Silver is a fairly rare and expensive precious metal that is often bought as an investment (in the same way people invest in gold). Its chemical symbol is Ag and its atomic number is 47. It is well known for its white metallic luster.

The word comes from old English ‘seolfor’, of Germanic origin; related to German ‘Silber’ and Dutch ‘zilver’.

Silver has:

- the highest electrical conductivity of all elements, and

- it has the highest thermal conductivity of all metals.

It is a little bit harder than gold, but is still malleable, i.e. it can be hammered or pressed into different shapes without cracking or breaking.

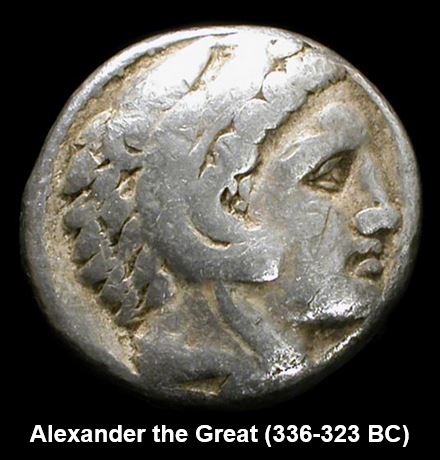

Silver coins have been around for thousands of years. (Image: ancientresource.com)

Silver coins have been around for thousands of years. (Image: ancientresource.com)

Silver is commonly used to make coins, jewelry, high-quality tableware, solar panels, and as a component of electrical contacts and conductors.

The metal is extracted from ores such as: argentite, copper, lead, and gold. In fact, most silver is produced as a by-product of lead, gold, copper and zinc refining.

In the past silver was considered to be legal tender – its first use as a currency dates back to 700 B.C.E.

However, since the end of the silver standard – an economic monetary policy in which each economic unit of account was a fixed weight of the metal – it no longer serves as legal tender. However, it remains a valuable asset.

Silver is traded in liquid markets. It serves as a store of wealth and an investment – even though its price fluctuates more steeply than gold’s.

Investing in silver

Silver (along with gold) is one of the most common precious metals bought as an investment or store of wealth.

Its price is determined by supply and demand and speculation.

Investors should be aware that the price of silver is much more volatile than gold. This basically comes down to extreme changes in demand for the metal between store of value and industrial uses.

Its price is often related to changes in the price of gold – because of changes in store of value demand. According to the article “Evolution of the ratio production and the price of the gold and the silver since 1900″, by Dr Thomas Chaize, the average ratio of the price between the gold and the silver since 1900 is 47:1.

Factors that influence the price

Large investors or traders – large traders or investors can positively or negatively drive the price of silver. For example, investment bank giant JP Morgan held short positions on 35,000 silver contracts (175 million oz) in 2013. The institution’s short market corners in the start of 2013 was an overwhelming 35% of the entire COMEX silver market.

Physical demand – the precious metal is used in a number of different electrical appliances in addition to being used for water purification and food hygiene.

According to the The Silver Institute, there is “a surge of applications for silver-based biocides in all areas: industrial, commercial and consumer. New products are being introduced almost daily. Established companies are incorporating silver based products in current lines – clothing, refrigerators, mobile phones, computers, washing machines, vacuum cleaners, keyboards, countertops, furniture handles and more.”

Financial distress – during times of financial distress and economic problems, people are more likely to purchase commodities as a means of hedging against devaluation, inflation, or deflation.

Changes in the housing market – this can indirectly affect the demand for silver (as copper is used for building new homes).

Ways of investing in silver

Bars – bars can be bought in major banks or other financial institutions. Bars are available in different weights (typically 500 grams, 1 kg, or 5kg).

Coins – coins are similar to gold bars in that they are physical. The most common coins are the Canadian Silver Maple Leaf (99.99% pure) and the American Silver Eagle (99.93% pure). Tip: Investors should purchase bullion coins or silver rounds and not buy coins for their numismatic value (the value added onto rare coins for collectors).

Certificates – this is a certificate of ownership that silver owners can hold without actually having to store the metal in physical form. As of February 2014, there is only one government-guaranteed silver-certificate program: the Perth Mint Certificate Program (PMCP).

Exchange traded funds (ETFs) – investing in a silver ETF is convenient because you do not need to hold onto the precious metal physically. Instead, with an ETF you are investing in a fund that replicates the movement of the price of silver. An example of an ETF is iShares Silver Trust (SLV), the largest silver ETF on the New York Stock Exchange.