Net asset value (NAV) is the value of a company’s total assets minus the value of its liabilities. This may also be the same as the equity value or book value of a business.

Net asset value is calculated on a frequent basis by Mutual funds and Unit Investment Trusts (UITs).

Shares and interests in these funds aren’t exchanged between investors. Instead, they are issued by the fund to every new investor, and when an investor withdraws they are redeemed back to the fund.

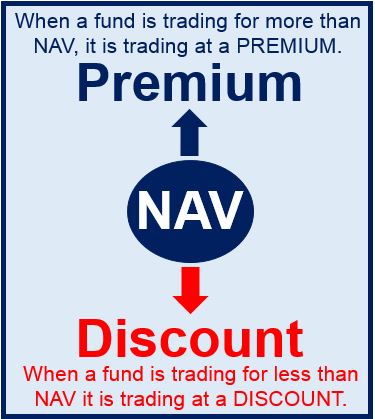

Fund shares may trade in the market for more or less than their NAV.

Fund shares may trade in the market for more or less than their NAV.

For US-registered open-ended funds, investments are commonly valued every business day the New York Stock Exchange is open, using closing prices (to represent fair value), at around 16:00 ET.

An investment company determines the NAV of a single share (“per share NAV”) by dividing its NAV by the number of outstanding shares.

Calculating NAV example:

If a mutual fund has net assets worth $200 million and has liabilities of $180 million, the fund’s NAV would be $20 million.

Calculating NAV of a single share:

If an Unit Investment Trust has a NAV of $50 million, and investors own 5 million of the fund’s shares, the fund’s per share NAV will be $10.

According to nasdaq.com, net asset value (NAV) is:

“The value of a fund’s investments. For a mutual fund, the net asset value per share usually represents the fund’s market price, subject to a possible sales or redemption charge. For a closed-end fund, the market price may vary significantly from the net asset value.”