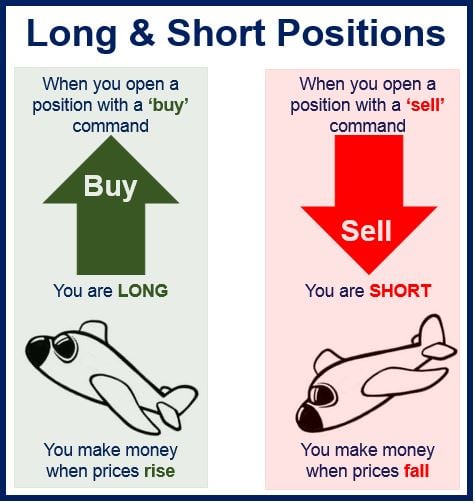

A short position is the sale of a borrowed security, currency, or commodity, with the expectation that its value will fall. An investor in a short position will make money if the price of a share falls, but will lose if it rises.

A short position does not mean that the trade has been closed though, as it only applies to the sale of a security where further action is required.

For example, if an investor borrows securities from a broker to sell them on the market, then he or she has a short position on those securities. The investor will have to eventually return the borrowed stock by buying it back from the market.

If the investor buys it for less than it was sold for, then a profit was made. A short-seller tries to do the same as any regular investor, i.e. make a profit by exchanging securities.

However, a short seller achieves this in reverse order by selling high and then buying low.

The opposite of a short position is called a long position.

Example of a short position

You learn that Company A will soon lose market share to rival Company B. Suppose Company A’s shares are selling at $40 each. You call your broker, borrow 500 Company A shares and sell them immediately.

The money from the sale is placed in a margin account by your broker.

A few weeks later, Company A officially announces it is losing market share, which sends the stock down to $30. You buy 500 shares at this lower price, you repay your broker, and you keep the $10 difference.

In just a few weeks, you have made a 25% profit.

Note:

The term is also applied to an investment position where an investor sells (writes off) an option contract with the obligation remaining outstanding. When an investor sells an option contract that is not long, he or she is said to be opening a short position, whereas investors purchasing an option contract that is already short are said to be closing a short position.