Pip, an abbreviation of ‘percentage in point’ or ‘price interest point’, is simply a measure of change in the exchange rate of a currency pair.

The term ‘pip’ is frequently used in the foreign exchange (Forex) market.

A pip is considered to be the smallest unit of change in a currency quote (such as USD/GBP, USD/EUR etc.)

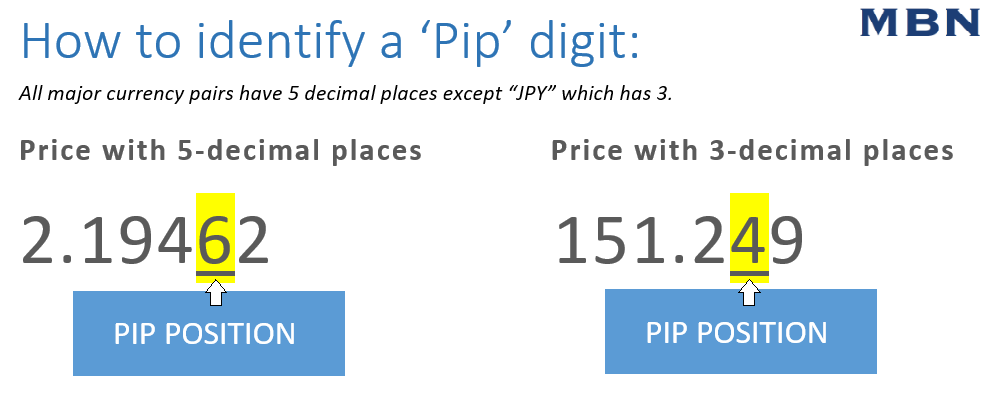

Most currency pairs are quoted to five decimal places (.00000).

For example, if the USD/GBP is quoted as 1.26156 then any change to the quote’s fourth decimal place (in this case 5) represents a pip change – this change can either be positive or negative.

Easy to remember:

- a pip represents one unit change of the fourth decimal point for most major currency pairs.

- for currency pairs with three decimal places (“JPY” for example”) a pip represents one unit change of the second decimal point.

When Forex traders are positive in pips, their position is profitable. When it’s negative, their position is making a loss.

Examples of pip changes in Forex

If, for example, the GBP/USD currency pair moves from 1.2601 to 1.2602 then the .0001 USD rise is equal to one pip.

Now, let’s say the GBP/USD moves from 1.2602 down to 1.2600 then the .0002 USD decline is equal to two pips.

Pip movement in Japanese yen (JPY) currency pairs:

If, for example, the USD/JPY currency pair moves from 114.335 to 114.345 the 0.010 increase is equal to one pip.

Now, let’s say the USD/JPY currency pair moves from 114.456 to 114.432 the 0.024 decline is equal to a two pip change.

Reference

“Understanding “Pip” Movement in FOREX Trading” – Mouhamed Abdulla, Ph.D.