The modern portfolio theory, or MPT, is a financial theory that tries to get the maximum portfolio expected return for a given level of risk, or alternatively attempts to minimize risk for a specific level of expected return. According to the theory, this is possible if the investor carefully selects the proportions of different assets.

American Economist Harry Markowitz introduced MPT in an article in 1952 and then in a 1959 book. He called it just ‘Portfolio Theory’, because according to him “There is nothing modern about it.”

The theory was later developed by Dr. William Sharpe, at Stanford University, and Dr. Merton Miller, at the University of Chicago. The three economists were awarded the Nobel Prize for Economics in 1990.

Although Modern Portfolio Theory is commonly used in practice in the financial world, in recent years the theory’s basic assumptions have been challenged by behavioral economists and other experts.

Many economists today challenge the modern portfolio theory.

Many economists today challenge the modern portfolio theory.

Combined versus individual risk

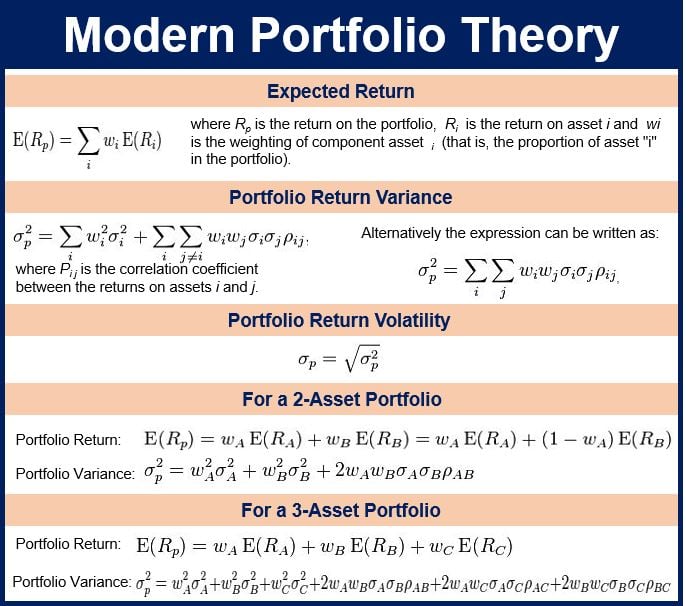

MPT is a mathematical formulation that aims to give a collection of investments a combined lower risk than when each asset is assessed individually. According to the creators of MPT, this is possible because different types of assets frequently change in value in opposite ways.

For example, stock and bond prices usually move in different directions. So, if one’s portfolio consists of both bonds and shares, collectively they would pose a lower risk for the investor.

MPT’s fundamental concept is that portfolio assets should not be selected individually, i.e. each on its own merits, but rather as a mix when determining expected returns and levels of risk.

Investing is a trade-off between expected return and risk. Assets with a higher expected return tend to be riskier. The components of an investor’s portfolio are selected depending on his or her risk tolerance. An ‘efficient portfolio’, for example, should have two or more stocks above the ‘minimum-variance portfolio’ (a portfolio with minimum risk).

“To reduce risk it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities whose returns rise and fall in near unison afford little protection than the uncertain return of a single security.” (Harry Markowitz)

“To reduce risk it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities whose returns rise and fall in near unison afford little protection than the uncertain return of a single security.” (Harry Markowitz)

For a specific amount of risk, MPT tells you how to select a portfolio with the best possible expected return. Or, for a set expected return, MPT explains how to achieve this with the smallest possible risk.

MPT, therefore, is a kind of diversification. It explains how to find the optimum diversification strategy.

Investors are risk-averse

MPT assumes that given two portfolios that offer identical expected returns, the investors will prefer to have the less risky one. This is because (according to the theory) investors are risk-averse.

Therefore, an investor will only consider a higher risk if the potential returns are greater, i.e. if he or she has a chance to make more money. Equally, if they want a greater return they must be willing to accept more risk.

While the exact trade-off will be identical for all investors, they will evaluate the trade-off differently based on individual risk-aversion characteristics. Thus, a rational investor is unlikely to select a portfolio if a second one exists with a more favorable risk-expected return profile, that is, if for that amount of risk another portfolio exists which offers better expected returns.