The Kondratiev cycle or Kondratiev wave is a cycle-like phenomenon of economic expansion and contraction over a fifty-year period. It is a very long-duration cycle of major capital goods expansion and contraction. The long-term cycle that exists in capitalist economies represents long-term, high- and low-growth economic periods. In other words, the wave underlies the typical boom-bust cycles that feature in the world’s capitalist economies.

The boom-bust cycle or business cycle refers to alternating periods of recession and recovery.

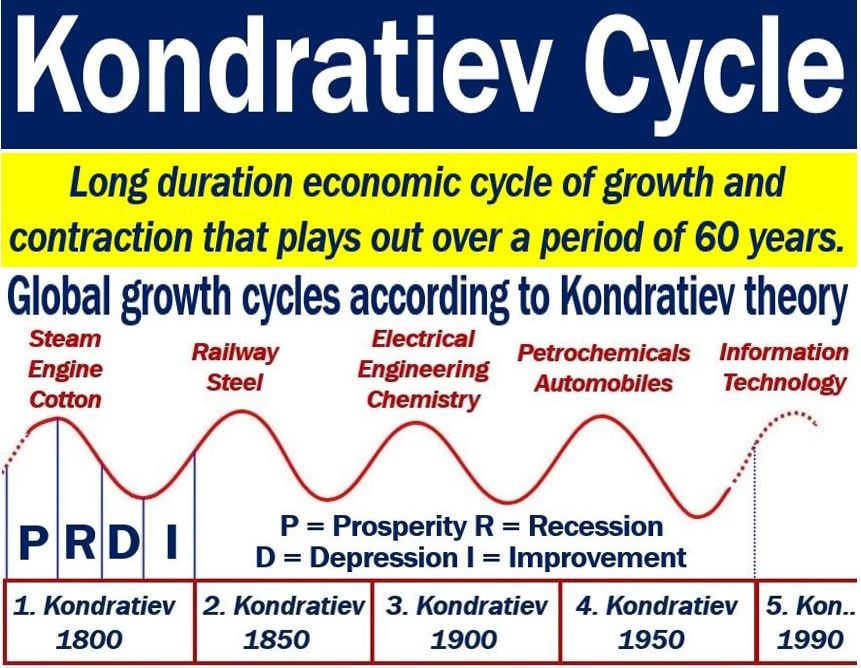

We also refer to the Kondratiev cycle as the long-wave cycle or the long economic cycle. We sometimes call the cycles supercycles, great surges, long waves, or K-waves.

Nikolai Dmitriyevich Kondratiev (1892-1938) was the first person to write about this long-term wave cycle. Kondratiev (spelling also Kondratieff) was a Russian economist. He was a proponent of small private, free market businesses in the Soviet Union, i.e., the New Economic Policy.

Kondratiev argued that these long cycles were a characteristic of the economic activity of every capitalist economy. He wrote that they were periods during which the economy would suffer and then correct itself.

Communist Russia did not like Kondratiev’s views. They did not like them because of his support for capitalism.

Russian authorities eventually sent him to a Siberian concentration camp. He faced the death penalty in 1938.

Kondratiev cycle controversy

Most academic economists across the world do not accept the long wave theory.

In fact, even among those who do accept it, there is disagreement regarding what causes the waves. They also disagree on when particular waves begin and end.

This controversy points to a major criticism of Kondratiev’s theory. Put simply; many say that the theory amounts to seeing things that are not really there. The theory, they say, is the result of seeing patterns that do not exist in a mass of statistics.

Kondratiev cycle has three stages

According to Kondratiev, the long cycles had three stages: expansion, stagnation, and recession. He later referred to four stages: prosperity, recession, depression, and improvement.

Kondratiev said that the long cycle affected every sector of a capitalist economy. A capitalist economy is one in which most sectors are in private hands. Private companies operate to generate a profit.

He focused on interest rates and prices. During the expansion phase, he noticed that interest rates were low while prices rose.

During the other phases, however, he observed that prices weakened while interest rates increased. His subsequent analyses focused on output.