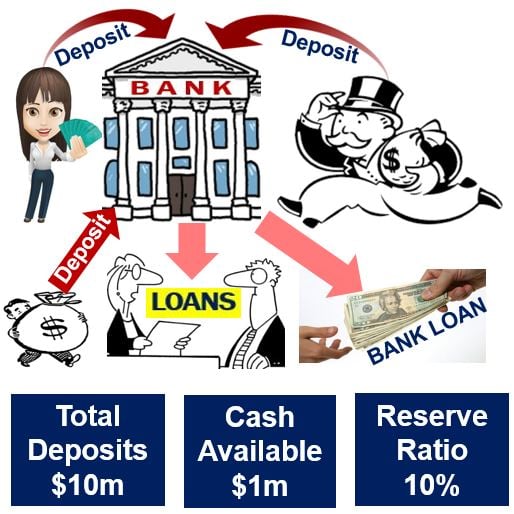

The reserve ratio is the proportion of customers’ deposits that a bank holds as reserves in the form of cash – the fraction of depositors’ balances that financial institutions (banks) must have available as cash. The central bank determines what banks’ reserve ratios must (or not) be.

The reserve ratio is sometimes called the bank reserve ratio, the cash reserve ratio (CRR), or the bank reserve requirement.

The bank’s reserves typically consists of cash that it owns and stores physically in its vault – known as vault cash – plus money it has in its account with the central bank.

Reserve ration & the money supply

Reserve ratios influence the money supply of an economy.

Central banks often use reserve ratios as a monetary policy tool. If they reduce the percentage of total money deposited by customers that must be available in the form of cash, banks will be able to make more loans.

If banks can lend more money the money supply grows, which can stimulate the economy and push up the inflation rate.

If the central bank increases the fraction of deposits that must be in the form of cash, the amount of money that banks can lend will decline, and the money supply shrinks. This may occur when the economy is overheating and the central bank wants to cool it, i.e. to slow things down.

The US Federal Reserve System, the Bank of England, the European Central Bank, and the other central banks of the advanced economies rarely increase their banks’ reserve ratio requirements because it would result in immediate liquidity problems for financial institutions with little cash at hand.

The advanced economies’ central banks, and those of many emerging economies, prefer to buy and sell government-issued bonds – i.e. open market operations – to implement their monetary policy.

China’s central bank – The People’s Bank of China – combats inflation by changing reserve ratios. In 2007, it increased the reserve ratio ten times, and in 2010 eleven times.

Over the past twenty years, China’s economy has expanded at a remarkable rate. Its central bank keeps a close eye on the inflation rate because a rapidly-expanding economy is always at high risk of overheating.

Reserve Ratio – United States

In the United States, the reserve ratio – commonly referred to as the reserve requirement by the Federal Reserve (Fed), is determined by the Board of Governors.

In the US, time deposit and savings accounts are not subject to reserve requirements, but checking accounts are.

The total amount of **Net Transaction Accounts (NTAs) held by customers with US depository institutions, plus the US paper and coin currency held by the non-banking public, is called M1.

** Basically, Net Transaction Accounts is the dollar value of all customers’ deposits and accounts receivable that the bank has in its books.

Banks and other institutions with checking account customers can satisfy their reserve ratio by holding either reserve deposits (money in a central bank account) or vault cash.

Reserve requirements ratios reduced to zero percent in 2020

The Board of Governors cut the reserve requirement ratios to zero percent on March 26, 2020. “This action eliminated reserve requirements for all depository institutions,” the Board states on its website (as of October 2023).

No reserve ratio requirement

Many countries have no reserve requirement. In these countries, banks are constrained by capital requirements, which experts say are more important than the reserve ratio, even in economies where reserve requirements exist.

In countries where there are no reserve requirements, their commercial bank’s overnight reserves do not become negative. Their central bank will always intervene and lend the required reserves if necessary. Bankers call this ‘defending the payment system’.