The Paris Club, or Club de Paris, is an informal group of official creditors who try to find sustainable and coordinated solutions to payment problems that debtor countries experience. As countries with major debts undertake reforms to restore and/or stabilize their financial and macroeconomic situations, creditors at the Paris Club provide a debt treatment that is appropriate to their situation.

The Paris Club creditors may facilitate debt rescheduling to debtor nations – rescheduling means renegotiating the terms of a loan, which may include postponing repayments. Some countries are offered concessional rescheduling – a reduction in debt-service obligations during a specified period.

According to the Economist’s glossary of terms, the Paris Club is: “The name given to the arrangements through which countries reschedule their official DEBT; that is, money borrowed from other governments rather than BANKS or private FIRMS. The club is based on Avenue Kléber in Paris.”

According to the Economist’s glossary of terms, the Paris Club is: “The name given to the arrangements through which countries reschedule their official DEBT; that is, money borrowed from other governments rather than BANKS or private FIRMS. The club is based on Avenue Kléber in Paris.”

On its homepage, the Paris Club writes:

“The Paris Club is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries.”

“As debtor countries undertake reforms to stabilize and restore their macroeconomic and financial situation, Paris Club creditors provide an appropriate debt treatment. Paris Club creditors provide debt treatments to debtor countries.”

Paris Club born in 1956

The Paris Club is over sixty years old. It all started when Argentina agreed to have a meeting with its public creditors in Paris in 1956. Over the past six decades, the Club has reached more than 433 agreements – worth over $583 billion – with ninety debtor countries

In an article prepared for the US Congress, Martin. A. Weiss wrote: “There are four types of Paris Club treatments depending on the economic circumstances of the distressed country. They are, in increasing degree of concessionality: Classic Terms, the standard terms available to any country eligible for Paris Club relief; Houston Terms, for highly-indebted lower to middle-income countries; Naples Terms, for highly-indebted poor countries; and Cologne Terms, for countries eligible for the IMF and World Bank’s Highly Indebted Poor Countries Initiative (HIPC). Classic and Houston terms offer debt rescheduling while Naples and Cologne terms provide debt reduction.”

In an article prepared for the US Congress, Martin. A. Weiss wrote: “There are four types of Paris Club treatments depending on the economic circumstances of the distressed country. They are, in increasing degree of concessionality: Classic Terms, the standard terms available to any country eligible for Paris Club relief; Houston Terms, for highly-indebted lower to middle-income countries; Naples Terms, for highly-indebted poor countries; and Cologne Terms, for countries eligible for the IMF and World Bank’s Highly Indebted Poor Countries Initiative (HIPC). Classic and Houston terms offer debt rescheduling while Naples and Cologne terms provide debt reduction.”

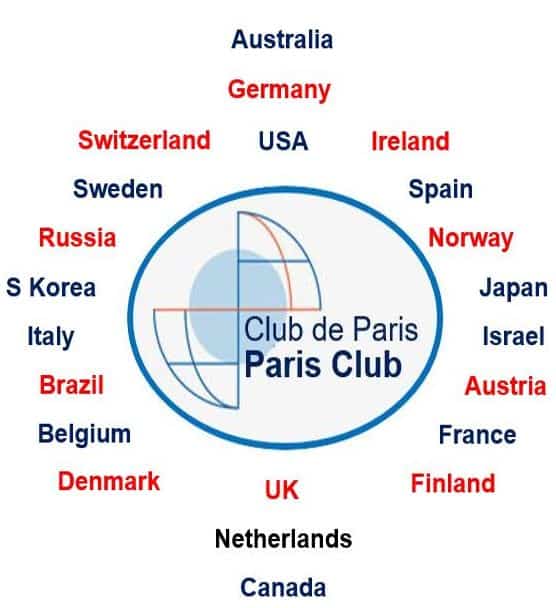

The Club consists of twenty-two permanent members – the founding nations of the OECD (Organisation for Economic Co-operation and Development) plus Russia, Brazil and South Korea.

The Club’s permanent members are: the United States, the United Kingdom, Switzerland, Sweden, Spain, Russian Federation, Norway, Netherlands, South Korea, Japan, Italy, Israel, Ireland, Germany, France, Finland, Denmark, Canada, Brazil, Belgium, Austria and Australia.

Other creditor nations are allowed to participate in negotiation meetings on a case-by-case basis, as long as they meet certain conditions.

Representatives of countries or international financial institutions may be invited to attend some of the meetings as observers.

Paris Club meetings

Creditor countries usually meet once a month – except for February and August – in Paris. Each meeting includes a one-day ‘Tour d’Horizon’, during which creditors talk about the external debt situation of debtor nations, or issues regarding how those countries are managing their debts.

There may also be meetings with debtor nations that have met all the negotiation conditions during the session.

The Paris Club invites debtor nations to a meeting with its creditors after it has concluded an appropriate program with the IMF (International Monetary Fund) that shows that the country cannot meet its external debt obligations, and therefore requires a new payment arrangement with its foreign creditors.

The creditors at the Paris Club link the restructuring of the debt to the IMF program, which includes policy reforms aimed at making sure the debtor nation does not have financial difficulties again.

The Paris Club’s twenty permanent members may attend the negotiation meetings, either as participating creditors if they are owed money by the invited debtor nation, or as observers if they are not.

If the permanent members and the debtor nation agree, other official bilateral creditors may also be invited to attend the negotiation meetings.

Representatives of the World Bank, the IMF and other international institutions, plus the relevant regional development bank, may also attend the meeting as observers.

The debtor country’s representative is usually its Minister of Finance, who heads a team comprising officials from his or her ministry and the central bank.

Paris Club – main principles

The Paris Club says that it has deliberately remained strictly informal – in fact, it has no legal status or basis.

The Club’s work is based on a number of principles and rules that the creditor countries agreed on. These rules and principles facilitate the decision-making process and the conclusion agreements.

The Paris Club’s six principles are:

– Solidarity: all Club members agree to act and respond as a group when dealing with any debtor nation.

They all agree to be sensitive to the effect that the management of their specific claims may have on other members’ claims.

– Consensus: Club decisions may only be taken following a general agreement (consensus) among the participating creditor nations.

– Sharing Information: the Paris Club says it is a unique information-sharing forum. Its members frequently share their views and debtor country information with each other. The IMF and World Bank are also closely involved. However, all discussions are kept strictly confidential.

– Case by Case: all decisions are taken on a case-by-case basis so that any actions are tailored to each debtor nation’s individual situation. This case-by-case principle was consolidated by the Evian Approach.

– Conditionality: the Paris Club only considers restructuring debts with debtor nations that need debt relief, have adhered to stipulated economic and financial reforms, or their track record shows that they implemented reforms under an IMF program.

– Comparability of Treatment: a debtor nation that signs an agreement with creditor nations that are Paris Club members should not accept bilateral creditor terms with countries that are not Paris Club members if those terms are less favorable.

Paris Club observers

Observers are present during a negotiation meeting but are not active participants in the negotiation itself. They do not sign the agreement that formalizes the negotiation’s result.

There are three types of observers:

– Representatives of International Institutions: including the IMF, the Inter-American Bank of Development, the World Bank, OECD, the European Bank for Reconstruction and Development, UNCTAD, the African Bank of Development, the European Commission, and the Asian Bank of development.

– Members with no Claims: these are representatives of Paris Club permanent members that have no claims regarding debt treatment, for example creditors whose lending are covered by the de minimis provision, or that are not owed money by the debtor nation but nevertheless wish to attend the meeting.

– Non Member Creditors: representatives from creditor nations that are not Paris Club members. They only attend if the debtor country and permanent members agree.

Video – South Korea joins Paris Club

South Korea became the 21st member of the Paris Club last year, followed by Brazil. South Korea was one of the poorest countries in the world in the 1950s – today it is a creditor nation.