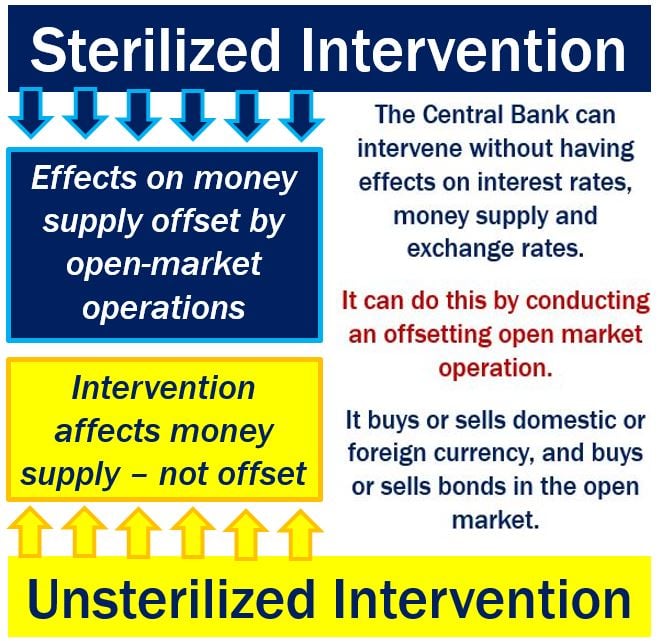

Sterilized intervention refers to a central bank’s purchase or sale of foreign exchange in the market; the aim being to influence the exchange rate. If the action has no effect on the short-term interest rate, it is a sterilized intervention. If the short-term interest rate does change as a result of the action, it is a non-sterilized intervention or unsterilized intervention.

When a central bank purchases or sells some of its foreign currency reserves, the nation’s money supply may be affected. Selling foreign currency reserves reduces the supply of the domestic currency, while purchasing reserves boosts the money supply.

Central banks can cancel out – sterilize – the effect on the money supply or monetary base caused by buying or selling foreign exchange reserves by purchasing or selling an equivalent quantity of securities.

If reserves are boosted by purchasing foreign currency, there will be an increase in the money supply, unless the government sells Treasury bills (short-term promissory notes) or some other type of domestic security to mop up the resulting extra demand.

According to Nasdaq’s glossary of terms, sterilized intervention is:

“Foreign exchange market activity by which monetary authorities insulate their domestic money supplies from the foreign exchange transactions with offsetting sales or purchases of domestic assets.”

Denmark’s central bank – Danmarks Nationalbank – says that in practice, the majority of central banks today apply a short-term interest rate as their operational target or monetary-policy instrument. Whether or not intervention in the foreign-exchange market is sterilized should not, therefore, normally be assessed on what the impact might be on the money-market interest rates.

An unsterilized intervention has impacts on the monetary base or money supply, while a sterilized intervention has no effects on the monetary base.

An unsterilized intervention has impacts on the monetary base or money supply, while a sterilized intervention has no effects on the monetary base.

Sterilized intervention – a falling currency

Imagine that a country’s currency is losing value – it is depreciating. Its central bank may decide to intervene in the foreign exchange market by creating artificial demand for its domestic currency.

This can be achieved by using some of the central bank’s foreign exchange reserves to purchase local currency. The resulting demand halts the currency’s decline – however, it also reduces the money supply in two ways:

– The central bank is directly removing some of the economy’s currency from circulation.

– If the target is overshot by the central bank, its intervention may create a current account deficit – or worsen an existing one – because the propped-up exchange rate makes imports cheaper and exports more expensive. This deficit sends more domestic currency out of the country, which further reduces liquidity.

The resulting decline in the money supply may have an undesirable deflationary effect, especially if unemployment levels are currently high.

To make up for the effect on the money supply, the central bank may choose to sterilize its foreign exchange intervention. This can be done by engaging in open market operations that inject liquidity into the system, by purchasing local-currency-denominated bonds and other domestic financial assets using local currency as payment.

Sterilized intervention to stop a currency’s decline is only effective in the medium term if whatever is causing the currency’s depreciation is addressed. If the currency falls because of a speculative attack based on some kind of political uncertainty, sterilization intervention usually resolves the problem permanently.

Towards the end of the last century, a common cause of many sterilized interventions was a high money supply which pushed local interest rates below the international average, which created the conditions for a carry trade – market participants would borrow at home and lend abroad at a higher interest rate.

Carry trade exerts downward pressure on the currency being borrowed. As sterilizing intervention does not reduce an already high money supply, domestic interest rates will still be low.

Participants continue borrowing at home and lending abroad and the central bank has to intervene again if it wants to prevent any future depreciation of its domestic currency. This cannot go on forever, because the central bank will eventually run out of currency reserves.

When the currency appreciates

When the domestic currency is going up in value – when it is appreciating – the central bank can intervene by selling its own currency for currency-denominated assets. This sterilized intervention is like the one in the example above, but completely the other way round. One of the nice side effects, in this case, is that the foreign currency reserves increase.

However, as the central bank is releasing more of its domestic currency into circulation, the money supply will grow. Money used for purchasing assets initially goes to other nations, but soon finds its way back into the domestic economy when exports have to be paid for.

If the money supply expands, the inflation rate may be pushed up, which will undermine a country’s export competitiveness just as badly as a currency appreciation would.

A classic sterilized intervention used by the central bank to neutralize the effect of the extra money flowing into the domestic base is to sell bonds at home – this soaks up the new cash.