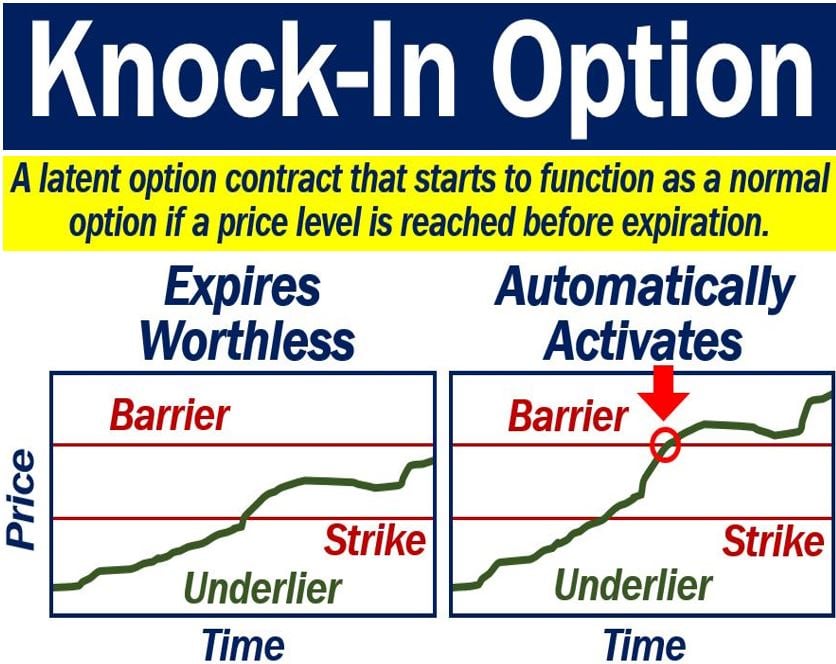

A knock-in option is an option contract that only comes to life when it reaches a certain price level. It must reach that level before expiration. In other words, it is an option that activates, i.e., knocks in, only when it hits a certain price.

In investing, an option is a contract that gives the purchaser the right, but not the obligation, to buy or sell a stock’s index or future. With an option, buyers can buy or sell at a specific price before a certain future date.

InvestmentandFinance.net has the following definition of the term:

“An option that automatically activates or comes into life only when a certain price of its underlying is hit.”

Knock-out and knock-in option

Some options, such as knock-in options, spring into existence when the asset reaches a pre-set barrier level. Others, however, such as knock-out options, die when the underlying asset’s price reaches the barrier level.

In this context, the ‘barrier level‘ means a specific price.

Therefore, the opposite of knock-in options are knock-out options.

Barrier options have lower premiums than similar options with no barrier.

Wikipedia says the following regarding barrier options :

“Barrier options were created to provide the hedge of an option at a lower premium than a conventional option.”

Let’s suppose an investor thinks that a common stock’s price will not reach $150 per share in six month’s time. However, he believes that particular stock, now trading at $100 per share, will rise within the next six months.

You could purchase the option with a $150 barrier level. Subsequently, you would face a lower premium than a conventional option on that same *common stock.

* ‘Common stock‘ is a kind of security that serves as evidence of part ownership of a company. Common stockholders have voting rights. In the UK, people say ‘ordinary shares.’

Knock-in option – example

You may, for example, buy a knock-in option to purchase a share of stock for a strike price of $20 which knocks in at $30.

If the price of the stock does not reach $30 over the option’s life, it’s as if it had never existed.

However, if the price of the stock price hits the knock-in price, the option automatically activates. It is subsequently an ordinary option with a $20 strike price.

Video – Barrier stock option

This Bionic Turtle video talks about knock-out and knock-in options, i.e., barrier options.