Inflation refers to a sustained increase in the overall price of goods and services. The rate is measured annually. As the prices of goods and services increase, every dollar, pound, euro, or yen you carry buys a smaller proportion of a product or service.

Economists use several different measures of inflation. The most commonly quoted, and probably the most important ones, are the RPI (Retail Prices Index) and CPI (Consumer Prices Index).

Each index looks at the prices of hundreds of goods and services we use, including basic foods, movie tickets, beer, and clothes – and tracks how these prices change over a given period.

Alongside RPI and CPI, some economists also consider the Producer Price Index (PPI), which reflects the average movement of selling prices from domestic production over time, as a leading indicator of inflation.

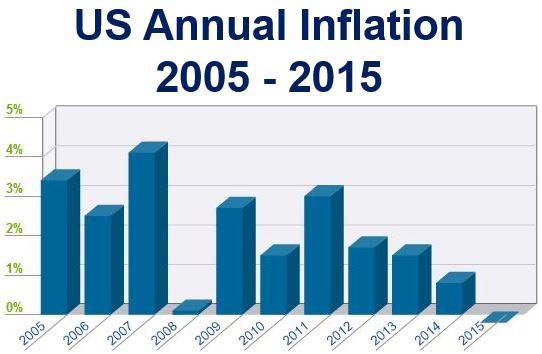

In 2015, the US and most other advanced economies are experiencing very low inflation or deflation. (Source: usinflationcalculator.com)

In 2015, the US and most other advanced economies are experiencing very low inflation or deflation. (Source: usinflationcalculator.com)

RPI versus CPI

The RPI and CPI are slightly different. RPI includes the cost of housing while the CPI does not.

The RPI is the prices of everything, then added up, and divided by the number of things. The CPI is calculated by multiplying the prices of all listed items together, then taking the nth root of them, where ‘n’ is the number of items involved.

Put slightly more simply, RPI is an arithmetic mean while CPI is a geometric mean.

The CPI takes into account that when prices go up, some consumers will switch to goods and services that have gone up by less. Hence, the CPI reading is nearly always lower than the RPI. The CPI is seen as the more important measurement.

Monetarists believes that inflation nearly always has its roots in the money supply. If the money supply increases faster than the rate of GDP growth, prices will rise, they say.

Inflation rates expressed as percentages

If the CPI is 3%, it means that the prices of goods and services we pay for, on average, are 3% higher than they were one year ago.

In other words, if they cost $100 a year ago, they would cost $103 now.

Why is inflation so important?

It is one of the major pieces of data for economists. It influences how central banks decide how to set interest rates, which affect how much we pay on our mortgages and loans, and our income from savings.

Many workers, especially in the public sector, whose wages are tied to the CPI, are clearly directly affected in their pay packages.

Most state benefits and occupational pensions are also linked to rising prices.

Some variations of inflation

Delflation: when prices overall fall. Deflation is the opposite of inflation.

Hyperinflation: this refers to very high inflation, often the threshold being anything above 50%. Hyperinflation can destroy a country’s monetary system and seriously damage its economy. In Zimbabwe in 2007, hyperinflation reached 7,000%.

Stagflation: this is when unemployment is high, the economy is not growing, but prices are rising. During the 1970s this happened to the advanced economies after OPEC raised oil prices.

When prices are rising rapidly, employers tend to be able to negotiate lower wage hikes (in real terms, i.e. after adjusting for price rises) compared to periods of very low inflation, zero price increases, or deflation. This is due to money illusion – where employees focus on the nominal value of a unit of currency and perceive, for example, a 7% wage hike in a year of 7% inflation as a better deal than a 0.5% increase when the prices of goods and services remain flat (at 0%).

Menu Costs: in times of hyperinflation, menu costs can seriously undermine a company’s chances of making a profit. Menu costs refers to the costs companies face when they change their prices: they have to redesign their catalogues, get new ones printed, tell their customers, and sometimes hire price experts. There is also the risk of lower than expected sales.

Innovative companies, however, often utilize dynamic pricing models to mitigate the risks associated with menu costs, allowing for real-time price adjustments in response to market conditions.