The price-to-book ratio, also known as the P/B ratio or market-to-book ratio, is a financial calculation used to compare a company share’s current market price to its book value.

The price-to-book ratio tells us whether investors value a company above, at or below the face value of its assets as they appear in its financial reports.

Investors use this ratio to determine whether a share is expensive or cheap.

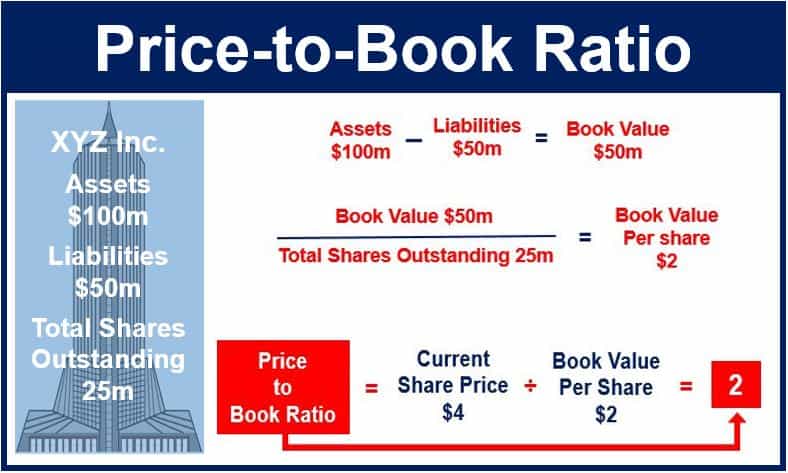

There are two ways of calculating the P/B ratio, with both providing the same result.

– Using the company’s balance sheet: the company’s market capitalization divided by its total book value (its value if all liabilities are subtracted from assets and common stock equity).

Price-to-book ratio = Current Market Capitalization ÷ Total Shareholders Equity.

– Using per-share values: the business’ current share price divided by the book value per share.

Price to book ratio = Current Share Price ÷ Book Value Per Share.

Example of price-to-book ratio

Imagine John Doe Inc. has $20,000,000 in market capitalization and $10,000,000 in book value.

John Doe’s price-to-book-value is 20,000,000 ÷ 10,000,000 = 2.

In other words, investors pay two dollars for every dollar of book value that John Doe has.

A price-to-book ratio greater than 1 means a company’s market value is worth more than its book value. The difference in value is sometimes referred to as the market goodwill or market value added. ‘Goodwill’ refers to an intangible asset that some companies have – customers, consumers and other stakeholders view the company favorably; this asset has a value.

The P/B ratio, along with other ratios such as the price/cash flows, price/sales and price/earnings, are commonly used when valuing companies or takeover targets. The results are compared with those of other firms in the same industry.

Speculators who specialize in purchasing companies whose current market prices are subdued, focus closely on their price-to-book ratios. They purchase businesses with low ratios but good returns of equity and sell them when the market changes (upwards) its opinion regarding the firm’s true worth.