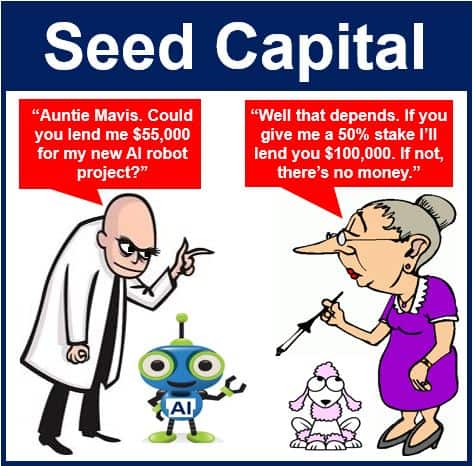

Seed Capital, also known as Seed Money or Seed Funding, is equity funding that investors provide for startup firms or pre-startups. Generally, the funding is aimed at financing product development, market research, and testing a business plan.

With seed capital, the private investor provides discretionary income and is typically given a stake in the firm in exchange.

Early-stage investment

As the word ‘seed’ suggests, this type of investment is done very early on, during the the idea or conceptual stage, and is aimed at supporting the start-up until it is able to generate its own cash, or until it is ready to raise further investments.

-

Validation point

Moreover, seed capital often serves as a crucial validation point, where external investors can signal confidence in the startup’s potential to future investors and the market.

The providers of seed capital generally like to wait until the start-up has matured a bit before deciding whether to invest further.

-

Before venture capital

This type of funding precedes venture capital or angel investment. (Some people include angel investment and seed capital in the same category)

Seed capital usually comes from the personal assets of the business’ founders, family or friends. The call for seed money is also known is the ‘friends and family round’.

In order to get a project off the ground, most businesses need seed capital. This type of investment is considered high risk, but one that can bring big returns if things go well.

Seed money can also often come from family or friends.

Seed money can also often come from family or friends.

Seed capital versus venture capital

Seed capital is not the same as venture capital, which tends to come from institutional investors, involves more money, comes at a later stage of development, and with more complex contracts that accompany the release of funds.

There is a higher element of risk in seed money, compared to normal venture capital funding. The investor in seed funding cannot so effectively determine how promising a venture is because there are no existing projects to evaluate for funding.

It is possible to raise seed money online using crowdfunding platforms such as Seedrs, Angels Den, and SeedInvest. Investors base their decisions on the skills and histories of the founders, and the perceived strengths of the ideas.

Collins Dictionary has the following definition of the term:

“Seed capital is an amount of money that a new company needs to pay for the costs of producing a business plan so that they can raise further capital to develop the company.”

University seed funds

Some universities in Western Europe, North America, Japan and other countries have seed fund schemes to help students get their startups and ideas off the ground.

The University of the Arts London (UAL), for example, has the SEED Fund that helps grow new business ideas or startups for its students and graduates. They can apply for small funding awards (up to £5,000) to support their early-stage business or get a new idea going.

The UAL fund is open to all current students and recent graduates. Funds are also available to people who have an ongoing project or early-stage business that needs further development.

The UAL SEED Fund also provides successful applicants with access to a network of mentors and intellectual property experts.

According to UAL “You don’t have to have a proven track record in developing projects to apply. We just want to find people with good ideas and help them flourish.”

Pros and cons of using seed money

For budding entrepreneurs there are some advantages and disadvantages to seeking out and accepting seed capital.

If people join you in your project, you will have to share its possible successes with others. What you had hitherto seen as ‘your baby’, will become part of a larger whole.

Some individuals find it hard to let go of their projects as more people become involved, and dislike having to relinquish total control of every aspect of the process.

However, if your project is time sensitive, such as the creation of computer software or a video game, receiving funding can help get the whole thing ready much more rapidly.

If your potential rivals (people who are currently working out of their garages and workshops) get outside help, you may have no other choice.

Video – What is Seed Capital?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Seed Capital’ means using simple and easy-to-understand language and examples.