Retained earnings (RE), sometimes referred to as ‘plowback’, are the earnings of a company that have built up since the business started, after dividends are paid. In other words, the money that is plowed back into the business.

The term can be treated as a plural or singular compound noun, e.g. ‘retained earnings are…’ or ‘retained earnings is…’.

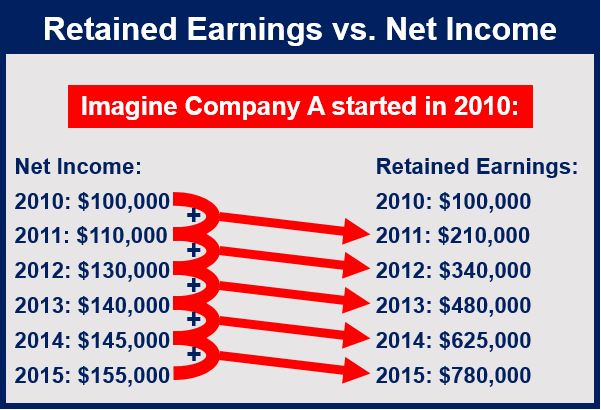

Net earnings are different from net income, which is not cumulative.

On a company’s balance sheet, its accumulated retained earnings appear as owner’s equity. Retained earnings are reported on a yearly basis. Retained earnings can appear as a negative (minus) number – which is posted as a deficit, accumulated deficit, retained losses, or accumulated losses.

Retained earnings are all the annual net incomes added up.

Retained earnings are all the annual net incomes added up.

The board of directors can pay a portion of a company’s income to shareholders and keep what is left over as RE.

The money from retained earnings can be left to accumulate, reinvested in the company, used to pay off a debt, or to purchase a capital asset, among other things. Capital assets are items that a business requires to produce its goods, like machinery, computer equipment, vehicles, etc.

There are four primary financial accounting statements published annually by publicly traded companies:

- a statement of retained earnings,

- an income statement,

- the balance sheet, and

- a statement of changes in financial position.

The current RE balance is calculated by adding retained earnings to the cumulative total of previous periods.

What factors determine whether (or how much) income a company will retain?

- The company’s dividend policy

- How old the company is

- Total net profit

- Plans regarding expansion and modernization

How to calculate retained earnings:

RE = (beginning RE) + (net income) – (dividends paid to stockholders)

Example:

Assume that a corporation reports a yearly net income of $200,000, and uses $50,000 of it for dividends. The company started the year with a retained earnings balance of $500,000.

Its retained earnings at the end of the fiscal year are $650,000:

($500,000)+($200,000)-($50,000) = $650,000

where:

Beginning retained earnings = $500,000

Net income = $200,000

Dividends = $50,000