Reserves, in the world of business and finance, refers to ‘money in hand’ – money that is available to be used for a wide range of possibilities, including meeting future planned payments, unexpected events, emergencies, opportunities, etc. They are funds that individuals, companies, organizations, central banks, and governments set aside for future use or ‘just in case’.

In banking, the term refers to money that is set aside for a financial institution’s day-to-day operations, or for meeting emergency liquidity problems – they are known as primary and secondary reserves respectively.

In accounting, reserves are any part of **stockholders’ equity, with the exception of basic share capital. The term may refer to money that is retained in the company and not distributed to the owners.

** Stockholders equity (shareholders’ equity) is the residual, or difference of a company’s assets minus liabilities.

Some people accumulate money in a piggy bank for a rainy day or to take advantage of an opportunity – companies have reserves for similar reasons. In an emergency, the money that has been put aside can save it from disaster. The funds may also help if the company becomes interested in acquiring another firm.

A government’s reserves are all the foreign exchange it holds, plus gold and IMF (International Monetary Fund) special drawing rights.

According to ft.com/lexicon, to define reserves is as follows:

“Liquid assets held by a bank, company or government in order to meet expected future payments and/or emergency needs. In the case of a bank, its reserves are cash and other liquid deposits held either in its vaults or with the central bank (see reserve requirement).”

“In the case of a company, reserves are normally built up from retained earnings (i.e. profits not distributed as dividends to shareholders). In the case of a government, its official reserves comprise foreign currency (foreign exchange reserves) as well as gold and IMF special drawing rights.”

Foreign exchange reserves

Foreign exchange reserves, also known as FX or forex reserves, is money and other assets that a central bank or government holds so that it can pay its liabilities and take action if it needs to defend its domestic currency.

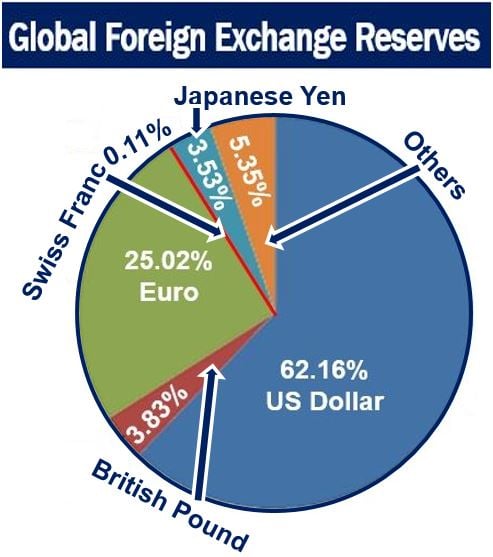

In most cases, the central bank has US dollars, and perhaps also euros, Japanese yen or pounds sterling – those are the four main reserve currencies. The US dollar represents more than sixty-percent of global foreign exchange that central banks set aside globally.

The US dollar is by far the most widely used reserve currency globally.

The US dollar is by far the most widely used reserve currency globally.

Technically speaking, the term ‘foreign exchange reserves’ includes just foreign banknotes, foreign treasury bills (short-term promissory notes), foreign government securities, and foreign bank deposits. However, people also use it when talking about how much gold the government holds, as well as SDRs (special drawing rights), and IMF reserve positions.

In a strict sense, we should use the term international reserves when we want to include foreign banknotes plus all the items mentioned in the previous paragraph.

Actuarial reserve

“An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay (in the event of a claim) based on an estimate of the present value of all future income that is derived from a contingent event.”

That means that in essence you have to add up all the money that is due on a policy’s claim. You have to work out that money’s present value – what it is worth in today’s terms. Then you look at how much you need to invest in order to meet the future value of that claim.

You need to make some simple assumptions when calculating an actuarial reserve – they involve how much the insurance company is likely to pay out and how much interest it can earn on its investments.

Regarding the assumptions you make, RiskHeads.org explains:

“The more accurate our assumptions – the better our actuarial reserves can be calculated. This is not always a simple task and in most cases a certain level of error can be expected.”

Imagine Tom expects to pay out $1,000,000 on a policy. He expects to pay out $500,000 in the first year, $300,000 in the second year, and $200,000 in the third year.

The actuarial reserve should tell him how much money he needs to put aside today in order to make sure that those payments are met.

We know that $1 today is most likely to be worth more than $1 in three years’ time. In order to make sure that the Tom has made provision for these payments, he needs to determine what he needs to invest now – so that the payments can be paid in full when they are due.

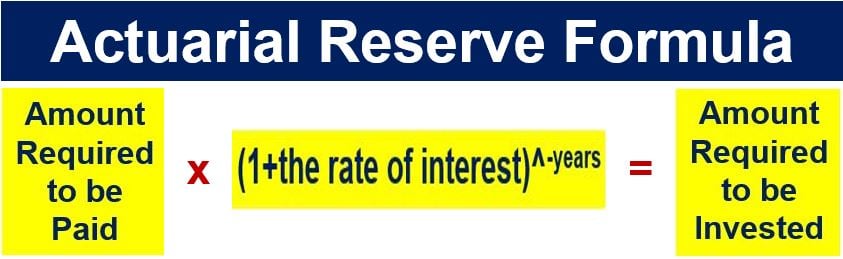

He can do this with this simple formula:

The calculation is simpler than it looks. See below.

The calculation is simpler than it looks. See below.

Lets assume that the investments pay a steady 6% rate of interest. The above formula can be calculated as follows:

Year 1

In the First Year he needs to pay $500,000. Below you can see the numbers added to the formula:

500,000 x (1+0.06)^-1= $471,698

This means that he places $471,698 into the investment vehicle immediately so that it will be worth $500,000 in the First Year.

Year 2

In the Second Year, he has to pay $300,000, therefore:

300,000 x (1+0.06)^-2= $266,998

Year 3

And in the Third Year he has to pay $200,000, therefore:

200,000 x (1+0.06)^-3= $167,922

The actuarial reserve is the sum of all the quantities that Tom has to invest now in order to meet a policy’s obligations. Therefore, in this case, the actuarial reserve he requires is:

$471,698 + $266,998 + $167,922 = $906,618

If $906,618 is invested now, and he gets a 6% interest rate – it will be worth $1,000,000 when the money has to be paid out.

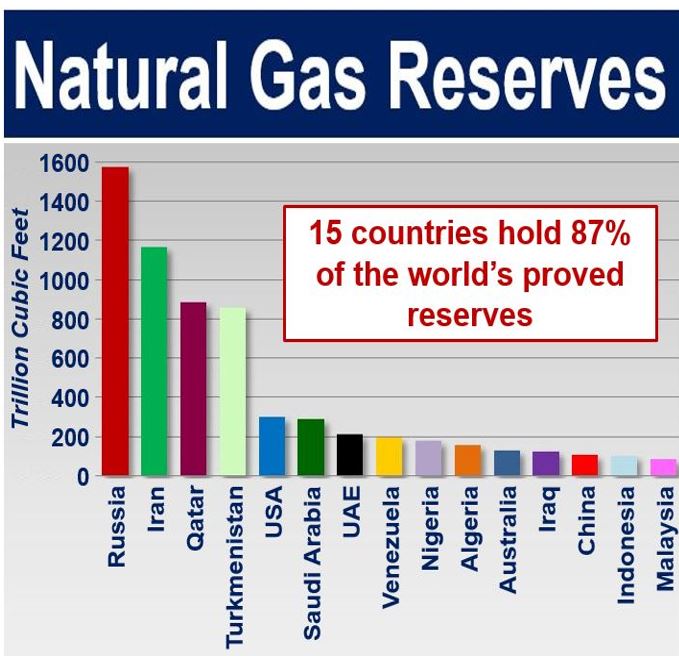

With such a huge quantity of natural gas reserves, Russia is set to dominate the energy scene in Europe for several decades – unless a new and ultra-cheap alternative is discovered or invented. (Image data source: uk.pinterest.com)

With such a huge quantity of natural gas reserves, Russia is set to dominate the energy scene in Europe for several decades – unless a new and ultra-cheap alternative is discovered or invented. (Image data source: uk.pinterest.com)

Energy

Physical energy reserves are estimates of how much oil, coal and gas is known to exist – with reasonable certainty – under the ground or seabed globally, or in a country or region.

The totals are calculated on the basis of engineering and geologic data identifying proved reserves.

Energy experts make projections drawn on the basis of how much coal, natural gas or oil there is left, and what we are able to extract with our current technology.

According to a 2013 survey by the World Energy Council – ‘World Energy Resources’:

“Proved recoverable reserves are the quantity within the proved amount in place that can be recovered in the future under present and expected local economic conditions with existing available technology.”

Venezuela, with 40,450 metric tonnes (Mt), has the most oil reserves in the world, followed by Saudi Arabia (36,500 Mt), Canada (23,598), Iran (21,359), and Iraq (19,300).