What is majority ownership? Definition and examples

Majority ownership means holding more than half the common stock or ordinary shares of a company. Whoever has majority ownership has control of the company. We also use the terms majority interest and controling interest with the same meaning. Somebody who has a majority ownership of a firm is the majority shareholder or majority stockholder.

We use the term for a person, group of people, company, or government. The entity with a majority ownership has more power in that firm than all the other shareholders combined. The words shareholder and stockholder have the same meaning.

The following quote comes from ‘What is a Majority Shareholder?‘ – a Market Business News article:

“An individual with a majority interest is usually the founder of the company, or a descendant of the founder if it is a long-established business. Controlling shareholders are more common in private companies than public companies.”

Public companies are those whose shares members of the public can buy and sell on a stock exchange. We cannot openly and freely buy and sell private company shares – this is done by private arrangement with their shareholders.

Managing the company when you have majority ownership

How a shareholder with a majority ownership manages a company varies considerably. Some stockholders like to become actively involved in the business’ everyday activities.

Others, however, prefer to adopt a more hands-off approach; leaving others to run things.

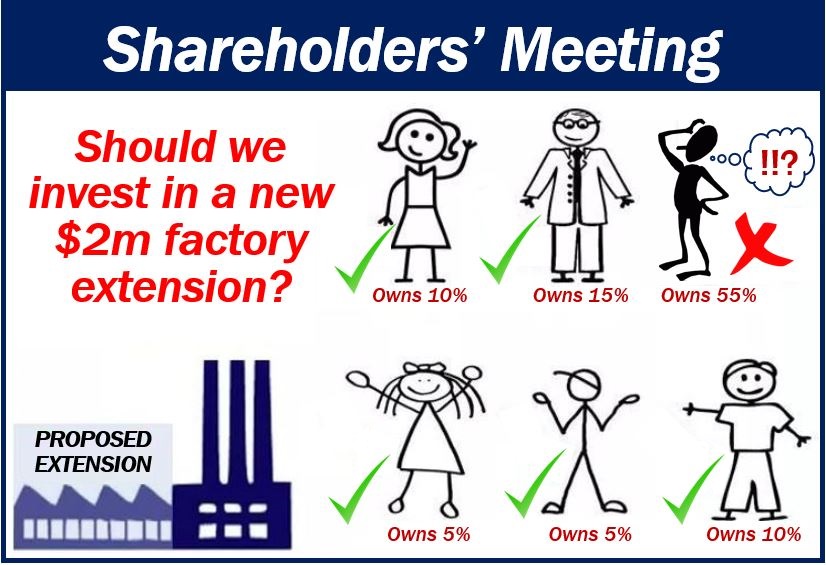

Shareholders with a controling interest have the right to control the company. They can, for example, decide who the members of the board of directors are. Majority shareholders can also make crucial decisions about the company’s direction.

They are have fiduciary duties to the other shareholders and are expected to act in good faith.

A corporate raider will find it virtually impossible to acquire a company if a shareholder with a majority ownership resists the takeover. If a shareholder controls the firm, the corporate raider cannot ‘divide and conquer.’ A corporate raider is a company that acquires other companies.