wildfires, tsunamis, droughts, and hurricanes, for example, are natural hazards.

Increased hazard – example

Let’s suppose you have a house ten miles from an extinct volcano. An extinct volcano is one that experts say will never erupt again.

However, a new study has just reported that the volcano is, in fact, dormant. A dormant volcano is one that has not erupted in the past 10,000 years, but it could erupt again.

Furthermore, with a dormant volcano, nobody knows when it might erupt again, i.e., it could even be today.

Consequently, there is now an increased hazard regarding your house, i.e., volcanic activity. The insurance company will probably increase your house insurance premium.

BusinessDictionary.com says the following regarding the term:

“A situation that places the insured or the insured property at a greater risk for loss.”

“For example, if the insured begins storing explosives in his or her garage, the hazard has increased.”

Increased hazard – insurer refuses

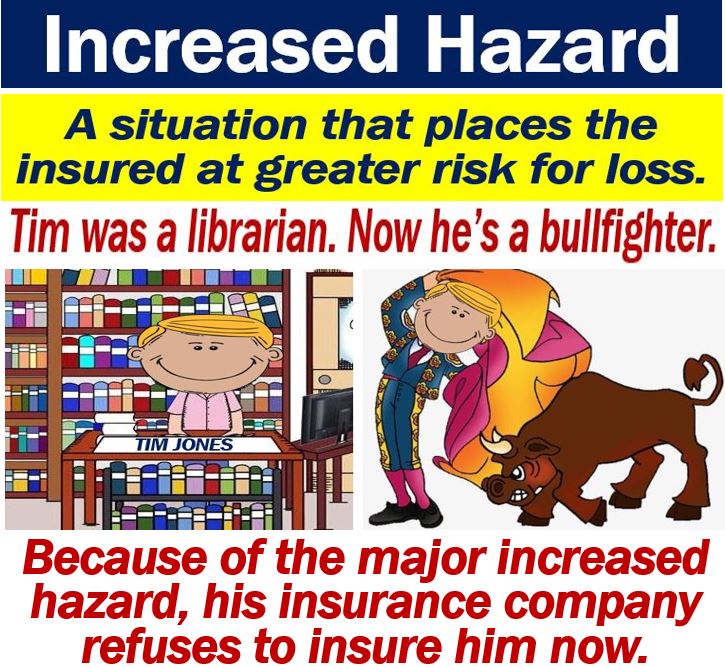

If the insured’s or the insured property’s circumstances change too drastically, the insurer may refuse to continue providing coverage.

Let’s suppose that for the last ten years you worked as a librarian and lived in a very safe area. However, you have been going to evening classes, and now you have a different career.

You have become an expert on modern explosives.

What would the insurer think if you started manufacturing dynamite, storing it, and experimenting with new explosives in your house?

It would definitely conclude that your property’s increased hazard was dramatic. After sending an assessor to check your house, the insurer might decide not to provide further insurance over.