Systemic risk is the risk of collapse of the whole financial system, or the risk of a company that is ‘too big to fail’ from collapsing and bringing the entire financial system down with it.

Systemic risk was a major contributor to the 2007/8 global financial crisis and the Great Recession that followed.

The term should not be confused with systematic risk, which is the risk that remains after diversification, also called undiversifiable risk or market risk.

Companies deemed ‘too big to fail’ are typically giant banks or financial institutions. Governments usually organize a rescue when a major bank gets into serious financial trouble, in order to stop the problem from spreading into the rest of the financial system and ultimately the whole national economy.

Lehman Brothers, the fourth-largest investment bank in the United States, after Goldman Sachs, Morgan Stanley and Merrill Lynch, collapsed in 2008 during the financial crisis. This event created a serious ripple-effect across the whole financial system and the US economy. Capital markets froze up completely while private individuals and companies could not get loans, or could only be considered for a loan if they were super-creditworthy.

Do systemic risk measures worsen things?

Critics of governments and regulators that organize rescues of major financial institutions that are in trouble say that the expectation of being bailed out encourages the behaviors that increase systemic risk.

Since the last global financial crisis, regulators in all the advanced economies and many emerging ones too have become much stricter regarding how major banks may operate, in order to reduce the likelihood of future crises.

According to the Systemic Risk Centre, part of the London School of Economics and Political Science (LSE):

“Systemic risk refers to the risk of a breakdown of an entire system rather than simply the failure of individual parts. In a financial context, it captures the risk of a cascading failure in the financial sector, caused by interlinkages within the financial system, resulting in a severe economic downturn.”

“A key question for policymakers is how to limit the build-up of systemic risk and contain crises events when they do happen.”

Systemic vs. idiosyncratic risk

Idiosyncratic risk is risk that is specific to one company or sector of the economy – the problem does not ripple out into the rest of the economic system.

System risk, on the other hand, may affect the entire financial system, triggering a major downturn in a country’s economy.

A systemic financial crisis is much more serious for the economy as a whole than a crisis in the car manufacturing or pharmaceutical sector, because of the major role that finance plays in the entire economy.

Systemic risk – cascading failure

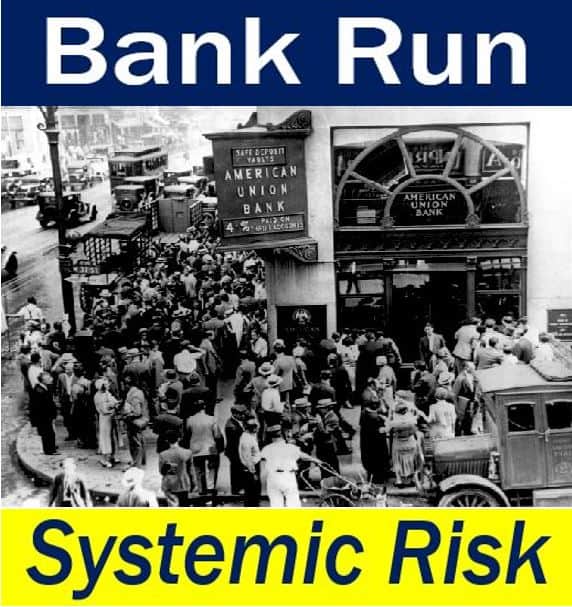

Imagine there is a run on a fictitious bank called John Doe Savings. A bank run occurs when a large number of customers begin withdrawing their money because they have lost faith in the bank. This has a negative effect on other financial institutions that are owed money by John Doe Savings, causing a cascading failure.

As customers, specifically depositors, sense the domino-effect of default (inability to pay back debts), and lack of liquidity rumors spread through the money markets, a panic ensues, with a sudden flight to quality, resulting in a market full of sellers and very few buyers.

What began as just a John Doe Savings bank run soon turns into a clustering of bank runs, which can spread across a major city and then the whole country.

It is these interlinkages and interdependence between financial institutions that worry policy makers, who try to have a system in place to minimize systemic risk.

Video – What is systemic risk

Before the global financial crisis of 2007/8, not many people had ever heard of the term systemic risk, and even fewer understood what it meant. This London School of Economics video explains that it means, and why so many economists missed it.