Second-best theory, also known as the theory of the second best, is a concept in economics that if a requirement for achieving an optimum economic situation is not satisfied, making a concerted attempt to satisfy those requirements that can be met might not be the second-best option, and may be harmful. In other words, if components of an economy is imperfect, attempting to improve the seemingly ‘good’ ones can do more harm than good.

Second-best theory states that when one optimum equilibrium condition is not met, all the other ones will probably change too. It is not like a jigsaw puzzle with one piece missing or distorted while the others remain intact – in economics, all the other pieces may become different as a result.

In this article, the word ‘equilibrium‘ means the solution of a model.

Second-best theory was set out in 1956 by Richard Lipsey, a Canadian academic historian, Professor Emeritus of Economics at Simon Fraser University, and Kelvin Lancaster (1924-1999), an Australian mathematical economist who was John Bates professor of economics at Columbia University.

If a requirement does not have the desired features, do not assume that all the other components in the market have not changed – they probably have.

If a requirement does not have the desired features, do not assume that all the other components in the market have not changed – they probably have.

Professors Lipsey and Lancaster showed what happens when an economic model’s assumptions are not fully met. They found that when not all the conditions are met, meeting as many of the other conditions as possible – the second-best situation – might not result in the best solution.

They found that the second-best solution involved changing other variables from their optimal values.

The second-best equilibrium may be worse than a completely new one brought about by government intervention, either to push the other markets away from their second-best conditions or to bring equilibrium to a market that is out of balance.

In their study – The General Theory of Second Best 1 – published in the Review of Economic Studies in 1956, Professors Lipsey and Lancaster wrote:

“The general theorem for the second best optimum states that if there is introduced into a general equilibrium system a constraint which prevents the attainment of one of the Paretian conditions, the other Paretian conditions, although still attainable, are, in general, no longer desirable.”

“In other words, given that one of the Paretian optimum condition cannot be fulfilled, then an optimum situation can be achieved only by department from all the other Paretian conditions.”

Richard Lispey and Kelvin Lancaster were best known for their joint work of Second-Best Theory, which was published in 1956. (Images: Left: econ.columbia.edu. Right: csls.ca)

Richard Lispey and Kelvin Lancaster were best known for their joint work of Second-Best Theory, which was published in 1956. (Images: Left: econ.columbia.edu. Right: csls.ca)

Regarding the implications of second-best theory, the Economist’s glossary of terms writes:

“Economists have seized on this insight to justify all sorts of interventions in the economy, ranging from taxing certain goods and subsidising others to restricting free trade. Whenever there is market failure, second-best theory says it is always possible to design a government policy that would increase economic welfare.”

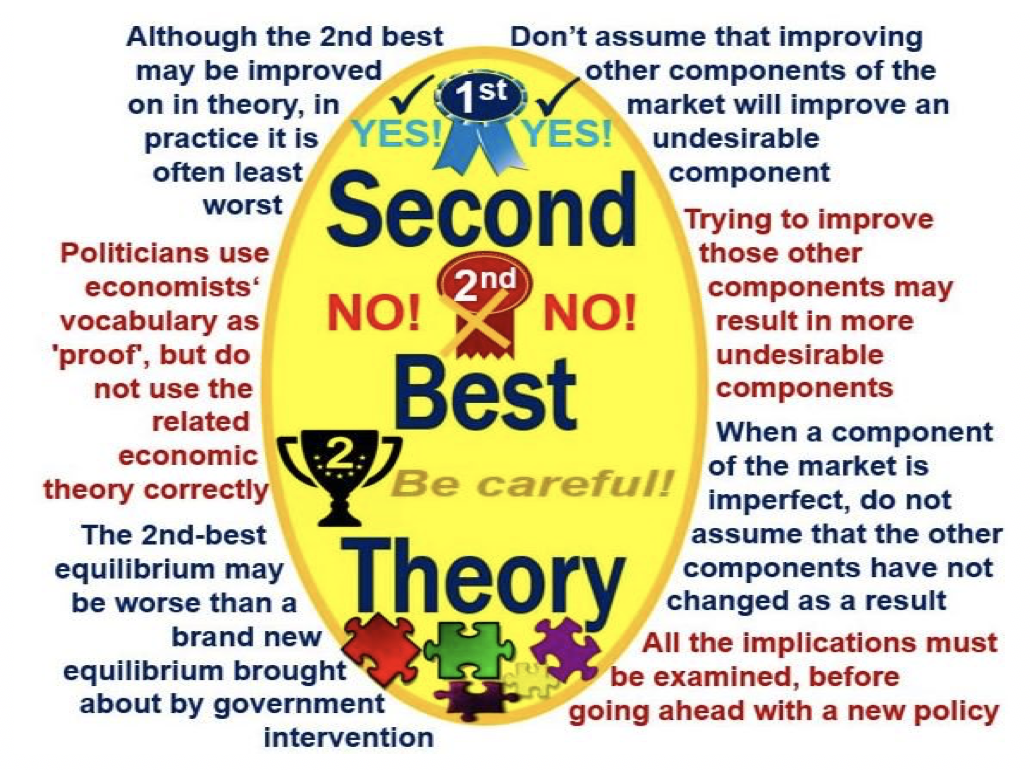

“Alas, the history of government intervention suggests that although the second best may be improved on in theory, in practice second best is often least worst.”

Second-best theory – Implications

In a country’s economy, with some uncorrectable market failure in one particular sector, measures taken to correct market failures in another related sector aimed at improving economic efficiency could actually undermine the efficiency of the economy as a whole.

It may, according to theory – instead of trying to fix either of them – be better to allow two market imperfections to cancel out each other. Thus, the government should sometimes intervene in a way that clashes with usual policy.

It is important for economists to gather and analyze all the data in a situation before rushing ahead with theory-based conclusions that an improvement in market perfection in one part of the economy implies an overall improvement in efficiency.

Second-best theory – an example

Imagine a fictitious mining company, John Coals Inc. The company, which has a monopoly in coal mining, is also a major polluter. John Coals mines dump tailings into rivers, while its miners breathe in deadly dust that damages their lungs, makes them ill, and reduces their lifespans.

The only way to reduce John Coals’ negative pollution effects is by reducing production. However, the government can force the company to break up, i.e. eliminate the monopoly.

If the monopoly is broken up there will be more competition, which means that total coal output will probably rise – given that monopolists tend to restrict production.

When production rises so will the damaging effects from pollution. As we can see in this case, it is not clear whether resolving the monopoly issue leads to better efficiency overall.

There will be gains for the coal market – more trade, better prices, etc. – however, the harms from the increased pollution may outweigh those gains.

Regarding second-best theory, the OECD (Organization for Economic Co-operation and Development) makes the following comment:

“The theory of the second best suggests that when two or more markets are not perfectly competitive, then efforts to correct only one of the distortions may in fact drive the economy further away from Pareto efficiency.”

Video – Second-best theory

In this video, the ‘Stealth Badger’ explains what the theory of the second best is using simple language and easy-to-understand terms.