What is investment philosophy?

Investment philosophy, also known as investment style, is a fund manager’s or investor’s particular approach to investing. Some may focus on companies with promising earnings prospects (fundamentals), seek out under-priced stocks (value), or businesses that produce things that are in strong demand (growth markets).

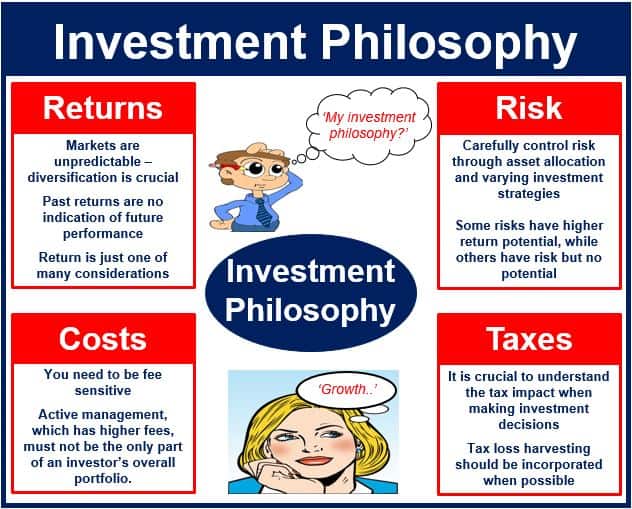

It is a coherent way of thinking about markets, how they operate (and sometimes don’t), and the types of mistakes that the person believes are common features of investor behavior.

Investment strategy is much narrower than investment behavior. When we put our investment philosophy into practice, that is our investment strategy. When a strategy is no longer effective, we go back to our investment philosophy to generate a new one (strategy).

We should all build our investment philosophy before beginning to invest.

We should all build our investment philosophy before beginning to invest.

An investment philosophy is crucial

Experts say that a person without an investment philosophy risks jumping from strategy to strategy, changing his or her portfolio too frequently, and ending up paying more in costs and taxes.

All investment philosophies have some elements in common. Most of us seek a positive return on our investments. So, if you are considering building your own philosophy, perhaps the first key conviction should be “I am placing my money in this investment because I think it can make a good return.”

Below are some examples of investment philosophies:

Contrarian Investing: follows a belief that certain crowd behavior among investors can lead to mispricings in securities markets that can be exploited. The investor buys and sells in contrast to the prevailing sentiment of the time, i.e. he or she sells when markets are rising and buys when they are declining.

Value Investing: a system of making money by buying financial products such as securities for less than they are worth. This system emerged in the 1930s.

Growth Investing: focusing on companies that show signs of above-average growth, even if their stock price seems expensive in price-to-book ratio or price-to-earnings ratio.

Socially Responsible Investing: concentrating on businesses that comply with a set of moral/ethical business values or standards, such as low emissions, no animal cruelty, fair wages, etc.

Fundamental Investing: looking at a company’s growth, revenues, earnings, management and capital structure before deciding whether to purchase its shares. In other words, focusing on businesses with promising earnings potential.

Three steps to an investment philosophy

In an article titled ‘Investment Philosophies’, Aswath Damodaran, Professor of Finance at the Stern School of Business at New York University, says there are three steps to an investment philosophy:

Step 1: Acquire the tools of the trade.

- – Acquire the ability to assess risk and incorporate this into your investment decisions.

- – You need to understand financial statements.

- – You must become aware of the frictions and the costs of trading.

Step 2: Develop a point of view about how markets function and where they may break down.

Step 3: Given your time horizon, tax status and risk aversion, find the philosophy that best fits you.

American billionaire investor Warren Buffett said the following about investing:

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1. Price is what you pay. Value is what you get. Risk comes from not knowing what you are doing.”

According to the Financial Times Lexicon, an investment philosophy is:

“An investor’s or fund manager’s particular approach to maximising returns. The focus could be on value (look for under-priced stocks); on fundamentals (look for the companies with strong earnings prospects); on growth markets (look for companies whose products are in strong demand); etc.”