Positive economics, also known as what is economics, is economics that describes and focuses on things as they are – the world as it is – instead of how it should be or trying to alter it. Positive economics is concerned with the development and testing of factual statements about the world which are verifiable and objective.

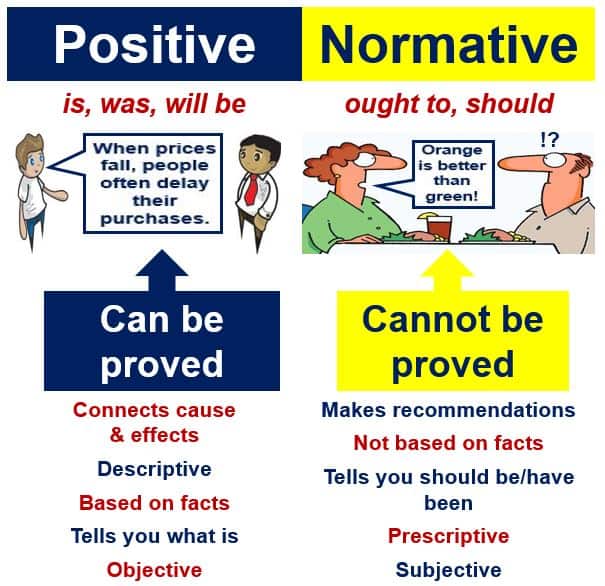

Positive economics contrasts with normative economics, which makes value judgments and looks at how things should be, ought to be, or should have been.

Positive economics tells you exactly how it is, was or will be, while normative economics expresses value regarding economic fairness or what policymakers’ goals and outcomes should be or should have been.

Positive economic statements are about things that have been or can be tested, while normative ones have not and cannot be. It is impossible to determine whether orange is better than green, but we can find out whether people delay their purchases when prices fall. In fact, during the deflation years in Japan in the 1990s, that is exactly what consumers did.

Positive economic statements are about things that have been or can be tested, while normative ones have not and cannot be. It is impossible to determine whether orange is better than green, but we can find out whether people delay their purchases when prices fall. In fact, during the deflation years in Japan in the 1990s, that is exactly what consumers did.

The majority of current economists concentrate on positive economics – analyzing real things that can be backed up with supporting evidence, or at least tested in the field. They use what is or what has been happening in a country’s economy as the basis for any statements or predictions about the future.

Positive economics, unlike normative economics, is all about causes and effects, behavioral relationships, and the proven facts that are involved in the development and evolution of economic theories.

An example of a positive economic claim would be: “Lowering the interest rate will encourage people to spend more and save less.” It is a statement of fact, whose accuracy has been tested. It contains no value judgments – whether or not lowering interests is the right thing is irrelevant.

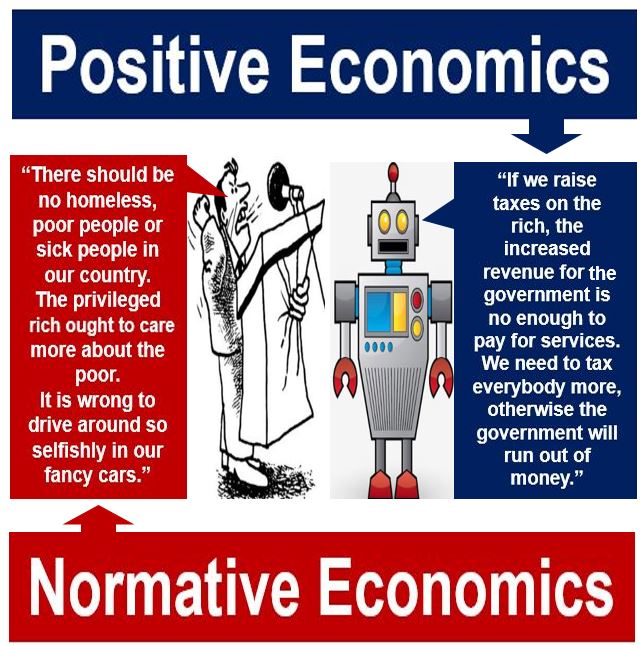

If a presidential election were between a robot who gave us pure facts – positive economics – and a professional politician who told us how things should be – normative economics – which one do you think would win? Most bets would be on the human winning. For some bizarre reason, human beings prefer to be told how things should be rather than how they really are.

If a presidential election were between a robot who gave us pure facts – positive economics – and a professional politician who told us how things should be – normative economics – which one do you think would win? Most bets would be on the human winning. For some bizarre reason, human beings prefer to be told how things should be rather than how they really are.

Positive economics and investors

Most newspapers and other media outlets use a combination of positive and normative statements and theories.

If you are an investor, it is crucial that you understand the difference between the two – one is about reality while the other is not.

Imagine an extreme scenario – you live in a street where an ogre walks up and down after sunset and hits anybody he sees on the head with a giant club.

If one newspaper dedicates a whole article to describing an ideal world where nobody is ever hit over the head, while another one just focuses on how many people get injured or killed each day by this ogre, where and at what time, your chances of staying safe and alive are considerably greater if you just read the newspaper that focuses on facts.

It is the same if you are considering investing your money – either in the stock market, abroad, in property, bonds, gold, or something else. You need hard facts, not value judgments – you need positive economics.

A positive economic theory may describe what happens if a certain measure is taken, but does not provide an instruction on what policy ought to follow it.

For example, a positive economic theory may describe how inflation is affected by growth in the money supply, but it will not provide any instructions or data on what policy should be followed.

Positive economics is full of words like ‘is’, ‘was’, and ‘will be’, while normative economics is filled with other types of words, including ‘should’ and ‘ought to’.

Managers need to know the difference

For any person working in a management position, it is important to be able to distinguish between normative and positive statements.

Managers and their workmates, or the people they are advised by, will probably use both types of statements.

Often, normative statements are disguised as positive ones. In other words, what is being delivered to you as a piece of positive economics, is really camouflaged normative economics.

While both normative and economic statements deserve consideration, management decisions tend to improve when the distinction between them is recognized. Normative statements, which are those expressing what ought to be, can often be reframed as positive, testable assertions.

For example, instead of saying “the subsidies of the European Union’s Common Agricultural Policy (CAP) should be removed,” one could say “removing CAP subsidies will raise farm prices in developing countries,” a claim that can, in theory, be evaluated for its validity.

Identifying positive economics in a text

Look at these two phrases below, and read about why one is a normative and the other a positive statement:

1. “Raising farm prices in developing countries is a good thing.”

This is definitely a normative statement. It is somebody’s opinion about what is ethically or morally good – it is a judgement statement.

2. “Raising farm prices in developing countries will improve rural incomes in those countries.”

This is an example of positive economics. It is stating a fact that can be tested. If farm prices are raised, a few months later a team of people could check to determine whether rural incomes grew.

The second statement does not tell us that rural incomes ought to be raised, just that an increase in farm prices will have that effect.

In the same University of London article, the authors add:

“To say that rural incomes should be raised is a normative statement, which you may well agree with, especially if you live and work in the rural areas of a developing country, or believe that increasing rural incomes is the best way to reduce poverty.”

“On the other hand, if you live in the city of a developing country and believe that the removal of CAP (Common Agricultural Policy) subsidies will raise food prices, or if you are an EU (European Union) food producer dependent upon CAP subsidies, you may feel differently about this – you may be less keen on raising rural incomes in developing countries, unless other ways can be found of achieving it.”

A developing country is a nation with relatively low levels of industrialization.