Short-termism is what people suffer from if they focus excessively on short-term results at the expense of an individual’s, company’s, or country’s long-term interests. People who are doing things that make themselves better off in the short-run but worse off in the end are guilty of short-termism.

Following the stock market bubble burst and the failure of Enron at the beginning of this century, accusations of short-termism were made against American and British stock market-focused capitalism.

Investors had become obsessed with short-term profits and share-price fluctuations, and failed to check out companies’ long-term performances, it was claimed.

This short-term approach by investors influenced company’s senior managers, who tried to make business profits look as good as possible over the short term, often at the expense of the commercial enterprise’s long-term health.

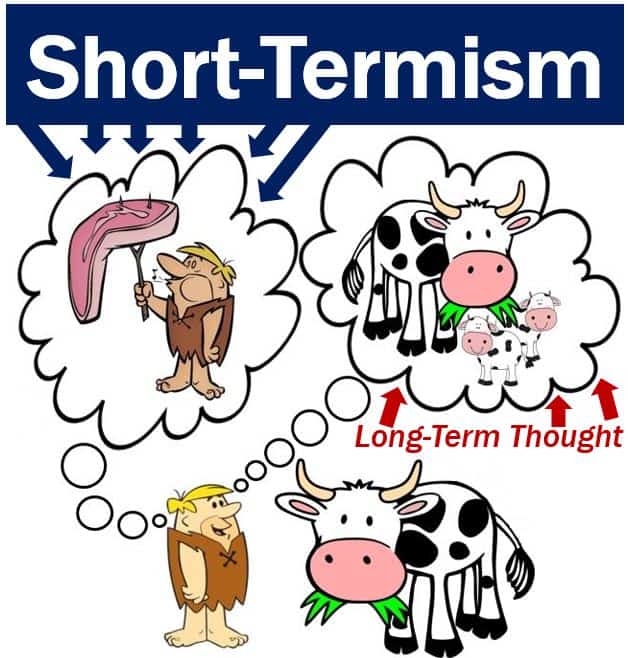

In this image, Barney, Fred Flinstone’s best friend, has two thoughts while looking at his cow. He could slaughter it and enjoy the benefits now, or wait until the cow reproduces. Eating the steak is an example of short-termism – if he eats the meat now, he will not have anything in the long-term future.

2006 Short-termism report

Former US Securities & Exchange Commission (SEC) Chairman, William H. Donaldson, called upon business leaders in a 2003 corporate governance forum to “[to] manage the business for long-term results and to get away from the attitude that you are managing the business out of a straight jacket that has been put upon you to create earnings-per-share on a regular basis.”

Mr. Donaldson further encouraged senior management to present to investors exactly how they had planned to manage the business.

At a 2005 CFA Institute annual conference, Mr. Donaldson said that ‘short-termism’ was a top critical issue that the financial industry was facing.

A 2006 report by the CFA Institute and the Business Roundtable Institute for Corporate Ethics – Breaking the Short-Term Cycle – said that short-termism by some analysts, investors and corporate leaders, together with a lack of regard for long-term strategy can harm the market’s credibility, undermine the balance in value-destructive ways for market players, and discourage long-term value investment and creation.

Ever since the last stock market bubble burst, the number of jokes about short-termism has increased considerably.

The CFA Institute, based in Charlottesville, Virginia, USA, is a worldwide association of investment professionals – it has 135,000 members. The Business Roundtable Institute for Corporate Ethics, based at the Darden School of Business, University of Virginia, USA, is an independent entity established with an association of CEOs of leading US companies – Business Roundtable – working to promote sound public policy.

The report authors, Dean Krehmeyer, Executive Director, Business Roundtable Institute for Corporate Ethics, Matthew Orsagh, CFA Senior Policy Analyst, CFA Centre for Financial Market Integrity, and Kurt N. Schacht, CFA, JD Managing Director, CFA Centre for Financial Market Integrity, encouraged all market participants to abandon short-termism and refocus on long-term values.

The authors quoted a survey involving over 400 financial executives, which found that eighty percent of respondents said they would reduce discretionary spending on such areas as advertising, maintenance, hiring, and R&D (research and development) to meet short-term earnings targets.

More than half of those questioned in the survey said they would delay new projects, even if that harmed value creation.

Regarding the survey, the authors added:

“These results demonstrate that short-termism is a larger issue than companies simply using accounting actions to meet quarterly earnings expectations. These are real actions—asset sales, cuts in research and development, and forgone strategic investments—that corporate managers use to hit ‘the quarterly earnings number.'”

“Although the creation of long-term company value is widely accepted as management’s primary responsibility, this research suggests that managing predominantly for short-term earnings expectations often impairs a manager’s ability to deliver such value to shareowners.”

Investors and senior managers who do not want ‘Jam Tomorrow’ – something nice in the future that may never materialize – want it now. They suffer from short-termism. (Image: fromoldbooks.org)

Warren Buffett, CEO of Berkshire Hathaway, considered by many as one of the most successful investors worldwide, addressed the short-termism issue in his letter to shareholders in 2000 by encouraging senior management teams to place their focus and attention on long-term strategy rather than quarterly earnings. In March 2017, Mr. Buffet was rated by Forbes magazine the second-wealthiest person in the USA, with a total net worth of $78.7 billion (this figure changes every month).

After Mr. Buffett’s letter, companies where Berkshire Hathaway had major holdings – including Gillette, The Washington Post Company, and Coca-Cola – stopped providing quarterly earnings guidance, and opted for just annual projections.

Short-termism is when people or businesses focus only on quick wins or immediate profits, instead of thinking about what’s best in the long run. For example, if a company just wants to boost its profits right now, it might ignore long-term goals or risks, which could hurt its future success.