A person who uses a top-down investing approach looks at the big picture first, that is, the overall economy (or global economy), and the industry sector, before examining individual companies.

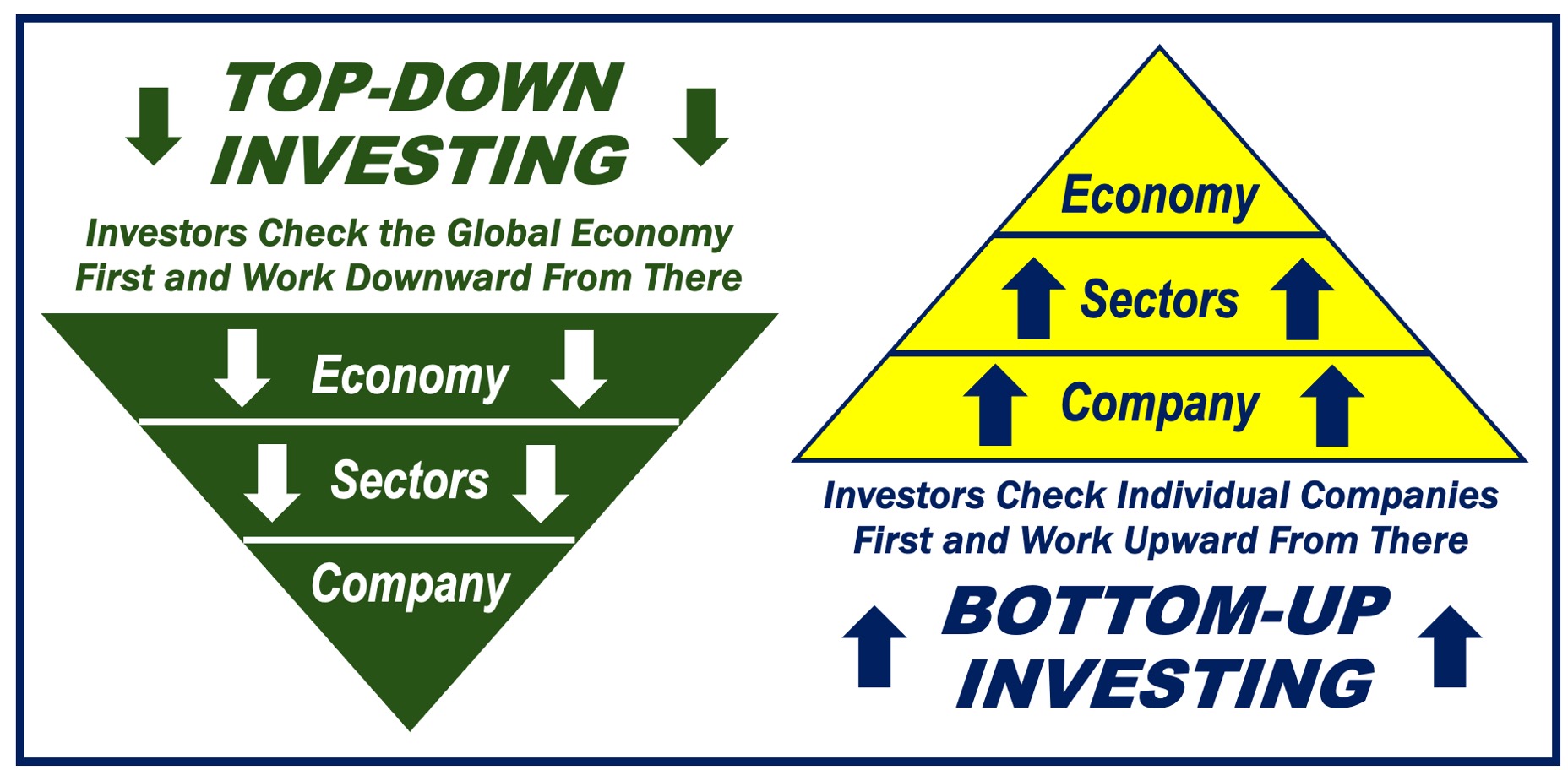

Top-down investing contrasts with bottom-up investing. A bottom-up investor focuses first on the company, regardless of how well its sector or the economy is doing. They start at the company level and then work upward.

Put simply, top-down investors first examine the global economy, then sectors, and work downward—they work from the top down, hence the name. Bottom-up investors, in contrast, start at the bottom, at the company level, and go up; they work from the bottom up.

The Motley Fool has the following definition of the term:

“In top-down investing, an investor looks at any new investment from the top down. They start with the broader economic climate, drill into market sectors that seem like they’ll benefit from the current climate, and then choose stocks or other securities that best seem to reflect trends in the wider economy.”

Top-down investing – the process

-

The global economy

First, the investor focuses on the global economy. They try to determine whether the economy is growing or shrinking. A growing economy can boost companies’ profits worldwide, while a weak one can hurt them.

-

Regions and countries

They then narrow down to the regions or countries that show the most promise. Countries do not all perform the same way and at the same pace simultaneously. While some are booming, others may be struggling.

-

Sectors and industries

After identifying a region or country, they then analyze industries and determine which ones could benefit the most from the current economic conditions.

In an economy that is expected to grow, industries like consumer goods and technology tend to do well because consumers, businesses, and the public sector will have more money to spend.

-

Individual companies

Finally, within those industries, investors select the most promising companies. They choose companies that stand out because of strong leadership, competitive products, and other competitive advantages.

Top-down investing – pros and cons

By keeping an eye on the big picture, it is possible to better manage risks. If the global economy is in trouble, it might not be the best time to invest in stocks, no matter how good they look on their own.

However, this strategy has its challenges. Forecasting economic trends is no easy task.

Sometimes, even when the macroeconomic features look good, individual stocks may not perform as expected due to unforeseen events. The term “macroeconomic features” refers to large-scale economic factors like inflation, unemployment, and GDP growth.

Video explanation

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what top-down investing is using simple and easy-to-understand language and examples.

Summary

Top-down investing starts broad and gradually gets more specific. Investors start by looking at the global economy, and move downward until they select individual companies.