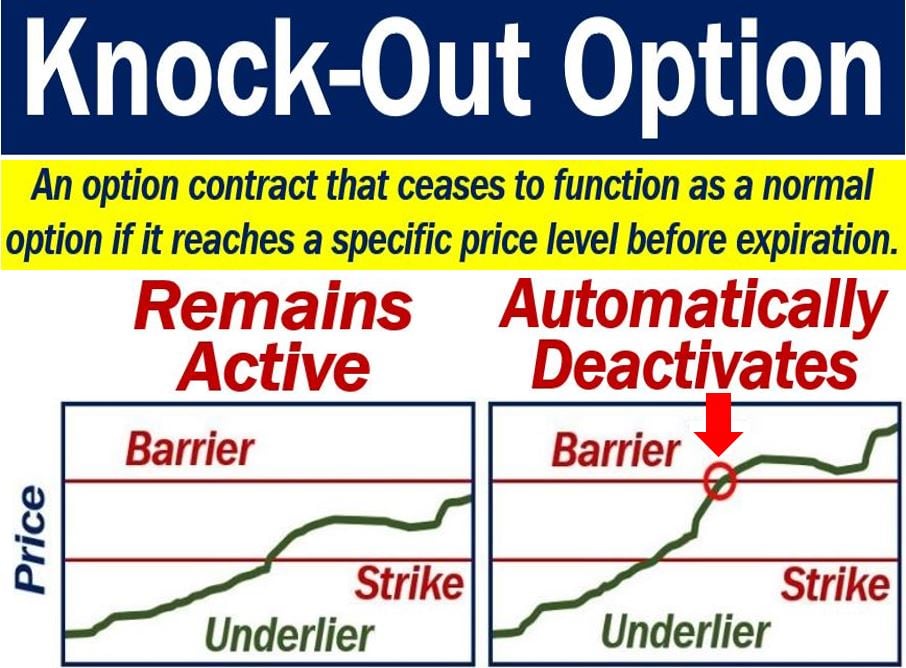

A knock-out option is an option contract that becomes worthless if it reaches a certain price. For it to become worthless, the knock-out option must reach that price before expiration. In other words, it is an option that dies, i.e., knocks out, when it hits a certain price.

An option is a contract that gives the buyer the right to buy or sell a stock’s index or future. The buyer has the option but not the obligation. With options, purchasers can buy or sell at a certain price before a specific future date.

Investors can buy knock-out options for a smaller premium than their equivalent options that do not have a knock-out stipulation. Therefore, they limit the profit potential for the buyer.

Knock-in vs. knock-out option

Some options, such as knock-out options, die when the underlying asset’s price hits the barrier level. Others, however, such as knock in options, spring into existence when the asset reaches a specific barrier level.

In this article, ‘barrier level‘ means a pre-set price.

Knock-in options, therefore, are the opposite of knock-out options.

Example of a knock-out option

You may sell a knock-out option to sell a share of a stock for a strike price of $50, which knocks out at $55.

If that stock price does not hit $55 before expiration, the option will continue being valid.

However, if the stock price hits the knock-out price, the option becomes worthless, i.e., it deactivates.

The knock-out feature usually causes the option holder to lose the premium that the writer receives.

However, in some cases, there is a rebate barrier option, i.e., the holder gets back part of the premium.