Operating activities are the daily activities in a company resulting in the sales of products or services. They are all the things that people in a business do that are related to the things it sells. In other words, everything people do in a company that generates revenue.

Revenue is the money a company receives from the sale of product or services to customers.

Examples of such activities include the production or purchase of goods, or expenditures for managing the business. Selling a product is also an operating activity.

Essentially, it is every activity within a company that we cannot classify as an investing or financing activity.

For example, in a restaurant, activities such as organizing work and day-to-day management are operating activities. The term also includes buying food for the restaurant, all human resource activities, and dealing with customers.

Operating activities and cash flow

Operating activities in a business should result in a positive cash flow. The cash flow comes from selling and buying products or services. A thriving company should be receiving more money from its sales of goods than it spends on making them.

Monitoring operating activities is vital. It reveals a company’s financial health, guiding stakeholders in decision-making. Effective management of these activities ensures sustainable growth, optimizing revenue, and strategic marketplace advantages.

In business, we need to make sure that a product’s sale price covers the cost of making or acquiring it. The sale price also needs to cover all business expenses.

For example, imagine a company makes a table and sells it for $200. It spent $150 buying the wood, paying the workers, storing the table, and delivering it to the buyer. It has received more from the sale of the table than it spent producing and delivering it. Therefore, its operating activities have resulted in a positive cash flow.

Reporting operating activities

It is important for companies to report their activities. They must report them because they need to determine which activities are good and which are bad for the company. In other words, which activities generate income and which do not.

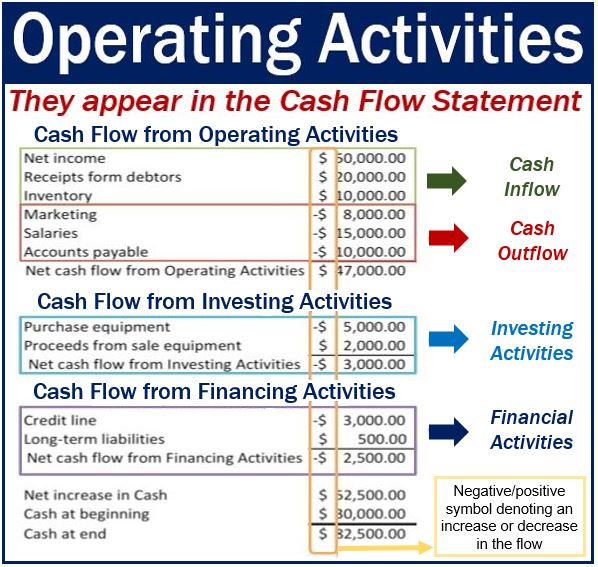

We can see the operating activities in the cash flow statement, along with investing and financing activities. We report the outflows and inflows to obtain the net cash flow from operating activities.

Cash inflows come from sales. Cash outflows, on the other hand, come from payments to suppliers, employees, or the government.

It is important to make sure that we represent the flows individually with a negative or positive symbol.

Operating activities can also be present in the income statement. However, in the income statement, they appear as revenues and expenses.

Different languages

Here is the translation of the term Operating Activities into some other languages:

- Actividades operativas (Spanish)

- Activités opérationnelles (French)

- Betriebliche Aktivitäten (German)

- Операционная деятельность (Russian)

- Attività operative (Italian)

- 営業活動 (Japanese)

- 운영 활동 (Korean)

- 运营活动 (Chinese)

- Atividades operacionais (Portuguese)

- الأنشطة التشغيلية (Arabic)

- Операційна діяльність (Ukrainian)

- Aktivitas operasional (Indonesian)

- İşletme faaliyetleri (Turkish)

- Әрекеттік қызмет (Kazakh)

- آپریٹنگ سرگرمیاں (Urdu)

- ऑपरेटिंग गतिविधियाँ (Hindi)

- অপারেটিং কার্যকলাপ (Bengali)

- ઓપરેટિંગ પ્રવૃત્તિઓ (Gujarati)

- ऑपरेटिंग गतिविधी (Marathi)

- ਆਪਰੇਟਿੰਗ ਗਤੀਵਿਧੀਆਂ (Punjabi)