Risk assets are any assets that are not risk-free – they carry an element of risk. The term generally refers to any financial security or instrument, such as equities, commodities, high-yield bonds, and other financial products that are likely to fluctuate in price.

Property (real estate) and currencies, which are subject to price volatility, are also classed as risk assets.

Economists and expert investors say all areas of fixed income, with the exception of high-quality sovereign bonds, such as Treasuries or gilts, are considered risk assets.

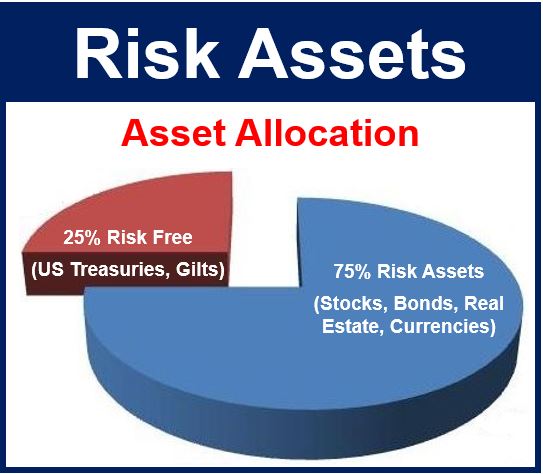

An individual’s asset allocation depends on his or her risk tolerance, aims, and investment horizon (how long they are willing to have their money tied up).

An individual’s asset allocation depends on his or her risk tolerance, aims, and investment horizon (how long they are willing to have their money tied up).

In the world of banking, a risk asset is a bank-owned asset whose value may change due to fluctuating interest rates, changes in credit quality, repayment risk, etc.

If you owned shares in a company that was in trouble, you would have to stand in line behind other lenders and bondholders (if it went bankrupt) to see whether you had recouped any of your investment – in such a case you would have a very risky asset.