What is a seller’s market? Definition and meaning

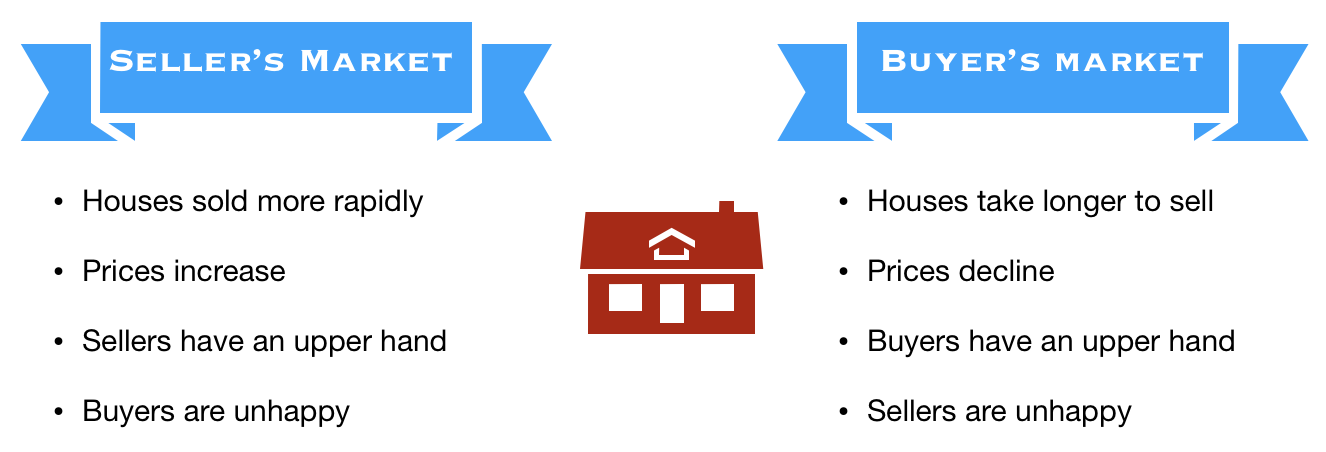

A Seller’s Market refers to a situation in which the seller calls the shots because demand is relatively high compared to supply. This means the seller is in a stronger position than the buyer to get high prices and negotiate better deals.

The opposite of a seller’s market is a buyer’s market, when prices are weak and supply exceeds demand. Both terms are commonly used in real estate.

After property prices have hit rock bottom, they start rising again and shift from a buyer’s to a seller’s market. The ratio of total properties on sale versus the number of buyers tilts in the seller’s favor, i.e. demand exceeds supply.

Additionally, in a seller’s market, it’s important for sellers to understand that while they may have the advantage, overpricing can still hinder a sale, as savvy buyers are informed by comparative market analyses and historical data trends.

Technology and greater transparency

Furthermore, technological advancements in digital real estate platforms now allow for greater transparency and data accessibility, making market conditions more apparent to all parties involved and potentially accelerating the transaction process.

Several factors can affect the price of property, as well as its demand and supply – investment growth (or lack of it), employment, interest rates, new construction, and legislative changes. These, as well as some other factors, can push the market in the seller’s or buyer’s favor.

In a seller’s market, buyers are in more of a rush. They need to make a decision more quickly (than in a buyer’s market) because anything they might be interested in is likely to be bought up by somebody else if they take too long thinking about it.

Example of seller’s market

Imagine you live in a small city with 150,000 homes, of which 4,000 are for sale.

XYZ Inc., the biggest employer in your city, has just announced that a massive investment plan has been approved by the board and a consortium of lenders. This means that over the next 24 months it will be doubling its workforce in your town.

Employment will increase, joblessness will decline, and more people will have to come into your town from outside to fill those new job vacancies. Demand for new homes will increase.

Local people are more likely to consider buying their first home or moving into a larger property now that their jobs are more secure and overall employment prospects in the town have improved.

Demand for property, which will suddenly increase much faster than supply, means that real estate will soon become a seller’s market. Houses will sell much faster and prices will rise.

If the opposite occurred – if XYZ Inc. announced that it was closing down in your town – demand for homes would fall and it would become a buyer’s market.

The term ‘seller’s market’ can be used for any market, including automobiles, gold, coffee, oil, and other commodities.

The market’s absorption rate

The best way to determine whether it is a seller’s or buyer’s market is by working out the absorption rate.

The absorption rate is calculated by adding up how many homes were sold in a specific month, and dividing that total by the number of homes for sale in that month. The figure shows how long it will take for the supply of homes on the market to be exhausted.

Most realtors (UK: estate agents) say that an absorption rate of at least 20% is a seller’s market.

For example, suppose a region has 10,000 homes currently on the market for sale. If buyers purchase 2,000 homes per month, that is an absorption rate of 20% – the supply of homes will be exhausted in 5 months.

The absorption rate is closely monitored by developers, because it helps them decide when to start building new homes.

Seller’s market in other industries

The terms seller’s market and buyer’s market are most commonly used in the real estate sector. However, they may also apply to other industries where goods and services are traded and where market forces affect prices.

Examples include oil, gold, and agricultural products, the automotive industry, and financial securities.

If I say, “The way the price of oil is going, it is becoming a seller’s market,” it means that oil producers such as Saudi Arabia and Kuwait are in a stronger position, while buyers such as Japan and Germany are in a weaker position.

Video – What is a Seller’s Market?

This video, from our YouTube partner channel – Marketing Business Network, explains what ‘Seller’s Market’ means using simple and easy-to-understand language and examples.