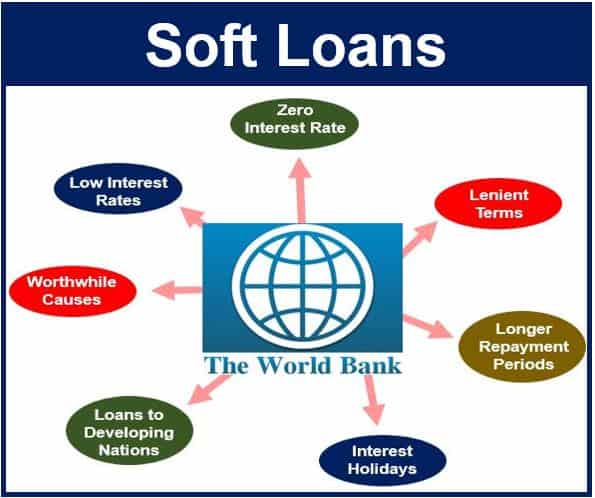

A soft loan, also known as soft financing or concessional funding, is a loan where the interest rate is below the market rate – sometimes it may even be at zero rate. Soft loans may also provide the borrower with longer repayment periods and interest holidays.

Soft loans are typically arranged when international agencies such as the World Bank provide lending for developing nations. Governments may also set up this kind of loan for projects they think are worthwhile, either domestically or internationally.

Some governments, such as China’s, arrange soft loans for their SMEs (small and medium-sized enterprises).

Difference between a soft loan and a hard loan

A soft loan contrasts with a hard loan. While soft loans are characterized by their below-market interest rates and lenient terms, hard loans are typically made at market rates and come with standard or more stringent terms. The terminology ‘hard’ does not specifically refer to the currency in which the loan is repaid. However, it’s worth noting that some loans require repayment in major and stable currencies like the dollar, pound, or euro – often referred to as hard currency.

In addition, soft loans are sometimes repaid not in cash, but in kind – in the form of goods, services, or other non-monetary compensation.

In 1958, Democratic Senator Mike Monroney (1902-1980) of Oklahoma pushed for the provision of soft-loans for developing nations with the World Bank as the dispenser of the aid. (Data source: World Bank)

In 1958, Democratic Senator Mike Monroney (1902-1980) of Oklahoma pushed for the provision of soft-loans for developing nations with the World Bank as the dispenser of the aid. (Data source: World Bank)

Example of a soft loan

In January 2008, the World Bank’s Board of Directors approved an $18.5 million interest-free credit by the International Development Association (IDA) loan to expand the quality and coverage of health services in Bolivia.

The aim of the loan was to improve the quality of life of Bolivia’s population, specifically mothers and children.

Soft loans for businesses

In many countries, businesses may have access to soft loans. In the UK, local Enterprise Agencies offer these types of loans to businesses if they meet their requirements and stipulations.

If a British business gets a soft loan from the government, it does not usually have to be repaid until it is making a profit. If the enterprise fails, the loan is automatically converted into a grant and thus does not have to be repaid. Grants are funds that are awarded for specific purposes or project by governments, individuals, local authorities, companies or charities. However, unlike grants, soft loans are expected to be repaid, albeit under more lenient terms.