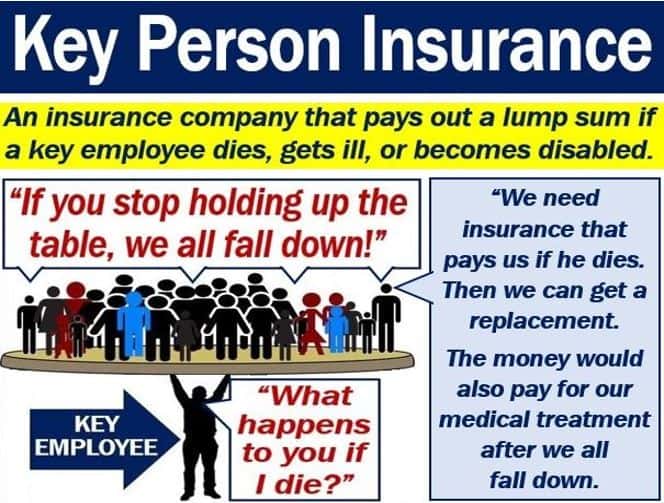

Key person insurance is life insurance of a key person in a company. We also call it key employee coverage, key man (or keyman) insurance or key person protection. Businesses have this type of insurance to protect themselves against financial losses if a key person leaves. The insurance may offer coverage for life, critical illness, or disability. In fact, some policies cover all three.

A key person or key employee is somebody who works in a company and has an important role. They may have an important decision-making or ownership role in the business. Some may have voting rights.

When a key employee leaves, the effect may be devastating for the company. In fact, the key person’s absence may bring down the whole business.

Put simply; the key person is vital for the company’s financial and commercial well-being.

Key person insurance – a safeguard

When a key employee in a company dies, it can have a damaging financial effect. In fact, sometimes the event can be completely devastating.

Companies can help safeguard their business against the critical or terminal illness, disability, or death of a key person. They can do this with key person insurance.

During the length of the policy, the employer receives a lump sum on the death of the key employee. The purpose of the lump sum is simply to help the company recover.

The employer can use the proceeds to recruit and train a replacement. It can also use the money to help replace lost profit.