What is leverage? Why use leverage?

Leverage is the ratio between credit and equity capital in a financial transaction. Equity capital refers to money that a company raises by selling shares to investors.

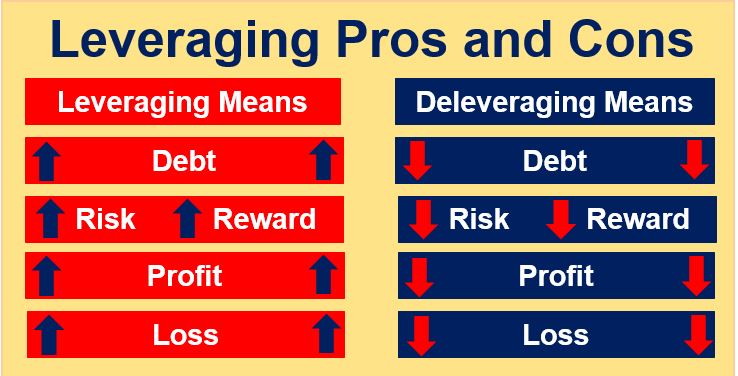

Leverage typically means using borrowed money to finance the purchase of an asset. One of the main reasons for using leverage is to increase the profitability of an asset.

People use leverage, i.e. borrow money, because they believe that with the extra funds, they can buy more assets and make a bigger profit.

However, one of the main disadvantages is that if the asset’s value drops there is a higher risk of losing your initial investment. In other words, if things do not go according to plan, you can lose all your initial capital.

In the UK, Australia, South Africa, New Zealand, and other countries with historical ties to the UK, people commonly use the term gearing instead of leverage. In India, they use the term leverage but also understand gearing.

Using leverage to buy assets

If you buy shares worth 500,000 USD and one year later the shares are worth 750,000 USD, you have managed to yield a 50% profit.

Now let’s imagine you used 50,000 of your own cash along with a bank loan of 450,000 (with a 10% annual interest rate) to finance buying the shares (worth 500,000 USD).

If in a years’ time the shares are worth 750,000 USD and you sell them, you have managed to make 205,000 USD (250,000 USD – 45,000 USD) after paying off the 450,000 USD loan. This translates into yielding 410% profit.

However, leverage can also be incredibly risky though.

Imagine you were to buy 500,000 USD worth of shares which a year later dropped to a value of 450,000 USD. You would have only lost 10% of your initial investment. However, if you used leverage to finance 450,000 USD of the purchase then you would have lost all your capital.

Who uses leverage?

- People may use leverage to buy a home by purchasing a portion using mortgage debt.

- People could use leverage by borrowing from their broker for financial investments.

- Business owners may use leverage to help finance their business.

- Hedge funds may leverage their assets by financing their portfolios with short sales of other positions.

The 2008 financial crisis – too much leveraging

Leading up to the 2008 financial crisis, consumers in the US, UK and most other advanced economies had very high levels of debt relative to their incomes and the value of their collateral assets.

When property prices plummeted, debt interest rates rose, and businesses made millions of workers redundant during the Great Recession that followed the financial crisis, a huge number of borrowers were no longer able to meet their debt payments, and lenders could not recover their money by selling collateral.

Financial leverage formula

The most common financial leverage ratio is the debt-to-equity ratio which is calculated by dividing total debt by shareholders equity.

The word ‘Lever’

The term leverage comes from the word lever.

A lever is a simple tool that you push or pull to lift something. It usually has a long handle and a fulcrum, or pivot point, which makes lifting easier.

Imagine you want to lift a rock. You should look for a stick and place it under the rock, and rest it on a stable point, like another smaller rock or a piece of wood. Then press down on the other end of the stick. This will help lift the rock more easily than if you tried to pick it up just with your hands.

Video – What is Leverage?

This interesting video, from our YouTube partner channel – Marketing Business Network, explains what Leverage’ is using simple and easy-to-understand language and examples.