A reserve currency, also called an anchor currency, is the foreign currency that a government, central bank and other major financial institutions hold as part of the their reserves.

It is a strong currency that is widely used in international trade. The reserve currency is used to settle international debt obligations. Central banks also use it to influence the exchange rate of their domestic currency.

Oil, gold, silver and other commodities are priced in the reserve currency, which encourages other nations to hold this currency to pay for them.

Having funds in a reserve currency helps minimize exchange rate risk – the purchasing country, if it holds some reserve currency, will not have to exchange its domestic currency for the current reserve currency to make purchases.

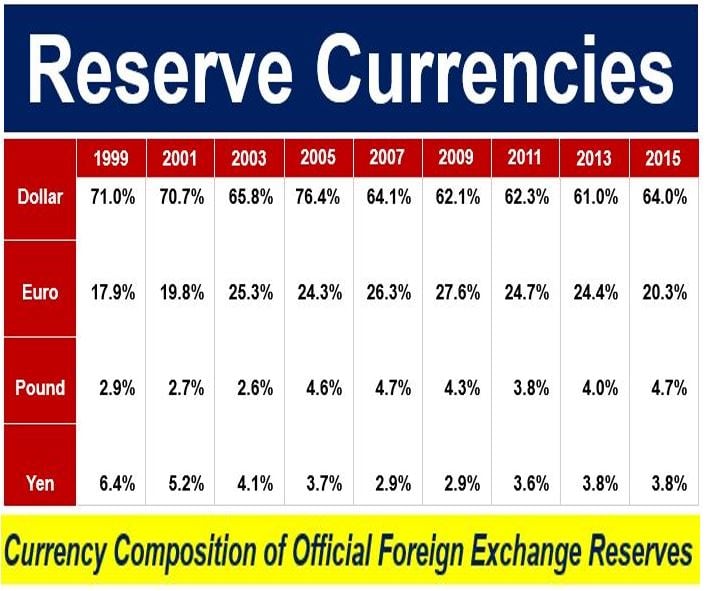

The table above represents a limited view of global currency reserves – it only includes allocated reserves. Even so, the US dollar is clearly by far the dominant reserve currency today – it has been for several decades. (Image: adapted from Wikipedia)

The table above represents a limited view of global currency reserves – it only includes allocated reserves. Even so, the US dollar is clearly by far the dominant reserve currency today – it has been for several decades. (Image: adapted from Wikipedia)

Outside the United States, the US dollar is the most extensively used reserve currency. Since the turn of the century, the euro has been increasingly widely used.

According to ft.com/lexicon, the Financial Times’ glossary of terms, a reserve currency is:

“A foreign currency that is traditionally held in countries’ official reserves because of its global importance as a medium of exchange and its inherent stability.”

Reserve currency – a brief history

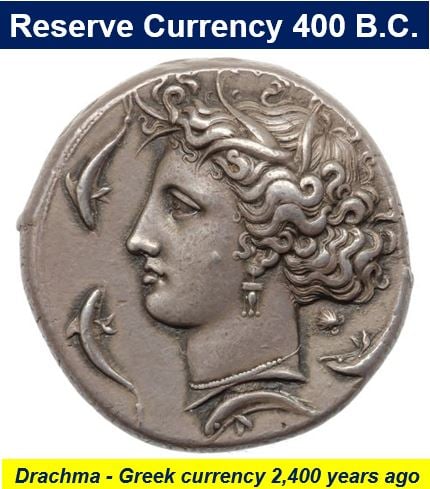

Reserve currencies have existed for thousands of years. In the fifth century B.C., it was the Greek drachma, followed by the Roman denari, the Byzantine solidus, and in the middle-ages the Arab dinar.

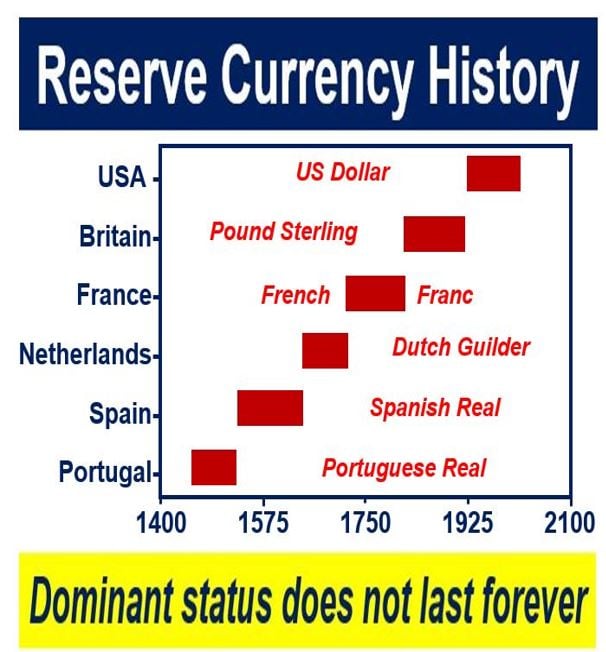

During the Renaissance period – 14th to 17th century – the Florentine florin and Venetian ducato served as reserve currencies. During the 14th and 15th centuries, Portugal and Spain’s currencies – both called ‘real’ – dominated the world. In the seventeenth century, they gave way to the French franc and Dutch guilder. These were followed by the British pound, the United States dollar, and the euro.

The Drachma has been used as the currency of Greece several times in its history. The coin above is a Sicily, Syracuse Dekadrachm, dated around 405-380 B.C. (Image: uk.pinterest.com)

The Drachma has been used as the currency of Greece several times in its history. The coin above is a Sicily, Syracuse Dekadrachm, dated around 405-380 B.C. (Image: uk.pinterest.com)

In the 18th century, when the Dutch East India Company dominated international trade, the Dutch guilder was the de facto world currency.

However, it was not until the middle of the nineteenth century that the modern concept of a reserve currency emerged. It was during this time that the global economy became increasingly more integrated and countries began to establish central banks and treasuries.

By the 1860s, the majority of the industrialized nations followed the lead of the British and put their domestic currencies onto the gold standard. During this time, more than sixty percent of world trade invoicing was done in pound sterling (British pound).

London had become the world’s financial center, where the major insurance and commodity markets were based. The city was by far the leading source of foreign investment globally.

Between the two World Wars of the 20th century, attempts were made to restore the gold standard. In 1925, the British Gold Standard Act reintroduced the gold bullion standard – and many countries did the same. Up until the Great Depression, there was a period of economic stability.

However, during the Great Depression in the 1930s, trade shrank considerably and the gold standard fell.

By 1931, Britain was forced off the gold standard entirely following speculative attacks on the pound.

During the 1930s, as several governments introduced trade tariffs and became protectionist, the British pound gradually lost its position as the world’s top reserve currency.

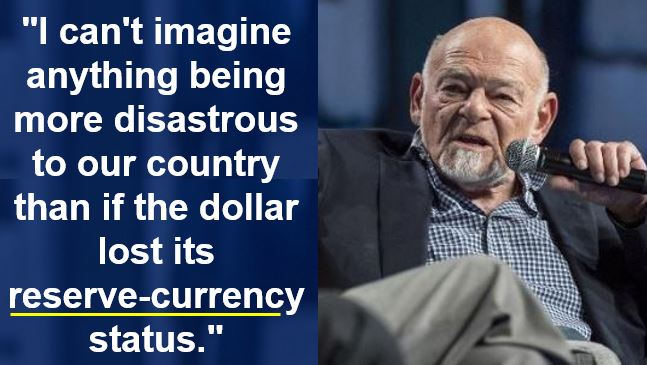

Samuel Zell is an American business magnate, often noted as a pioneer in the modern commercial real estate industry. He also has major investments in manufacturing, healthcare, communications, energy, and logistics/transportation. According to Forbes, he had a net worth of $5 billion in March, 2017. (Image: forbes.com)

Samuel Zell is an American business magnate, often noted as a pioneer in the modern commercial real estate industry. He also has major investments in manufacturing, healthcare, communications, energy, and logistics/transportation. According to Forbes, he had a net worth of $5 billion in March, 2017. (Image: forbes.com)

Emergence of US dollar as top reserve currency

After WWII (World War II), the global financial system was governed by the Bretton Woods System, which placed the US dollar as its anchor.

The US government guaranteed other central banks that they could sell their dollar reserve currency at a fixed rate for gold.

Since the middle of the last century, the US dollar has been the leading reserve currency across the world. It began overtaking the pound sterling for the number one spot during the second half of the 1920s.

In 1999, 71% of the official foreign exchange reserves across the world were in dollars, while 17.9% were in euro, 2.9% in pound sterling, and 6.4% in Japanese yen.

By 2014, the 63.1% were in dollars, 22.1% in euros, 3.8% in pound sterling, and 3.9% in Japanese yen.

Governments and their central banks across the world monitor US monetary policy closely to check whether the value of their reserves is not negatively affected by inflation.

No reserve currency dominates forever. Currently, all bets are on the Chinese yuan taking over from the US dollar. Many economists say that since Donald Trump pulled his country out of the Trans-Pacific Partnership, China will get there much faster.

No reserve currency dominates forever. Currently, all bets are on the Chinese yuan taking over from the US dollar. Many economists say that since Donald Trump pulled his country out of the Trans-Pacific Partnership, China will get there much faster.

Yuan becomes a reserve currency

In September 30th, 2016, the yuan – China’s currency – joined the US dollar, euro, pound sterling and Japanese yen as a global reserve currency.

The IMF (International Monetary Fund) now includes the yuan, which is also called the renminbi, in a basket of currencies that it uses to help manage countries’ economic problems.

On September 30th, 2016, the IMF wrote:

“Today, the International Monetary Fund (IMF) announced the launch of the new Special Drawing Right (SDR) valuation basket including the Chinese renminbi (RMB), and the new currency amounts that will determine the value of the SDR during the new valuation period.”

“As approved by the Executive Board of the IMF on November 30, 2015, effective October 1, 2016, the RMB is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency, along with the U.S. dollar, the euro, Japanese yen, and the British pound.”

The IMF had reviewed China’s currency in 2010, but decided not to adopt it as an official reserve currency because “it was not judged to be freely usable.” In 2015, the IMF’s Executive Board met again, and determined that five years later the yuan was freely available.

‘Reserve Currency’ in other languages: moneda de reserva (Spanish), monnaie de réserve (French), Leitwährung (German), Moeda de reserva (Portuguese), valuta di riserva (Italian), Резервная валюта (Russian), Rezerv para birimi (Turkish), 準備通貨 (Japanese), 储备货币 (Chinese), عملة إحتياطية (Arabic), आरक्षित मुद्रा (Hindi), রিজার্ভ মুদ্রা (Bengali), ریزرو کرنسی (Urdu), mata uang cadangan (Indonesian), mata wang rizab (Malay), magreserba pera (Filipino), hifadhi ya fedha (Swahili), and מטבע עתודה (Hebrew).

Video – Reserve currency future

In this video, Peter Schiff, CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer firm based in Westport, Connecticut, USA, talks about the future of China’s currency – the yuan – as a reserve currency, and whether it will soon replace the US dollar’s dominant position.